Warren Buffett's Latest Move: Bank Of America Sell-Off Fuels Consumer Brand Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Latest Move: Bank of America Sell-Off Fuels Consumer Brand Investment

Oracle of Omaha shifts focus, shedding banking giant stakes to bolster consumer goods portfolio.

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has sent ripples through the financial world with a significant strategic shift. Recent filings reveal a substantial reduction in Berkshire Hathaway's holdings of Bank of America stock, a move that has fueled speculation about a renewed focus on consumer brands. This unexpected maneuver follows years of steady investment in the banking sector and marks a potentially significant change in Berkshire's investment strategy. The sell-off has raised eyebrows and prompted analysts to dissect the implications for both the banking and consumer goods sectors.

A Bet on Familiar Brands?

The precise reasons behind Buffett's decision remain shrouded in some mystery. However, the timing coincides with Berkshire Hathaway's increased activity in acquiring and expanding its holdings in various consumer-facing companies. While Buffett has always maintained a diversified portfolio, this recent divestment from Bank of America suggests a possible re-evaluation of risk tolerance and a potential bet on the resilience of consumer spending, even amidst economic uncertainty. This isn't a complete abandonment of the financial sector, but rather a strategic reallocation of resources.

What does this mean for investors? The move has already impacted Bank of America's stock price, though the overall effect remains to be seen. However, the increased investment in consumer brands could signal a bullish outlook on the sector's long-term prospects. This could be particularly appealing to investors seeking stability and growth in a volatile market.

Beyond the Headlines: Analyzing the Shift

Several factors could be contributing to Buffett's decision:

- Valuation Concerns: Bank of America, while a stable institution, might have reached a valuation point considered less attractive by Buffett's famously value-oriented investment strategy.

- Market Diversification: Reducing exposure to a single sector, even a strong one, is a standard risk management technique employed by seasoned investors.

- Growth Potential: The consumer goods sector, particularly brands with strong recognition and established market share, often offers compelling growth opportunities. This allows for a broader diversification of investment risk.

This isn't the first time Buffett has adjusted his portfolio significantly. His investment decisions are always closely watched, and this recent shift emphasizes the importance of adaptability and long-term vision in successful investing. Furthermore, this highlights the dynamic nature of the investment landscape and the continuous need for astute portfolio management.

The Future of Berkshire Hathaway's Investment Strategy

While the exact details of Buffett's future investment plans remain undisclosed, this move signifies a potential paradigm shift in Berkshire Hathaway's approach. The company's increased engagement with the consumer brands sector may indicate a belief in the enduring power of strong consumer brands, even in the face of economic headwinds. This warrants continued observation and analysis from market experts and investors alike. The upcoming earnings reports will offer further insights into Berkshire Hathaway's strategic direction.

Looking Ahead: Keep an eye on Berkshire Hathaway's future investments to see how this significant shift plays out. The Oracle of Omaha's moves always provide valuable lessons for both seasoned and novice investors. Learning from his decisions, whether buying or selling, is a key aspect of navigating the complex world of finance. What are your thoughts on this recent shift in investment strategy? Share your insights in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Latest Move: Bank Of America Sell-Off Fuels Consumer Brand Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Minnesota Gophers Rashod Bateman Lands Lucrative Nfl Deal Exceeding Eric Deckers

Jun 05, 2025

Minnesota Gophers Rashod Bateman Lands Lucrative Nfl Deal Exceeding Eric Deckers

Jun 05, 2025 -

Post Injury Power Mike Trouts First Home Run For The Los Angeles Angels

Jun 05, 2025

Post Injury Power Mike Trouts First Home Run For The Los Angeles Angels

Jun 05, 2025 -

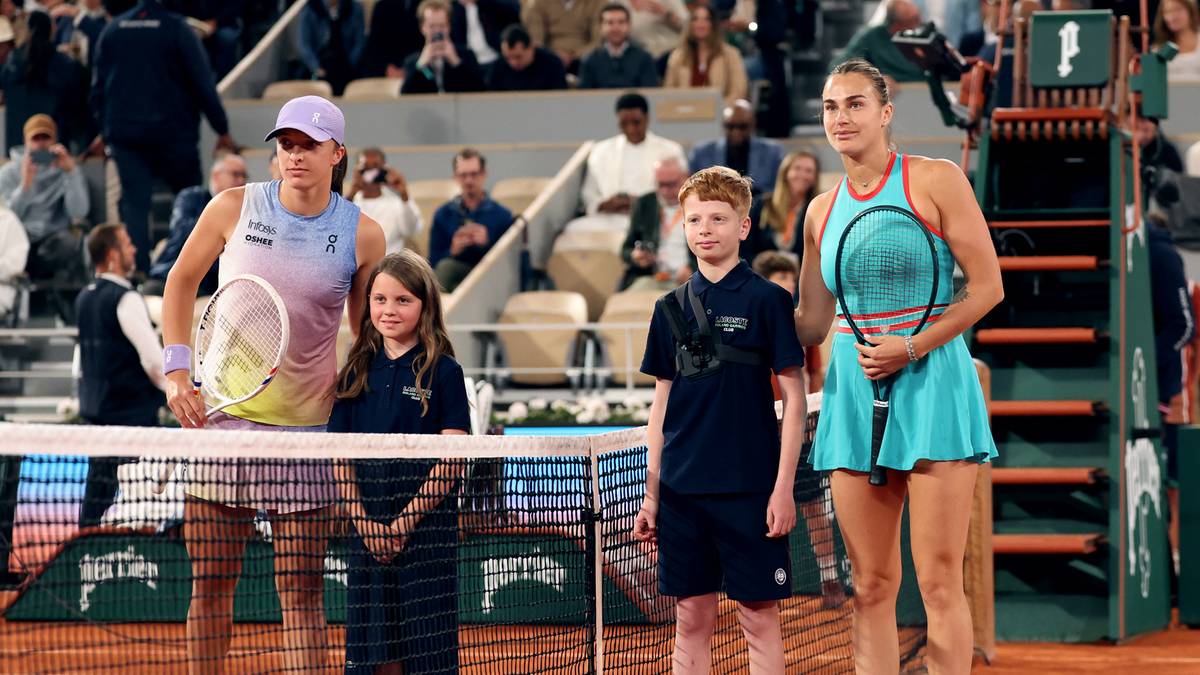

Roland Garros Zobacz Mecz Swiatek Sabalenka Online Wynik Na Zywo

Jun 05, 2025

Roland Garros Zobacz Mecz Swiatek Sabalenka Online Wynik Na Zywo

Jun 05, 2025 -

Four Goal Blitz Uswnt Cruises Past Jamaica To Finish Unbeaten International Window

Jun 05, 2025

Four Goal Blitz Uswnt Cruises Past Jamaica To Finish Unbeaten International Window

Jun 05, 2025 -

Kerry Carpenters Three Homerun Performance Fuels Tigers Victory Against White Sox

Jun 05, 2025

Kerry Carpenters Three Homerun Performance Fuels Tigers Victory Against White Sox

Jun 05, 2025