What Will Determine Cardano's (ADA) Price Future? Retail Or Whales?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

What Will Determine Cardano's (ADA) Price Future? Retail or Whales?

Cardano (ADA), the pioneering proof-of-stake blockchain platform, has seen its fair share of price volatility. While its technological advancements and ambitious roadmap continue to garner attention, the question on many investors' minds remains: what will ultimately shape ADA's future price? Is it the collective power of retail investors, or the strategic moves of the crypto "whales"? The answer, as with most things in the volatile crypto market, is complex.

The Retail Investor Influence:

The sheer number of retail investors holding ADA is significant. This broad base of support provides a degree of price stability, as numerous smaller transactions can mitigate the impact of large sell-offs. However, retail investor sentiment is notoriously fickle, often driven by hype cycles, market trends, and social media influence. FOMO (Fear Of Missing Out) can lead to rapid price increases, while fear and uncertainty can trigger equally swift drops. Understanding retail investor behavior – their propensity for panic selling or holding through dips – is crucial in predicting short-term price fluctuations. Analyzing social media sentiment, trading volume from smaller exchanges, and overall market sentiment indicators can offer valuable insights into this dynamic.

The Power of the Whales:

On the other hand, the actions of "whales" – individuals or entities holding massive amounts of ADA – can exert disproportionate influence on the price. Their large-scale buying and selling activities can significantly impact market liquidity and create substantial price swings. Whale activity is often less transparent and more difficult to predict than retail investor behavior. However, blockchain analytics tools can provide some clues, tracking large transactions and identifying potential patterns. Understanding whale behavior, while challenging, is vital for long-term price forecasting. Their strategic decisions – whether to accumulate, distribute, or hold – can have a considerable effect on ADA's trajectory.

Technological Advancements: The Underlying Factor:

While retail and whale activity drives short-term price volatility, the long-term price of ADA will ultimately be determined by the project's underlying fundamentals. Cardano's ongoing development, including advancements in its smart contract functionality (Plutus), scalability improvements, and the expansion of its decentralized applications (dApps) ecosystem, will play a decisive role. Positive developments in these areas could attract institutional investors and boost long-term price appreciation. Conversely, setbacks or delays could negatively impact investor confidence and suppress price growth. Staying updated on Cardano's roadmap and technological progress is therefore crucial for any investor. You can find more details on the official Cardano website. [Link to Cardano website]

The Interplay of Forces:

It's important to remember that the influence of retail investors and whales isn't mutually exclusive; they interact dynamically. Whale activity can influence retail sentiment, creating cascading effects. For example, a large whale sell-off could trigger panic selling among retail investors, leading to a significant price drop. Conversely, a whale's large-scale buying could generate FOMO and drive retail investors to purchase, leading to a price surge.

Conclusion: A Holistic Approach:

Predicting Cardano's future price requires a holistic approach. Analyzing both retail investor sentiment and whale activity, combined with a thorough understanding of Cardano's technological advancements and market conditions, provides a more comprehensive picture. While short-term price movements might be unpredictable, focusing on the project's long-term potential and its ability to deliver on its promises remains the key to informed investment decisions. Remember to always conduct thorough research and consider your own risk tolerance before investing in any cryptocurrency.

Keywords: Cardano, ADA, Cardano price prediction, crypto whales, retail investors, cryptocurrency, blockchain, Plutus, smart contracts, dApps, cryptocurrency investment, crypto market analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on What Will Determine Cardano's (ADA) Price Future? Retail Or Whales?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cardano Price Analysis Oversold Conditions Fuel 0 75 Target Speculation

