Warren Buffett's Investment Shift: Selling Two Long-Term US Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Investment Shift: Selling Two Long-Term US Stocks Sends Shockwaves Through Wall Street

Oracle of Omaha's surprising move to significantly reduce Berkshire Hathaway's holdings in two long-term US stocks, US Bancorp (USB) and Bank of America (BAC), has sent ripples of speculation throughout the financial world. This unexpected shift in investment strategy from the legendary investor is prompting analysts to re-evaluate the current market climate and consider potential future trends.

The news, revealed in Berkshire Hathaway's recent 13F filing, shows a considerable decrease in the company's ownership of both banking giants. While Buffett has long been known for his value investing approach and long-term holdings, this move signifies a potential change in his outlook on the financial sector, or at least a strategic realignment within his portfolio.

The Details of the Downgrade

Berkshire Hathaway's reduced stake in US Bancorp is particularly noteworthy, considering its long history as a Berkshire holding. This divestment suggests a shift in Buffett's assessment of the bank's future prospects, possibly related to concerns about rising interest rates or changing economic conditions impacting the banking sector. Similarly, the reduction in Bank of America shares, while less dramatic, still raises eyebrows given Buffett's historically bullish stance on the institution.

This isn't the first time Buffett has adjusted his portfolio; however, the magnitude of these recent changes, especially concerning such long-held positions, has caught the attention of investors and financial experts alike. The question now is: what does this mean for the future?

Interpreting the Oracle's Actions: Possible Reasons Behind the Shift

Several factors could be contributing to Buffett's decision:

- Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes to combat inflation could be impacting the profitability of banks, prompting Buffett to adjust his holdings. Higher rates can squeeze net interest margins and increase loan defaults.

- Economic Uncertainty: The current global economic climate, characterized by high inflation and geopolitical instability, introduces uncertainty that could lead even seasoned investors like Buffett to re-evaluate their risk exposure.

- Portfolio Diversification: It's possible that Buffett is simply rebalancing his portfolio to better align with his evolving long-term strategy. This doesn't necessarily signal a bearish outlook on the banking sector as a whole.

- Identifying More Attractive Opportunities: Buffett’s legendary success stems from his ability to identify undervalued assets. He may have found more promising investment opportunities elsewhere.

What This Means for Investors

Buffett's actions serve as a potent reminder that even the most successful investors adapt to changing market conditions. While his decisions don't necessarily predict a market crash, they do highlight the importance of:

- Diversification: Spreading your investments across different asset classes can help mitigate risk.

- Regular Portfolio Review: Regularly assessing your investment portfolio and making necessary adjustments is crucial.

- Staying Informed: Keeping abreast of market trends and news impacting your investments is essential for informed decision-making.

This situation underscores the dynamic nature of the stock market and the need for investors to remain vigilant and adaptable. The long-term implications of Buffett's recent moves remain to be seen, but one thing is certain: the Oracle of Omaha's actions will continue to be closely scrutinized by investors worldwide.

Learn More: For further insights into Warren Buffett's investment strategies, you can visit the official Berkshire Hathaway website [link to Berkshire Hathaway website]. You can also explore resources on value investing and portfolio management through reputable financial news sources. Remember to consult a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Investment Shift: Selling Two Long-Term US Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Karen Read Retrial Thursdays Witness Testimony Cancelled Explanation

Jun 05, 2025

Karen Read Retrial Thursdays Witness Testimony Cancelled Explanation

Jun 05, 2025 -

Angels Trout Fuels Win With 3 Hits And A Home Run

Jun 05, 2025

Angels Trout Fuels Win With 3 Hits And A Home Run

Jun 05, 2025 -

Belmont Stakes 2025 Full Horse Draw Post Positions And Race Day Information

Jun 05, 2025

Belmont Stakes 2025 Full Horse Draw Post Positions And Race Day Information

Jun 05, 2025 -

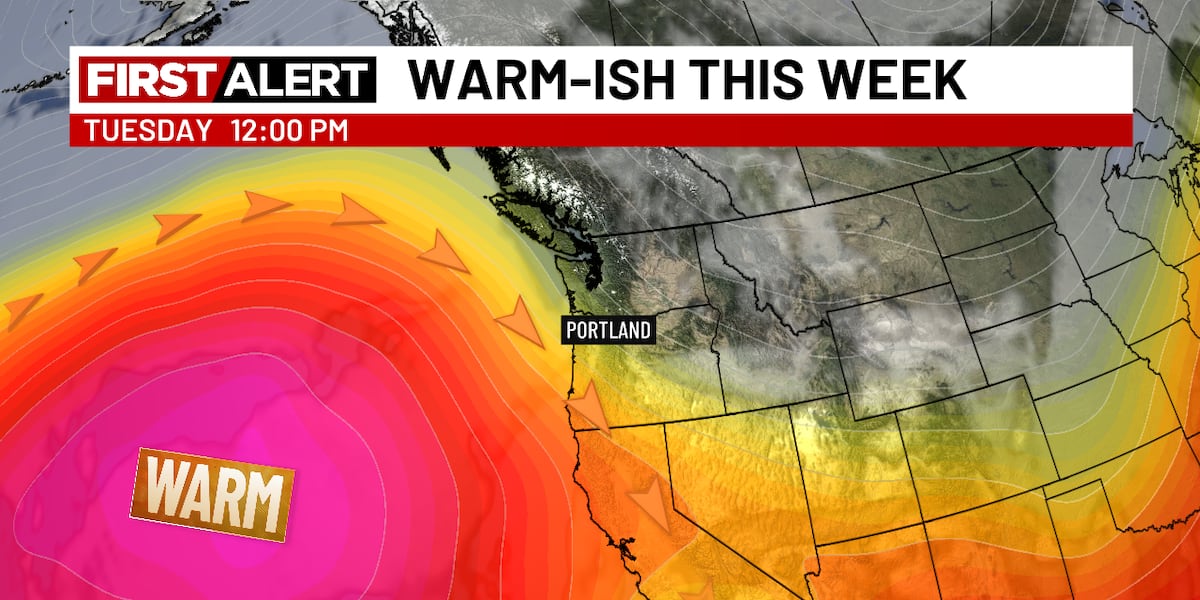

Sunshine And Warmth Dominate Early June Forecast

Jun 05, 2025

Sunshine And Warmth Dominate Early June Forecast

Jun 05, 2025 -

Colorado Rockies End Losing Skid First Series Win Since 2024

Jun 05, 2025

Colorado Rockies End Losing Skid First Series Win Since 2024

Jun 05, 2025