What's Driving GameStop (GME) Stock Higher Today? A Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

What's Driving GameStop (GME) Stock Higher Today? A Market Analysis

GameStop (GME) stock has once again captured the attention of investors, experiencing significant price fluctuations. Understanding the forces behind these movements requires a nuanced look at several contributing factors, going beyond the simple "meme stock" narrative. This market analysis dives deep into the potential drivers behind GME's recent price action.

The Persistent Meme Stock Effect:

Let's be clear: the enduring legacy of GameStop's 2021 short squeeze continues to influence its price. A significant portion of GME's trading volume still stems from retail investors, many of whom remain heavily invested despite considerable volatility. Social media platforms continue to be a breeding ground for discussions and speculation surrounding the stock, fueling its unpredictable price swings. This "meme stock" effect, while unpredictable, remains a powerful force impacting GME's trajectory. Understanding the psychology behind this phenomenon is crucial for any serious market analysis. For a deeper dive into meme stock behavior, you might want to check out .

Company Transformation and Financial Performance:

While the meme stock narrative dominates headlines, GameStop's ongoing transformation shouldn't be overlooked. The company is actively pivoting towards e-commerce and expanding its offerings beyond traditional video game retail. Recent financial reports, while not always positive, show signs of strategic shifts. Investors are carefully scrutinizing these reports, looking for indicators of long-term viability and potential profitability. Any significant positive changes in the company's financial performance, such as increased revenue or improved operating margins, could trigger further price increases. However, it's crucial to remember that these shifts require time to fully materialize and impact the stock price significantly.

Macroeconomic Factors and Market Sentiment:

The broader macroeconomic environment also plays a significant role. Periods of market uncertainty or increased risk aversion can lead investors to seek out "safe haven" assets, potentially impacting the price of more volatile stocks like GME. Conversely, a positive shift in overall market sentiment, driven by factors such as positive economic news or easing inflation concerns, could boost investor confidence and lead to increased trading activity in riskier assets, including GME. Monitoring key economic indicators and understanding the overall market mood is therefore essential when analyzing GME's price movements.

Short Interest and Potential Squeezes:

The level of short interest in GME remains a crucial factor. While the massive short squeeze of 2021 is unlikely to be repeated on the same scale, any significant increase in short interest could create the potential for another squeeze, leading to rapid price increases. Conversely, a significant decrease in short interest might indicate reduced speculative activity and a potential for price declines. Tracking short interest data provides valuable insight into potential future price volatility.

Conclusion: A Complex Equation

The price movements of GameStop stock are driven by a complex interplay of factors. While the meme stock phenomenon and social media chatter play a significant role, the company's strategic transformation, macroeconomic conditions, and short interest levels all contribute to the overall picture. Investors need a multi-faceted approach to understand the current dynamics and make informed decisions. It's crucial to avoid impulsive trading based solely on social media sentiment and instead rely on thorough research and a balanced understanding of all contributing factors.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Investing in the stock market involves significant risk, and you should consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on What's Driving GameStop (GME) Stock Higher Today? A Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Roland Garros Henrique Rocha Vence Na Estreia Em Grand Slam

