Warren Buffett's Berkshire Hathaway: Reduced Bank Of America Stake, Increased Consumer Brand Holding

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Berkshire Hathaway Adjusts Portfolio: Less Bank of America, More Consumer Goods

Warren Buffett's Berkshire Hathaway, one of the world's most closely watched investment firms, has revealed significant shifts in its portfolio in its latest 13F filing. The changes highlight a subtle shift in strategy, reducing its stake in Bank of America while simultaneously increasing its holdings in several prominent consumer brands. This move has sent ripples through the financial markets, sparking debate among analysts about Buffett's investment philosophy and the future direction of Berkshire Hathaway.

A Smaller Slice of Bank of America:

Berkshire Hathaway significantly decreased its holdings in Bank of America (BAC), a long-standing investment for the Oracle of Omaha. The reduction, while substantial, still leaves Berkshire with a considerable stake in the financial giant. This strategic downscaling might be attributed to several factors, including a reevaluation of the bank's future prospects in a changing economic landscape, a need for portfolio diversification, or simply taking profits on a highly successful investment. Analysts are closely examining the reasons behind this decision, speculating on whether it signals a broader shift away from the financial sector for Berkshire Hathaway. Further analysis of market trends and economic indicators could provide more insight. [Link to Bank of America's financial reports]

Increased Appetite for Consumer Goods:

Conversely, Berkshire Hathaway significantly boosted its investments in various consumer brands. This indicates a growing confidence in the resilience and long-term growth potential of the consumer sector, even amidst economic uncertainty. Specific increases in holdings weren't explicitly detailed in the initial filing but reports suggest a focus on companies offering essential goods and services, implying a focus on defensive stocks. This strategy reflects a potentially conservative approach, prioritizing steady returns over higher-risk, higher-reward ventures.

What Does This Mean for Investors?

These portfolio adjustments highlight the dynamic nature of Berkshire Hathaway's investment strategy. Buffett's moves are meticulously planned and often serve as a significant market indicator. The reduction in Bank of America might not signal a bearish outlook on the bank itself, but rather a strategic reallocation of assets within a diversified portfolio. The increase in consumer brand holdings suggests a bet on the continued strength of consumer spending and the stability these businesses provide.

Key Takeaways:

- Reduced Bank of America Stake: A significant decrease, though Berkshire retains a considerable holding.

- Increased Consumer Brand Holdings: A shift toward more defensive, stable investments.

- Strategic Portfolio Adjustment: Reflecting a dynamic and adaptable investment approach.

- Market Implications: Buffett's moves often serve as a significant market indicator.

The full implications of these changes will unfold over time. However, this portfolio adjustment clearly showcases Berkshire Hathaway’s ongoing efforts to maintain a robust and adaptable investment strategy within the ever-evolving global economic landscape. Investors and analysts will be closely monitoring the performance of these newly weighted holdings in the coming quarters. Further investigation into Berkshire Hathaway's annual report will provide additional clarity. [Link to Berkshire Hathaway's investor relations page]

Call to Action: Stay informed about market trends by regularly reviewing financial news and conducting your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett's Berkshire Hathaway: Reduced Bank Of America Stake, Increased Consumer Brand Holding. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Grace Potter Opens The Vault Rare Recordings And Behind The Scenes Stories