Aug 03, 2025

Cardano Price Analysis Oversold Conditions Fuel 0 75 Target Speculation

Aug 03, 2025 -

Contract Dispute Is Micah Parsons Leaving The Dallas Cowboys

Aug 03, 2025

Contract Dispute Is Micah Parsons Leaving The Dallas Cowboys

Aug 03, 2025 -

Leagues Cup Suspends Messis Bodyguard For Improper Conduct

Aug 03, 2025

Leagues Cup Suspends Messis Bodyguard For Improper Conduct

Aug 03, 2025 -

Dodgers World Series Chances 2025 Odds Shift After Recent Trades

Aug 03, 2025

Dodgers World Series Chances 2025 Odds Shift After Recent Trades

Aug 03, 2025 -

Sha Carri Richardson In Trouble Details Emerge Following Assault Arrest

Aug 03, 2025

Sha Carri Richardson In Trouble Details Emerge Following Assault Arrest

Aug 03, 2025

Latest Posts

-

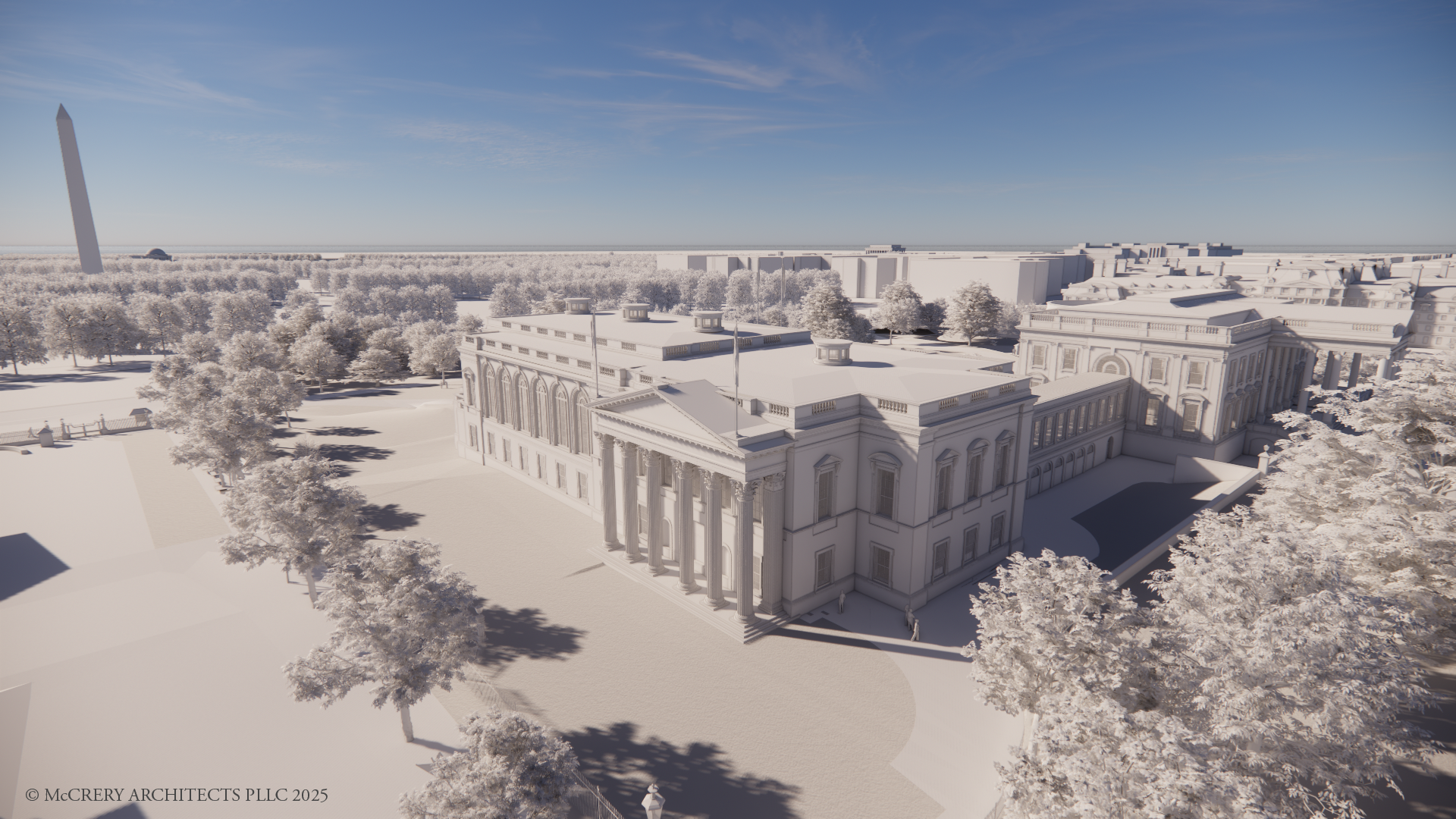

White House Ballroom Renovation Construction To Begin

Aug 04, 2025

White House Ballroom Renovation Construction To Begin

Aug 04, 2025 -

Ten Blockbuster Trades Shaping The 2025 Mlb Season

Aug 04, 2025

Ten Blockbuster Trades Shaping The 2025 Mlb Season

Aug 04, 2025 -

2024 Fantasy Football Do Not Draft List Top Overvalued Players To Avoid

Aug 04, 2025

2024 Fantasy Football Do Not Draft List Top Overvalued Players To Avoid

Aug 04, 2025 -

Abigail Folger Coffee Fortune And The Manson Familys Brutal Killings

Aug 04, 2025

Abigail Folger Coffee Fortune And The Manson Familys Brutal Killings

Aug 04, 2025 -

Leagues Cup Suspends Messis Bodyguard Following Espn Report Of Misconduct

Aug 04, 2025

Leagues Cup Suspends Messis Bodyguard Following Espn Report Of Misconduct

Aug 04, 2025