Warren Buffett's Bold Move: Bank Of America Shares Sold, New Consumer Brand Investment Soars

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett's Bold Move: Bank of America Shares Dumped, Consumer Brand Investment Soars

Omaha, Nebraska – The Oracle of Omaha, Warren Buffett, has sent shockwaves through the financial world with a surprising shift in his investment portfolio. Berkshire Hathaway, Buffett's investment conglomerate, has significantly reduced its holdings in Bank of America, a long-standing cornerstone of its investment strategy. Simultaneously, the company has dramatically increased its stake in a lesser-known consumer brand, highlighting a potential strategic shift towards a different sector.

This unexpected move has sparked intense speculation amongst financial analysts and investors alike. The sale of Bank of America shares, a substantial portion of Berkshire Hathaway's portfolio for years, represents a departure from Buffett's traditionally conservative investment approach. But what prompted this bold decision, and what does it mean for the future of Berkshire Hathaway’s investment strategy?

The Bank of America Sell-Off: A Sign of the Times?

Berkshire Hathaway's recent 13F filing revealed a significant decrease in its Bank of America holdings. While the exact reasons remain undisclosed, several factors could be at play. Some analysts suggest the move reflects a reassessment of the banking sector's overall performance in the current economic climate. Rising interest rates and concerns about a potential recession could be contributing factors. Others speculate that Buffett is reallocating capital to more promising sectors, seeking higher growth potential.

The decision to divest from a seemingly stable blue-chip stock like Bank of America is undoubtedly a bold one. It underscores Buffett's willingness to adapt his investment strategy in response to evolving market conditions. This move demonstrates his commitment to long-term value creation, even if it means parting ways with long-held positions.

A New Focus: Investing in Consumer Brands

While the Bank of America sell-off grabbed headlines, the substantial increase in Berkshire Hathaway's investment in an unnamed consumer brand is equally significant. Although details are scarce, this move points towards a potentially larger investment strategy shift. The move signifies a renewed focus on consumer-facing businesses, a sector offering potentially high-growth opportunities. Analysts are eagerly awaiting further information on this new investment to fully understand Buffett's strategic thinking.

This investment may represent a bet on the continued strength of the consumer market, despite macroeconomic headwinds. It could also signal a belief in the long-term potential of a specific consumer brand with strong growth prospects. This sector is often characterized by higher volatility compared to traditional banking stocks.

What This Means for Investors

Buffett's actions always send ripples through the market, and this dual move is no exception. Investors are left pondering the implications for both the banking sector and the consumer goods market. The reduction in Bank of America shares could trigger further sell-offs in the banking sector, while the increased investment in the unnamed consumer brand could lead to a surge in interest and valuation for similar companies.

This situation highlights the importance of diversifying investment portfolios and staying informed about market trends. It also underscores the need for investors to carefully consider their risk tolerance before making any investment decisions.

Looking Ahead

The full implications of Buffett’s bold moves remain to be seen. Further analysis is needed to fully understand the reasoning behind the Bank of America share sale and the significant investment in the consumer brand. However, one thing is certain: Warren Buffett continues to demonstrate his remarkable adaptability and shrewd investment acumen, shaping the market with every strategic decision. This situation serves as a reminder that even the most seasoned investors must adapt to evolving market conditions and opportunities. Stay tuned for further updates as this story unfolds. Are you prepared to navigate these market shifts? Consider consulting with a financial advisor to plan your investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Bold Move: Bank Of America Shares Sold, New Consumer Brand Investment Soars. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Manchester United Star Bruno Fernandes Snubs Al Hilal Move Staying At Old Trafford

Jun 05, 2025

Manchester United Star Bruno Fernandes Snubs Al Hilal Move Staying At Old Trafford

