Why Is GameStop (GME) Stock Climbing Today? Investor Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Why is GameStop (GME) Stock Climbing Today? Investor Analysis

GameStop (GME) stock has once again captured the attention of investors, experiencing a surge in price. But what's driving this latest climb? Understanding the factors influencing GME's volatile price requires a look beyond the headlines and into the complex world of investor sentiment and market speculation. This analysis delves into the potential reasons behind today's price increase.

The Rollercoaster Ride Continues: A Brief History of GME Volatility

GameStop's stock price has been anything but predictable. The infamous "meme stock" saga of 2021, fueled by Reddit forums like r/WallStreetBets, saw the share price skyrocket, defying traditional financial analysis. Since then, the stock has remained highly volatile, with significant price swings often driven by social media trends and speculative trading.

Potential Factors Contributing to Today's Rise:

Several factors could be contributing to the current upward movement in GameStop's stock price:

-

Short Squeeze Potential: While less prominent than in previous surges, the possibility of a short squeeze remains a factor. A short squeeze occurs when investors who have bet against the stock (short sellers) are forced to buy shares to cover their positions, driving the price up. The percentage of shares shorted in GME remains a closely watched metric.

-

NFT Marketplace and Other Initiatives: GameStop's ongoing efforts to diversify its business model beyond traditional brick-and-mortar retail are being closely scrutinized. The company's investment in an NFT marketplace and other initiatives aimed at entering the digital asset space could be attracting investor interest. The success (or failure) of these ventures will significantly impact future price movements.

-

Social Media Sentiment: The power of social media in influencing meme stock prices cannot be underestimated. Positive sentiment on platforms like Twitter and Reddit can quickly translate into increased buying pressure, leading to price increases. Conversely, negative sentiment can trigger sell-offs. Monitoring these platforms is crucial for understanding short-term price fluctuations.

-

Overall Market Conditions: The broader market environment also plays a role. A generally bullish market sentiment can lift even volatile stocks like GME. Conversely, a market downturn can amplify downward pressure. Analyzing the overall market trends is vital for a comprehensive understanding of GME's performance.

Analyzing the Investor Landscape:

It's crucial to distinguish between different types of investors involved in GME:

- Long-term investors: These investors believe in GameStop's long-term transformation and hold onto their shares regardless of short-term price fluctuations.

- Swing traders: These investors aim to profit from short-term price movements, capitalizing on the volatility of GME.

- Day traders: These investors buy and sell shares within the same day, aiming to profit from even smaller price changes.

The Risks Involved:

Investing in GameStop, or any highly volatile stock, carries significant risk. The potential for substantial losses is considerable, and investors should proceed with caution. It's crucial to conduct thorough due diligence and only invest what you can afford to lose. Consider consulting with a qualified financial advisor before making any investment decisions.

Conclusion:

The reasons behind GameStop's latest price climb are multifaceted and likely involve a combination of factors. While the potential for a short squeeze, positive sentiment surrounding the company's new initiatives, and broader market conditions all play a role, the inherent volatility of GME makes predicting future price movements exceptionally challenging. Investors need to remain aware of the risks involved and make informed decisions based on their own risk tolerance and investment goals. Stay tuned for further updates and analysis as the story unfolds.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Why Is GameStop (GME) Stock Climbing Today? Investor Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Game Stop Stock News Mark Your Calendar For June 9

May 28, 2025

Game Stop Stock News Mark Your Calendar For June 9

May 28, 2025 -

Paolinis Roland Garros Streak Seven Straight Wins After Defeating Yuan

May 28, 2025

Paolinis Roland Garros Streak Seven Straight Wins After Defeating Yuan

May 28, 2025 -

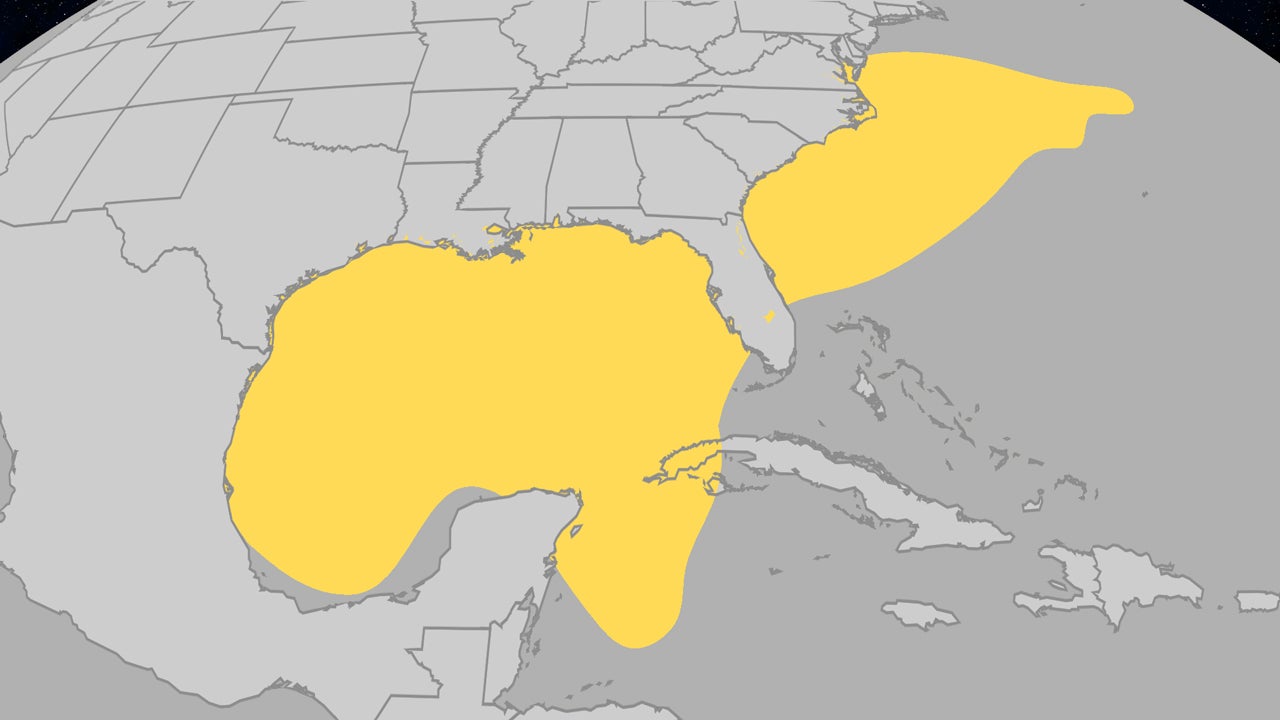

Understanding Junes Role In Atlantic Hurricane Season A Look At Recent Storms

May 28, 2025

Understanding Junes Role In Atlantic Hurricane Season A Look At Recent Storms

May 28, 2025 -

Expect Heavy Rain Series Of Disturbances Tap Into Abundant Gulf Moisture

May 28, 2025

Expect Heavy Rain Series Of Disturbances Tap Into Abundant Gulf Moisture

May 28, 2025 -

Project Maven Pentagon Invests Heavily In Palantirs Ai Technology

May 28, 2025

Project Maven Pentagon Invests Heavily In Palantirs Ai Technology

May 28, 2025