May 29, 2025

Roland Garros Henrique Rocha Vence Na Estreia Em Grand Slam

May 29, 2025 -

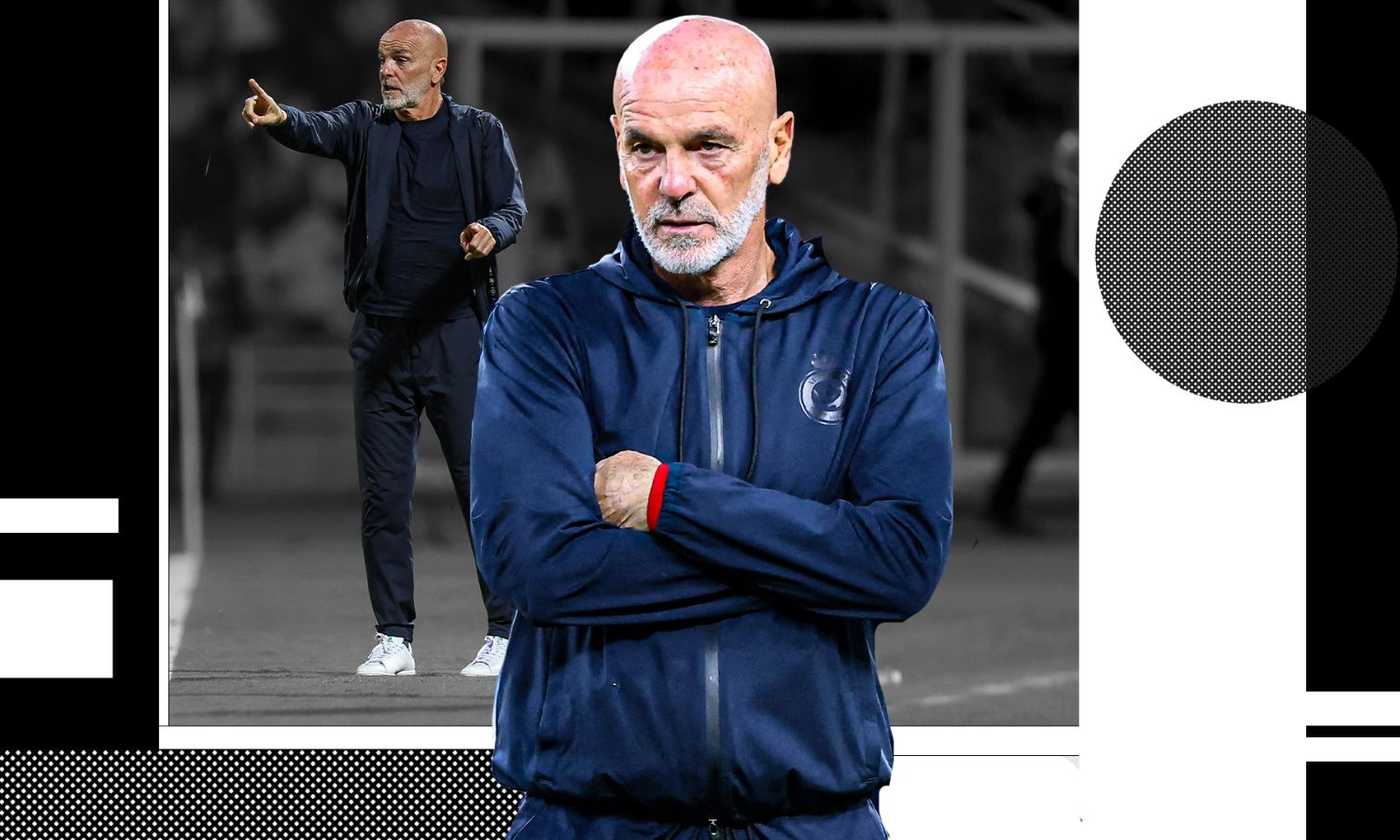

Dopo Gasperini Pioli All Atalanta Ecco Le Ultime Indiscrezioni

May 29, 2025

Dopo Gasperini Pioli All Atalanta Ecco Le Ultime Indiscrezioni

May 29, 2025 -

Indianapolis 500 Prize Money A Record Breaking Fourth Year

May 29, 2025

Indianapolis 500 Prize Money A Record Breaking Fourth Year

May 29, 2025 -

Relive The Excitement Every Touchdown From Ufl 2025 Week 9

May 29, 2025

Relive The Excitement Every Touchdown From Ufl 2025 Week 9

May 29, 2025 -

Nyt Connections Hints And Solutions Tuesday May 27 2025 716

May 29, 2025

Nyt Connections Hints And Solutions Tuesday May 27 2025 716

May 29, 2025