Why Is IBM Stock Falling? A Deep Dive Into Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is IBM Stock Falling? A Deep Dive into Performance

IBM, a tech giant with a storied history, has recently seen its stock price decline, leaving investors wondering about the future. This isn't a sudden plummet; rather, a gradual dip reflecting a complex interplay of factors impacting the company's performance and market perception. Let's delve into the key reasons behind IBM's falling stock price.

H2: The Shifting Tech Landscape: Cloud Competition and Legacy Systems

One major headwind for IBM is the intense competition in the cloud computing market. While IBM offers its own cloud services through IBM Cloud, it faces stiff competition from industry behemoths like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These competitors often boast a larger market share and a more established presence, putting pressure on IBM's cloud revenue growth. Furthermore, IBM's reliance on legacy systems and mainframes, while still profitable, presents a challenge in attracting younger, cloud-focused clientele. This struggle to effectively navigate the shift to cloud-based solutions is a key factor in investor hesitancy.

H2: Revenue Growth Concerns and Profitability Challenges

Consistent revenue growth is crucial for any company's stock price, and IBM has faced challenges on this front. While the company reports revenue, the rate of growth hasn't kept pace with some competitors, raising concerns amongst analysts and investors. Furthermore, maintaining profitability in a highly competitive market requires significant investment in research and development, as well as strategic acquisitions—all of which can impact short-term profit margins. This combination of slower revenue growth and pressure on profitability contributes to the downward trend in IBM's stock price.

H2: The Impact of Global Economic Uncertainty

The global economic climate plays a significant role in stock market performance. Factors such as inflation, rising interest rates, and geopolitical instability can all impact investor sentiment and risk appetite. These macroeconomic factors are not specific to IBM, but they undeniably influence investor decisions across the board, and IBM's stock is not immune to these broader market forces. During periods of economic uncertainty, investors often gravitate towards more stable, less risky investments, potentially leading to a sell-off in stocks perceived as less resilient.

H3: Specific Examples of Recent Challenges:

- Decreased Hybrid Cloud Adoption: While IBM is pushing hybrid cloud solutions, adoption rates haven't met some analyst expectations, impacting revenue projections.

- Increased Competition in AI: The rapid advancement in Artificial Intelligence (AI) presents both opportunities and challenges. While IBM is investing heavily in AI, intense competition in this space requires significant and ongoing investment.

- Supply Chain Disruptions: Like many companies, IBM has experienced challenges related to global supply chain disruptions, impacting production and delivery timelines.

H2: Looking Ahead: Potential for Growth and Recovery

Despite the challenges, IBM isn't without potential for future growth. Its continued investment in hybrid cloud solutions, AI, and quantum computing could yield significant returns in the long term. Strategic acquisitions and a focus on specific market segments could also contribute to a turnaround. However, the speed and extent of this recovery remain uncertain.

H2: Investor Sentiment and Market Reaction

Investor sentiment towards IBM has been cautious, reflected in the stock price decline. This caution stems from the factors outlined above – competition, revenue growth concerns, and macroeconomic uncertainties. Analyzing analyst reports and market commentary can provide further insights into current investor sentiment. Keep an eye on earnings reports and announcements for clues regarding future performance.

H2: Conclusion: A Complex Picture

The decline in IBM's stock price isn't attributable to a single factor but rather a complex interplay of competitive pressures, economic uncertainties, and challenges in adapting to the rapidly evolving technology landscape. While challenges remain, IBM’s long history and ongoing investments in promising technologies offer a potential for future growth. Investors should carefully weigh the risks and opportunities before making any investment decisions. Stay informed by following financial news and conducting your own thorough research.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is IBM Stock Falling? A Deep Dive Into Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Red Sox Vs Angels Recap Rafaelas Epic 308 Foot Home Run Decides Game

