Why Is IBM Stock Falling? Examining Market Trends And Company Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is IBM Stock Falling? Examining Market Trends and Company Performance

IBM, a tech giant with a storied history, has seen its stock price fluctuate recently, leaving investors wondering about the underlying causes. While IBM remains a significant player in the technology sector, several factors contribute to its recent downward trend. Understanding these factors is crucial for investors considering adding IBM to their portfolios or reassessing their existing holdings.

Market-Wide Headwinds:

The broader market plays a significant role in individual stock performance. The current economic climate, characterized by [mention current economic trends like inflation, recession fears, interest rate hikes, etc. Link to a reputable source discussing these trends], creates uncertainty for investors. Technology stocks, often considered more volatile than others, are particularly susceptible to these macroeconomic shifts. This general market downturn impacts even established companies like IBM.

Industry Competition and Technological Disruption:

The tech landscape is incredibly dynamic. IBM faces fierce competition from newer, more agile companies specializing in cloud computing, artificial intelligence (AI), and cybersecurity – sectors where IBM is actively investing but may be perceived as playing catch-up. Companies like [mention key competitors like Amazon AWS, Microsoft Azure, Google Cloud] are aggressively pursuing market share, creating a challenging environment for IBM's growth. This competitive pressure directly impacts investor confidence and can lead to a falling stock price.

IBM's Transformation and its Impact on Earnings:

IBM is undergoing a significant transformation, shifting its focus from traditional hardware and software to hybrid cloud solutions, AI, and consulting services. This strategic shift, while promising long-term growth, involves substantial investments and can temporarily impact short-term profitability. Investors often react negatively to periods of transition and uncertainty, particularly when immediate returns are not immediately apparent. Recent earnings reports should be carefully analyzed to understand the impact of this transformation on IBM's financial performance. [Link to IBM's investor relations page for access to financial reports].

Analyzing IBM's Financial Performance:

- Revenue Growth: Examine IBM's recent revenue growth trends. Is the company showing signs of growth in its key strategic areas, or is revenue stagnating or declining?

- Profitability: Analyze profit margins and overall profitability. Are investments in new technologies impacting short-term profitability?

- Debt Levels: Assessing IBM's debt-to-equity ratio provides insight into its financial stability and risk profile. High debt levels can be a cause for concern among investors.

- Free Cash Flow: Free cash flow is a key indicator of a company's ability to generate cash after covering operating expenses and capital expenditures. Strong free cash flow is often viewed positively by investors.

Looking Ahead: Potential for Growth and Recovery:

Despite the challenges, IBM's vast experience, strong brand recognition, and significant investments in emerging technologies offer potential for future growth. The success of its transformation strategy will be crucial in determining its future stock price trajectory. Investors should carefully monitor IBM's progress in its key strategic areas and assess the company's ability to execute its long-term vision.

Conclusion:

The decline in IBM's stock price is a complex issue influenced by various factors, ranging from macroeconomic headwinds to intense industry competition and the company's own strategic transformation. While the short-term outlook may appear uncertain, a thorough analysis of IBM's financial performance and its long-term growth potential is crucial for informed investment decisions. Keep a close eye on future earnings reports, industry trends, and IBM's strategic execution to better understand the future trajectory of its stock price.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is IBM Stock Falling? Examining Market Trends And Company Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Maycee Barbers Ufc Medical Incident Further Testing Required

