Wall Street's $250 Prediction: Analyzing Broadcom's Upcoming Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street's $250 Prediction: Analyzing Broadcom's Upcoming Earnings

Wall Street is buzzing with anticipation as chipmaker Broadcom (AVGO) prepares to announce its upcoming earnings. With a bold $250 price target from some analysts, the question on everyone's mind is: can Broadcom deliver? This article delves into the factors influencing this prediction, analyzing the potential upsides and downsides for investors.

Broadcom's Strong Performance and Future Outlook

Broadcom has consistently exceeded expectations in recent quarters, demonstrating robust growth across its key segments – semiconductor solutions and infrastructure software. This strong performance has fueled investor confidence and contributed to the optimistic $250 price target. The company's diversified revenue streams, encompassing networking, wireless, and storage solutions, provide a buffer against market volatility.

Key Factors Driving the $250 Prediction:

Several factors contribute to the bullish outlook for Broadcom:

- Strong Demand for Semiconductors: The ongoing digital transformation across various industries, from data centers to smartphones, is driving immense demand for semiconductors. Broadcom's position as a leading provider in this market places it well to capitalize on this growth.

- Acquisition of VMware: The completion of Broadcom's acquisition of VMware significantly expands its software portfolio and opens new revenue streams. This strategic move is expected to boost long-term growth prospects.

- 5G Infrastructure Deployment: The continued rollout of 5G networks globally presents a significant opportunity for Broadcom, as its components are crucial for building and maintaining these networks.

- Data Center Growth: The ever-increasing demand for data center infrastructure positions Broadcom's networking solutions favorably. This sector is experiencing substantial growth, fueling demand for Broadcom's products.

Potential Headwinds and Risks:

While the outlook is largely positive, several factors could potentially impact Broadcom's performance and the validity of the $250 price target:

- Global Economic Slowdown: A potential global economic downturn could reduce demand for semiconductors, impacting Broadcom's revenue.

- Geopolitical Uncertainty: The ongoing geopolitical tensions could disrupt supply chains and affect Broadcom's operations.

- Increased Competition: The semiconductor industry is highly competitive. Intense competition could put pressure on Broadcom's pricing and margins.

Analyzing the $250 Price Target:

The $250 price target reflects a significant upside potential, but it's crucial to approach such predictions with caution. It's important to conduct thorough due diligence and consider the potential risks before making any investment decisions. While several analysts believe Broadcom's strong fundamentals and strategic moves justify this ambitious target, it's not a guaranteed outcome.

What to Watch for in the Upcoming Earnings Report:

Investors should closely monitor the following aspects of Broadcom's upcoming earnings report:

- Revenue Growth: Tracking the growth across different segments is crucial for assessing the overall health of the business.

- Profitability: Analyzing profit margins and operating expenses will provide insights into the company's efficiency and cost management.

- Guidance for Future Quarters: Broadcom's outlook for the next quarter and beyond will offer valuable clues about its future performance.

Conclusion:

The $250 price target for Broadcom reflects significant optimism regarding the company's future prospects. However, investors should carefully weigh the potential upside against the inherent risks before making investment decisions. Thorough analysis of the upcoming earnings report, along with a comprehensive understanding of the macroeconomic environment and competitive landscape, is crucial for informed investment strategies. Stay tuned for updates following Broadcom's earnings announcement!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street's $250 Prediction: Analyzing Broadcom's Upcoming Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New England Patriots To Keep Stefon Diggs After Video Controversy