Jun 07, 2025

Red Sox Vs Angels Recap Rafaelas Epic 308 Foot Home Run Decides Game

Jun 07, 2025 -

Kidnapped By A Killer Steve Guttenberg Talks New Lifetime Movie

Jun 07, 2025

Kidnapped By A Killer Steve Guttenberg Talks New Lifetime Movie

Jun 07, 2025 -

The Ibm Transformation Is The Company Cool Again In 2024

Jun 07, 2025

The Ibm Transformation Is The Company Cool Again In 2024

Jun 07, 2025 -

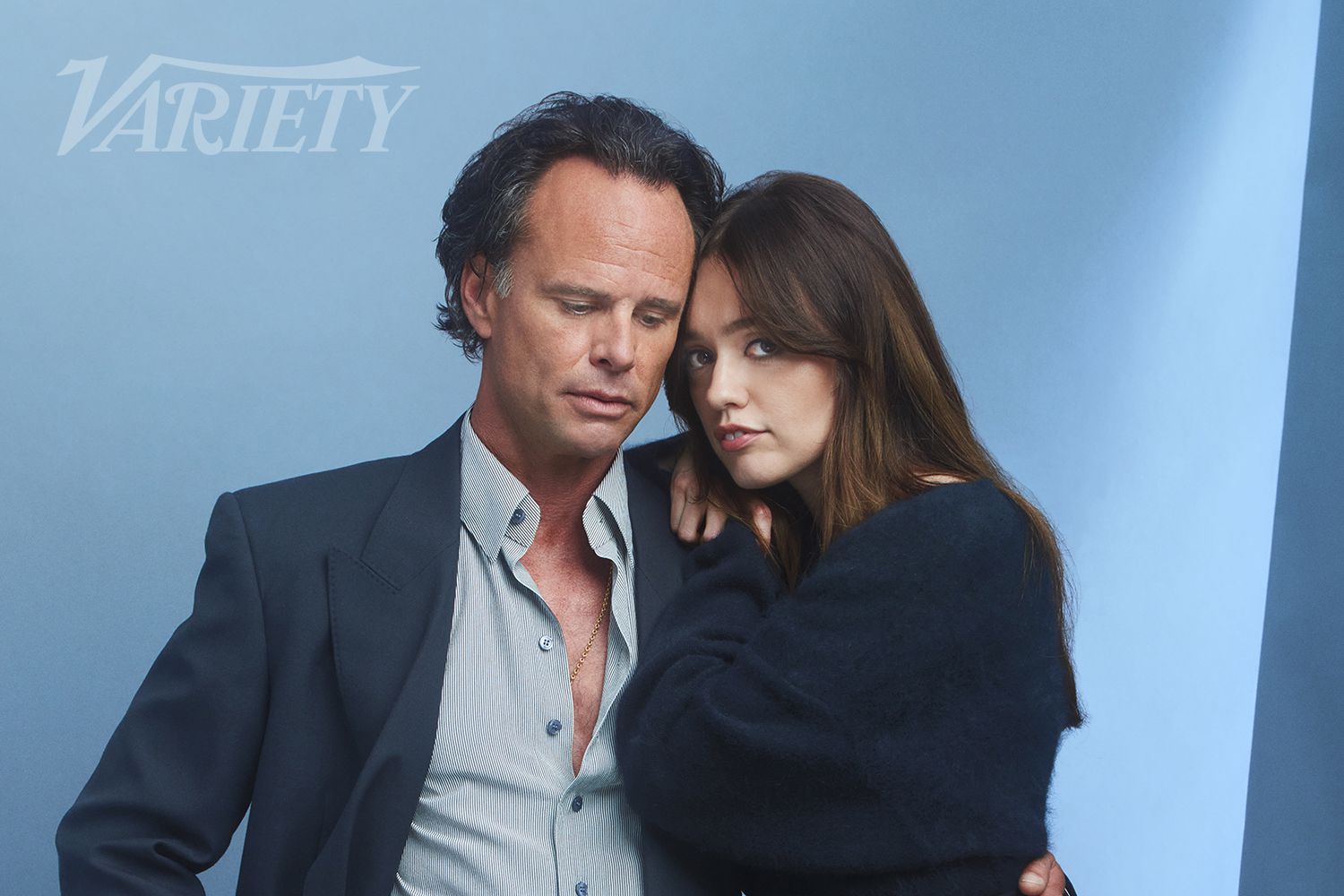

Exclusive Walton Goggins And Aimee Lou Wood Deny Public Feud In New Interview

Jun 07, 2025

Exclusive Walton Goggins And Aimee Lou Wood Deny Public Feud In New Interview

Jun 07, 2025 -

Wiegmans Challenges Englands Domestic Issues And The Euro 2025 Squad

Jun 07, 2025

Wiegmans Challenges Englands Domestic Issues And The Euro 2025 Squad

Jun 07, 2025