Jun 05, 2025 -

Gabby Thomas Heckled Fan Duel Takes Action Against Bettor

Jun 05, 2025

Gabby Thomas Heckled Fan Duel Takes Action Against Bettor

Jun 05, 2025 -

May 2024 Ranking The Months Top 10 Sports Headlines

Jun 05, 2025

May 2024 Ranking The Months Top 10 Sports Headlines

Jun 05, 2025 -

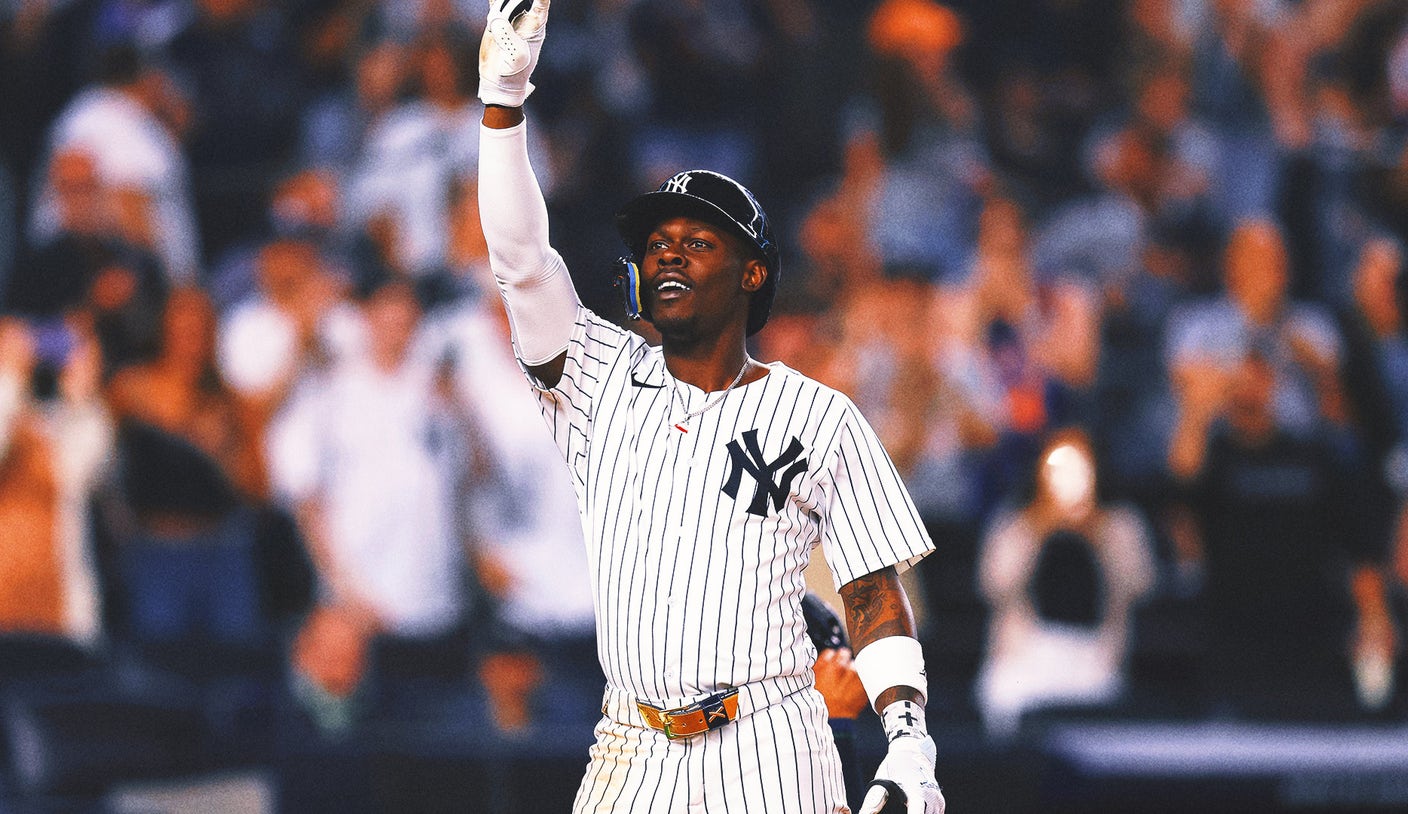

Yankees Chisholm Jr Makes Impactful Injury Return With Winning Solo Homer

Jun 05, 2025

Yankees Chisholm Jr Makes Impactful Injury Return With Winning Solo Homer

Jun 05, 2025 -

Hear The Unheard Grace Potter Opens Her Musical Archives

Jun 05, 2025

Hear The Unheard Grace Potter Opens Her Musical Archives

Jun 05, 2025