Which AI Semiconductor Stock Reigns Supreme: CRDO Or AVGO? A Comprehensive Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Which AI Semiconductor Stock Reigns Supreme: CRDO or AVGO? A Comprehensive Analysis

The artificial intelligence (AI) boom is reshaping the tech landscape, and semiconductor companies are at the forefront of this revolution. Two titans, Coherent (CRDO) and Broadcom (AVGO), are vying for dominance in this lucrative market. But which stock offers investors the better opportunity? This comprehensive analysis dives deep into both companies, comparing their strengths, weaknesses, and future prospects to help you make an informed investment decision.

Coherent (CRDO): Laser Focus on AI Infrastructure

Coherent, a leading provider of lasers and photonic components, is experiencing significant growth driven by the surging demand for advanced AI infrastructure. Their high-performance lasers are crucial for various AI applications, including data centers, optical communication networks, and advanced manufacturing processes vital to AI chip production.

Strengths of CRDO:

- Market Leadership in Specialized Lasers: Coherent holds a dominant position in the market for high-power lasers used in advanced manufacturing techniques, like those needed for creating cutting-edge AI chips.

- Strong Growth Potential: The ongoing expansion of AI data centers and the increasing sophistication of AI hardware create significant growth opportunities for CRDO's specialized laser technologies.

- Strategic Partnerships: Coherent's partnerships with key players in the semiconductor industry strengthen its position within the AI supply chain.

Weaknesses of CRDO:

- Higher Risk Profile: As a smaller company compared to AVGO, CRDO carries a higher degree of investment risk. Its stock price can be more volatile.

- Dependence on Specific Markets: CRDO’s success is heavily reliant on the continued growth of specific market segments within the AI sector.

Broadcom (AVGO): A Diversified AI Powerhouse

Broadcom, a diversified semiconductor giant, offers a broader range of products crucial for AI development. From networking chips to storage solutions, AVGO's portfolio supports the entire AI ecosystem. Their strong presence in the cloud computing sector further enhances their AI-related revenue streams.

Strengths of AVGO:

- Diversified Revenue Streams: AVGO's diverse product portfolio mitigates risk, making it a more stable investment than CRDO.

- Strong Financial Performance: AVGO consistently delivers robust financial results, showcasing a strong track record of profitability and growth.

- Established Market Presence: Broadcom's established market leadership and brand recognition provide a solid foundation for continued success.

Weaknesses of AVGO:

- Higher Valuation: AVGO's stock typically trades at a higher valuation compared to CRDO, potentially limiting upside potential.

- Less Direct Exposure to Specialized AI Hardware: While AVGO benefits from AI growth, its exposure is less direct than CRDO's laser-focused approach.

CRDO vs. AVGO: The Verdict

Choosing between CRDO and AVGO depends heavily on your risk tolerance and investment strategy.

-

For aggressive investors seeking higher potential returns: CRDO offers a more focused bet on the growth of specialized AI hardware. However, be prepared for potentially higher volatility.

-

For more conservative investors prioritizing stability and diversification: AVGO presents a safer, albeit potentially less explosive, investment opportunity. Its established market position and diverse revenue streams offer greater stability.

Ultimately, thorough due diligence is crucial before making any investment decision. Consider consulting with a financial advisor to determine which stock aligns best with your individual financial goals and risk profile. Remember that past performance is not indicative of future results. Stay informed about market trends and company news to make informed decisions.

Further Research:

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Which AI Semiconductor Stock Reigns Supreme: CRDO Or AVGO? A Comprehensive Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Shohei Ohtani Two Game Home Run Streak Achieved Twice

May 28, 2025

Shohei Ohtani Two Game Home Run Streak Achieved Twice

May 28, 2025 -

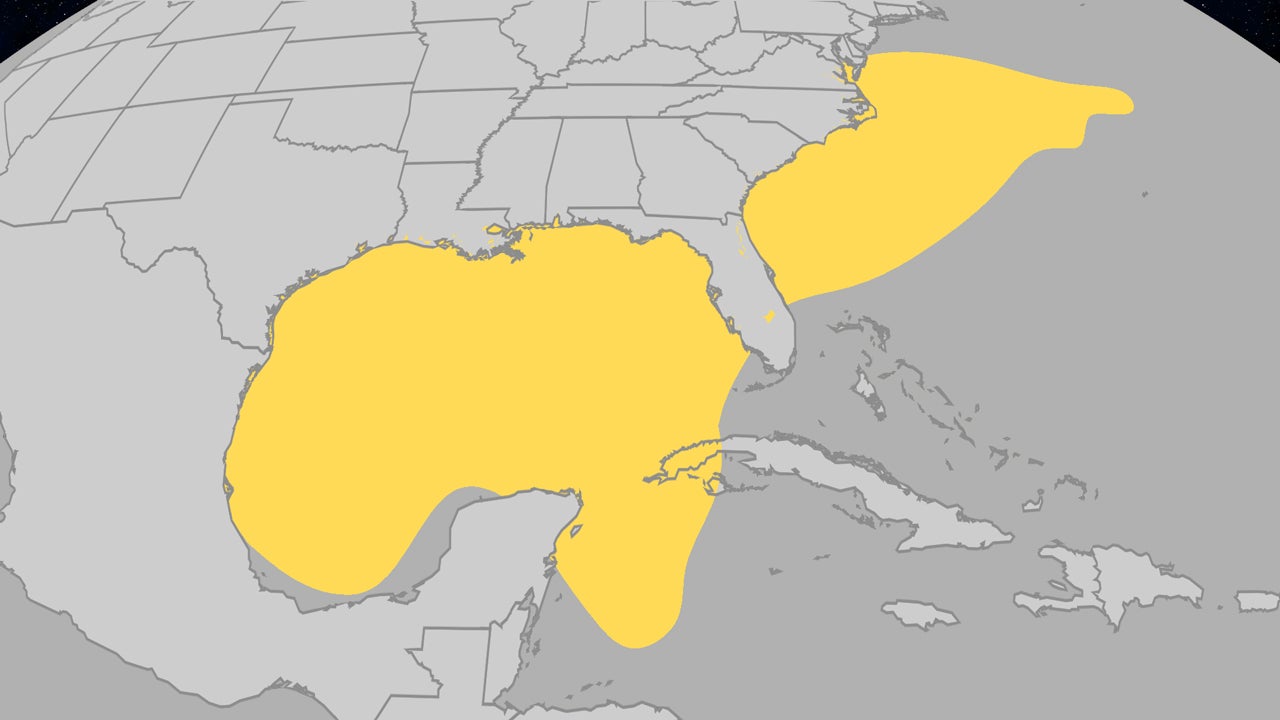

Early Hurricane Season Activity Understanding June Storm Development In The Atlantic

May 28, 2025

Early Hurricane Season Activity Understanding June Storm Development In The Atlantic

May 28, 2025 -

Pacers Game 3 Loss To Knicks Effort Questioned By Coach

May 28, 2025

Pacers Game 3 Loss To Knicks Effort Questioned By Coach

May 28, 2025 -

Smci Stock Is A 14 62 P E Multiple A Buy Signal

May 28, 2025

Smci Stock Is A 14 62 P E Multiple A Buy Signal

May 28, 2025 -

From 1992 To 2023 Comparing Opening Lap Disasters At Indy 500

May 28, 2025

From 1992 To 2023 Comparing Opening Lap Disasters At Indy 500

May 28, 2025