Warren Buffett Sells US Stocks: What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Warren Buffett Sells US Stocks: What It Means for Investors

The Oracle of Omaha's recent moves have sent shockwaves through the market. What does Warren Buffett's selling of US stocks signal for the average investor?

The investment world is abuzz. Warren Buffett, the legendary CEO of Berkshire Hathaway and arguably the most influential investor of our time, has been significantly reducing his holdings in several major US stocks. This isn't just idle market maneuvering; it's a development that demands attention from seasoned investors and newcomers alike. Understanding the implications requires careful analysis of Buffett's strategy and the current economic climate.

Buffett's Recent Stock Sales: A Deeper Dive

Recent filings reveal substantial decreases in Berkshire Hathaway's stakes in companies like [insert specific company examples with links to reliable financial news sources]. These sales, totaling [insert approximate dollar amount or percentage], have sparked widespread speculation about the future market direction. While Buffett famously avoids short-term market predictions, these actions speak volumes.

It's crucial to remember that Buffett's investment decisions are rarely impulsive. His strategies are typically long-term, rooted in fundamental analysis and a deep understanding of company value. Therefore, these sales warrant a careful examination of potential factors driving this shift.

Possible Reasons Behind Buffett's Actions

Several explanations are circulating among financial analysts:

- Overvaluation: Perhaps Buffett believes certain sectors are currently overvalued, prompting him to secure profits before a potential market correction. This is consistent with his value investing philosophy, focusing on buying undervalued assets and holding them for the long term.

- Sectoral Shifts: The economic landscape is constantly changing. Buffett might be reallocating capital towards sectors he deems more promising for future growth, reflecting a strategic shift in his investment portfolio. This could include increased investment in [mention potential sectors like renewable energy, technology etc., with relevant links].

- Strategic Portfolio Adjustments: Large-scale portfolio adjustments are normal for even the most seasoned investors. Buffett may be rebalancing his portfolio to mitigate risk and optimize returns.

What This Means for You: Navigating Market Uncertainty

Buffett's actions don't necessarily signal an impending market crash. However, they do underscore the importance of:

- Diversification: A well-diversified portfolio can help mitigate risk. Spreading your investments across different asset classes and sectors can help cushion the blow of any single investment underperforming. Learn more about effective diversification strategies [link to a reputable financial resource].

- Long-Term Perspective: Buffett's success is a testament to the power of long-term investing. Don't panic sell based on short-term market fluctuations. Stick to your investment plan and re-evaluate periodically.

- Due Diligence: Before making any investment decisions, conduct thorough research. Understand the fundamentals of the companies you're investing in and stay updated on market trends.

The Bottom Line

Warren Buffett's recent stock sales are a significant event in the financial world. While we can't definitively state the exact reasons behind his actions, they serve as a reminder of the ever-evolving nature of the market and the importance of prudent investment strategies. Investors should approach the situation with caution, maintaining a long-term perspective and focusing on their individual financial goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Warren Buffett Sells US Stocks: What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amanda Seyfrieds Premiere Look A Rabanne Fringe Dress For I Dont Understand You