Jun 05, 2025

Grace Potter Opens The Vault Rare Recordings And Behind The Scenes Stories

Jun 05, 2025 -

2025 Belmont Stakes Post Time Tv Channel And Horse Racing Info

Jun 05, 2025

2025 Belmont Stakes Post Time Tv Channel And Horse Racing Info

Jun 05, 2025 -

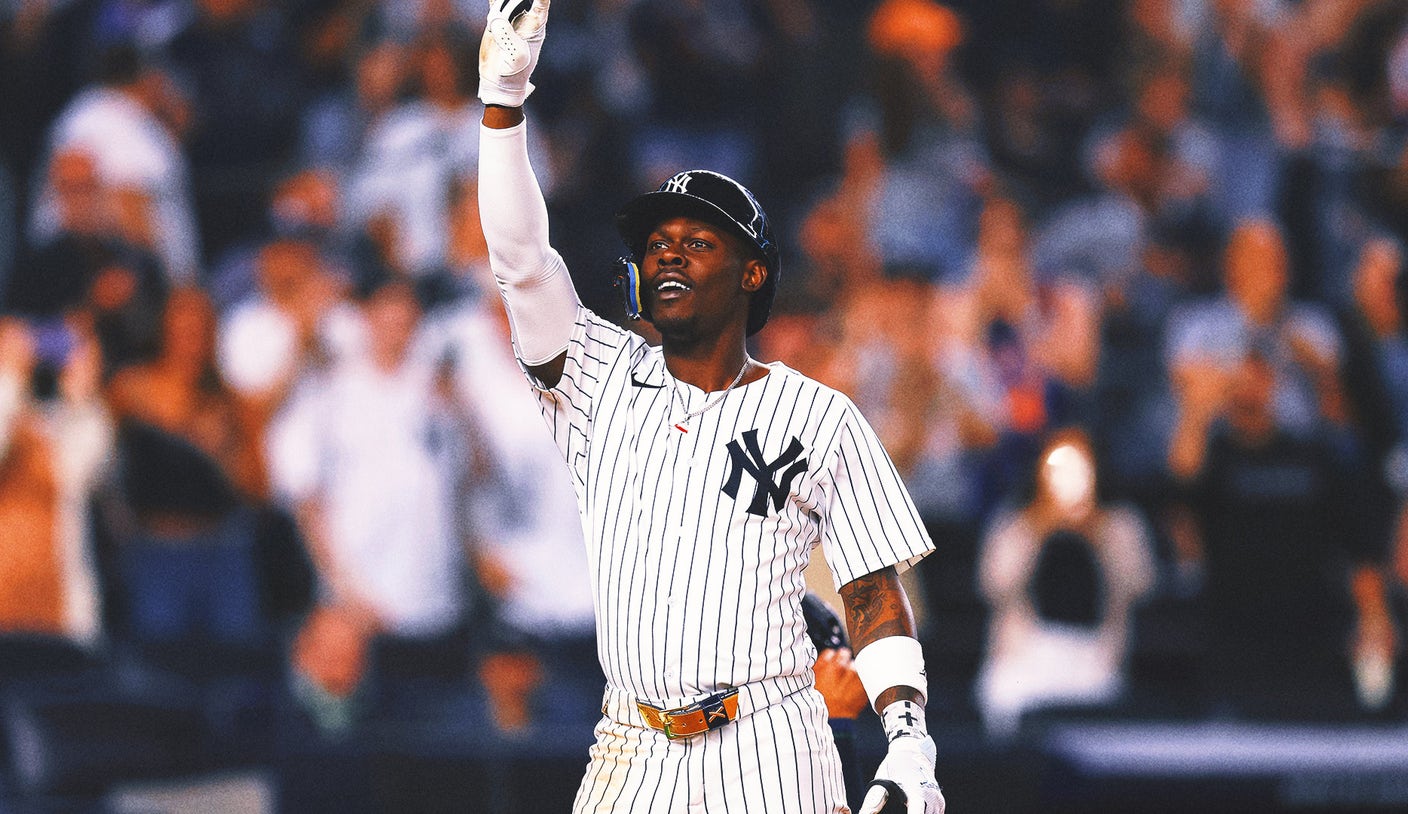

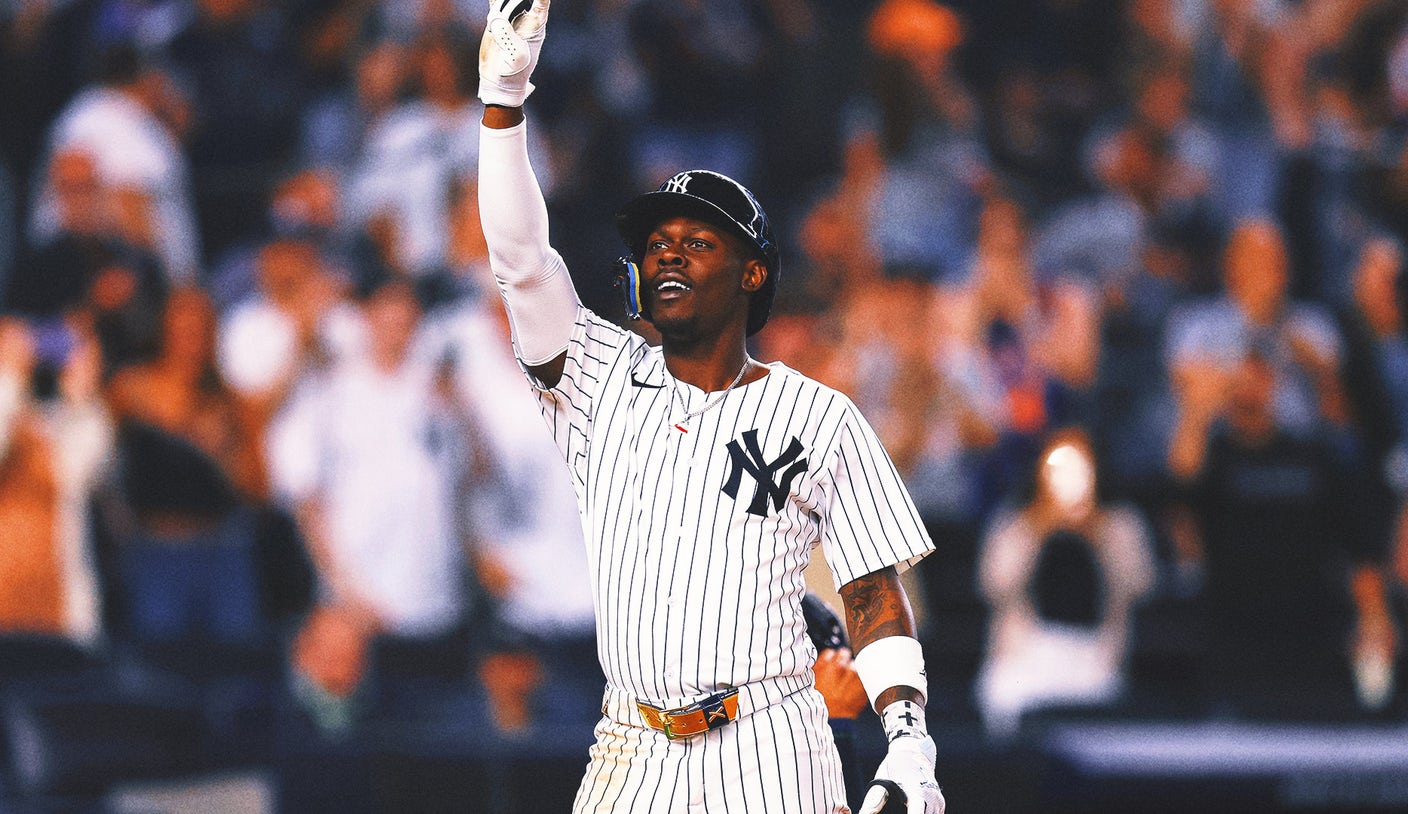

Chisholm Jr S Solo Shot Fuels Yankees Victory In Injury Return

Jun 05, 2025

Chisholm Jr S Solo Shot Fuels Yankees Victory In Injury Return

Jun 05, 2025 -

Controversy Fan Duel Takes Action Against Bettor For Track Event Disruption

Jun 05, 2025

Controversy Fan Duel Takes Action Against Bettor For Track Event Disruption

Jun 05, 2025 -

Chisholm Jr S Injury Comeback Sparks Yankees Win

Jun 05, 2025

Chisholm Jr S Injury Comeback Sparks Yankees Win

Jun 05, 2025