Jun 06, 2025

Maycee Barbers Ufc Medical Incident Further Testing Required

Jun 06, 2025 -

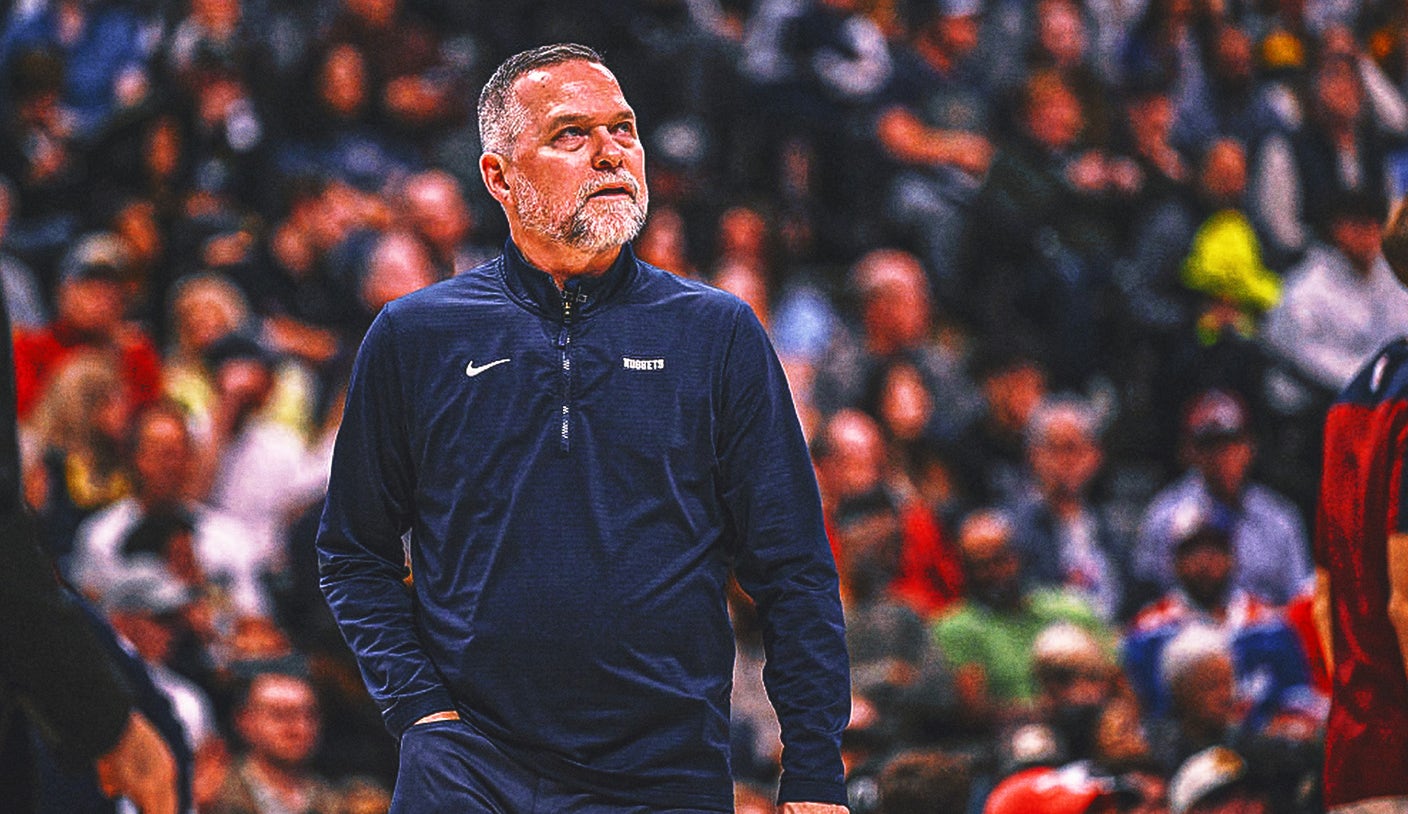

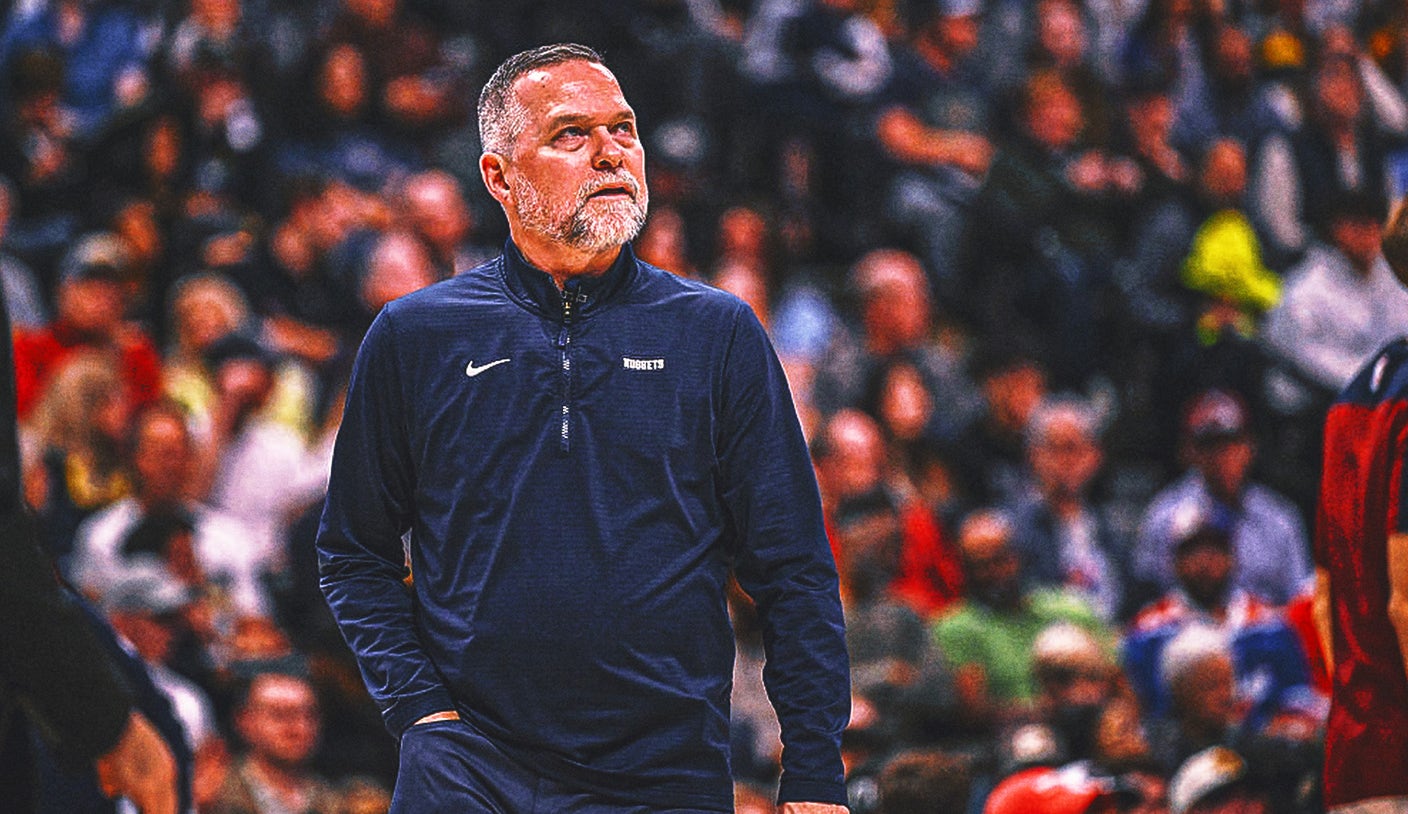

Who Will Coach The Knicks Next Analyzing The Latest Head Coach Odds

Jun 06, 2025

Who Will Coach The Knicks Next Analyzing The Latest Head Coach Odds

Jun 06, 2025 -

Tom Thibodeau Out Examining The Odds For The Next Knicks Head Coach

Jun 06, 2025

Tom Thibodeau Out Examining The Odds For The Next Knicks Head Coach

Jun 06, 2025 -

Is Joe Sacco Joining This Nhl Teams Staff After Bruins Exit

Jun 06, 2025

Is Joe Sacco Joining This Nhl Teams Staff After Bruins Exit

Jun 06, 2025 -

Joe Saccos Bruins Exit Destination And New Role Revealed

Jun 06, 2025

Joe Saccos Bruins Exit Destination And New Role Revealed

Jun 06, 2025