Jun 05, 2025

Amanda Seyfrieds Premiere Look A Rabanne Fringe Dress For I Dont Understand You

Jun 05, 2025 -

Nations League Semifinal Germany Vs Portugal Tv Channels Streaming And Odds

Jun 05, 2025

Nations League Semifinal Germany Vs Portugal Tv Channels Streaming And Odds

Jun 05, 2025 -

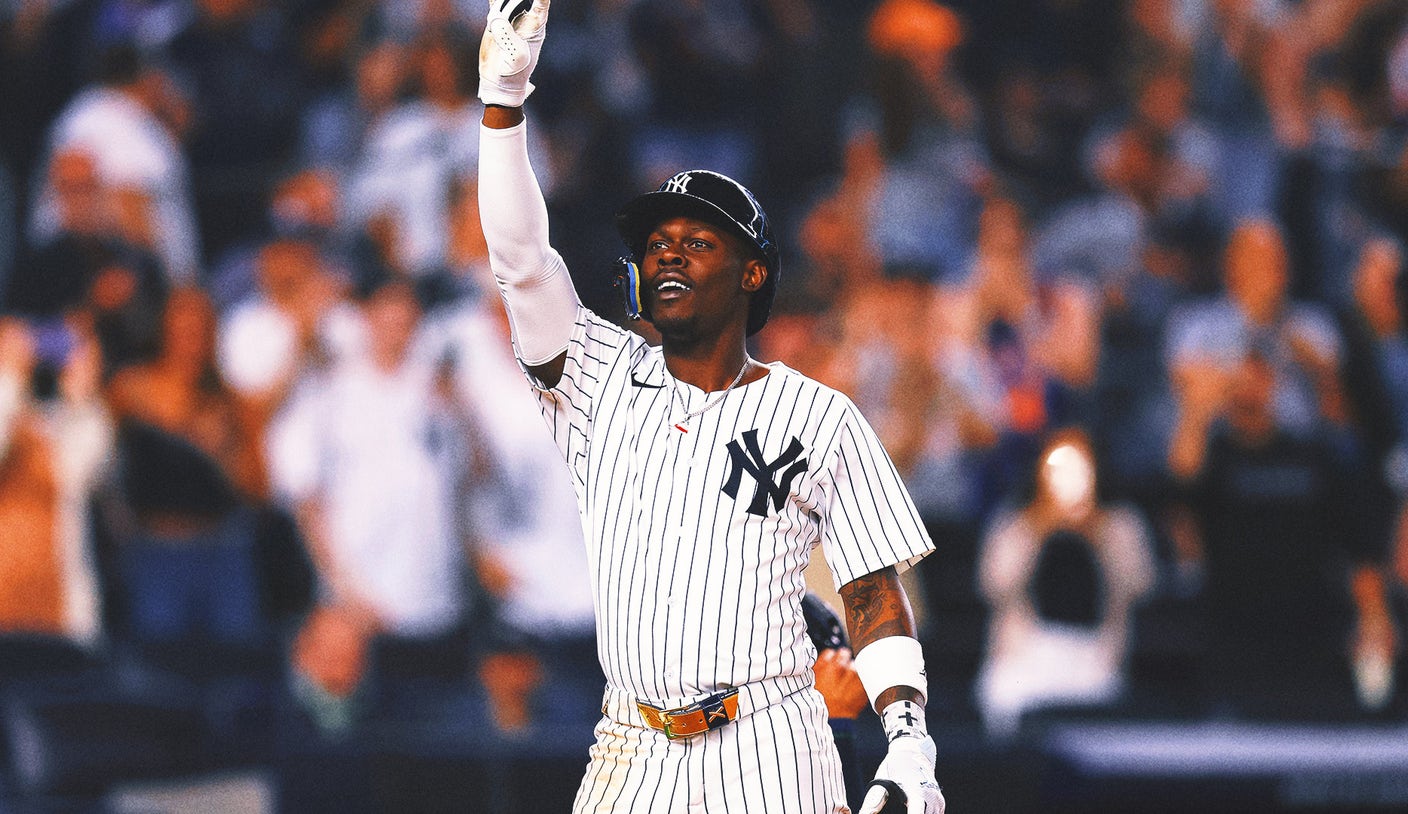

Yankees Triumph Chisholm Jr S Return Highlighted By Crucial Solo Home Run

Jun 05, 2025

Yankees Triumph Chisholm Jr S Return Highlighted By Crucial Solo Home Run

Jun 05, 2025 -

Fan Duels Ban Highlights Online Bettings Responsibility After Thomas Incident

Jun 05, 2025

Fan Duels Ban Highlights Online Bettings Responsibility After Thomas Incident

Jun 05, 2025 -

U S Open Bound Cameron Youngs Dramatic Playoff Qualification

Jun 05, 2025

U S Open Bound Cameron Youngs Dramatic Playoff Qualification

Jun 05, 2025