Jun 04, 2025

New England Patriots To Keep Stefon Diggs After Video Controversy

Jun 04, 2025 -

Cant Stop Wont Stop Netflixs New 8 Episode Series Is Addictive

Jun 04, 2025

Cant Stop Wont Stop Netflixs New 8 Episode Series Is Addictive

Jun 04, 2025 -

Mlbs Rockies Hit A Low Another Sweep Fastest To 50 Losses

Jun 04, 2025

Mlbs Rockies Hit A Low Another Sweep Fastest To 50 Losses

Jun 04, 2025 -

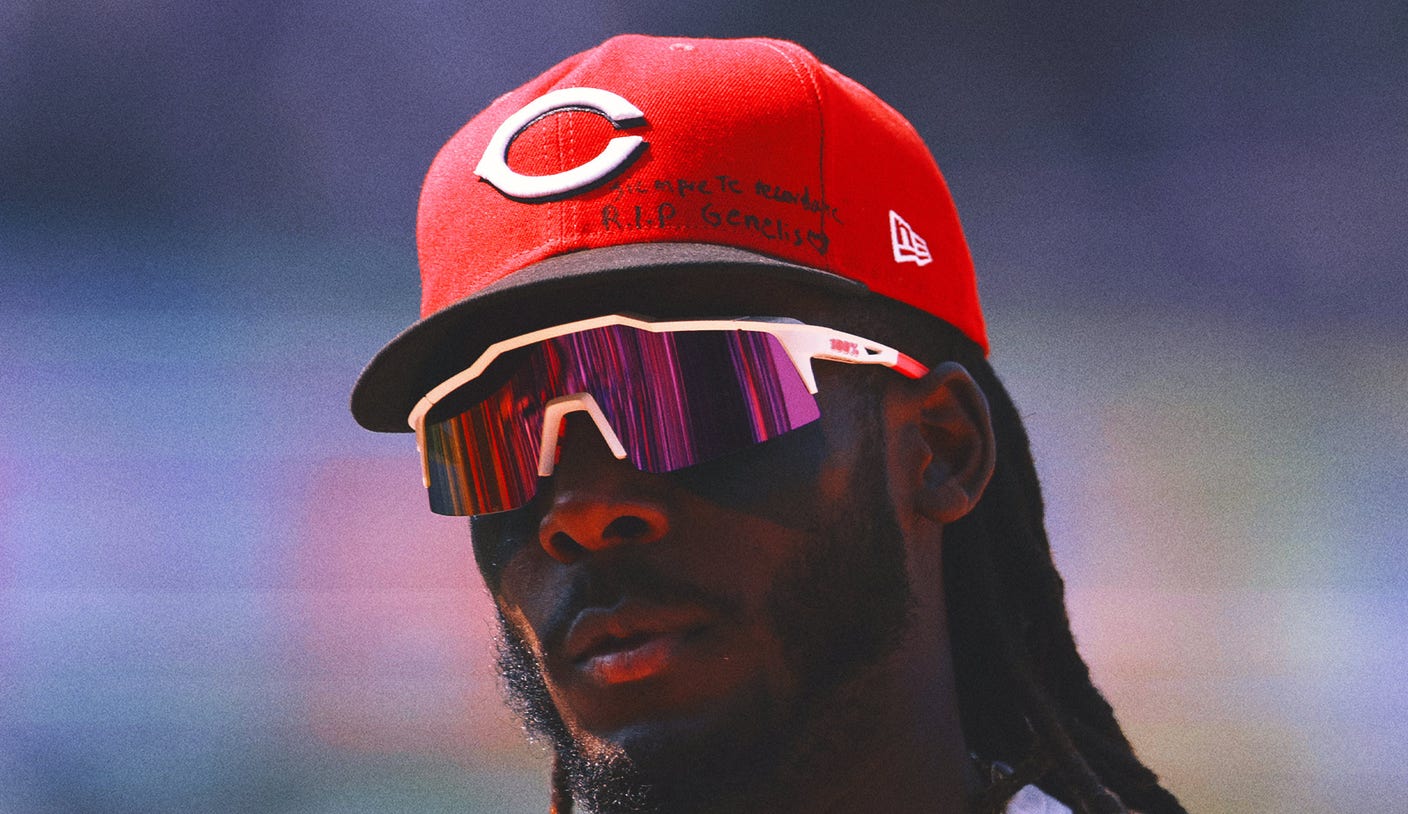

Cincinnati Reds Elly De La Cruzs Powerful Tribute After Family Loss

Jun 04, 2025

Cincinnati Reds Elly De La Cruzs Powerful Tribute After Family Loss

Jun 04, 2025 -

Kerry Carpenters Three Homerun Performance Fuels Tigers Win Over White Sox

Jun 04, 2025

Kerry Carpenters Three Homerun Performance Fuels Tigers Win Over White Sox

Jun 04, 2025