Wall Street Resilience: Stock Market Rebounds After Moody's Downgrade Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Resilience: Stock Market Rebounds After Moody's Downgrade Announcement

The unexpected bounce-back: Wall Street defied expectations on Tuesday, staging a surprising rebound after Moody's Investors Service downgraded 10 small and midsize US banking companies and issued a negative outlook on the sector. This move, initially anticipated to trigger a significant sell-off, instead saw major indices close with modest gains, highlighting the market's resilience and perhaps indicating a growing sense of complacency regarding systemic risk.

The downgrade announcement, released late Monday, cited concerns about the deteriorating credit quality of US banks and the potential for further losses in their commercial real estate portfolios. Many analysts predicted a sharp market correction, fearing a domino effect similar to the banking crisis earlier this year. However, the market's response proved far more muted than anticipated.

Why the Unexpected Rebound?

Several factors may explain the market's resilience:

-

Selective Downgrade: The Moody's downgrade targeted smaller banks, largely avoiding the giants that underpin the US financial system. This limited the immediate impact on investor confidence. Larger institutions, like JPMorgan Chase and Bank of America, were not directly affected.

-

Market Anticipation: The possibility of further downgrades and tighter credit conditions has been anticipated by the market for several weeks. This preemptive pricing may have lessened the immediate shock of the announcement. Investors may have already adjusted their portfolios accordingly.

-

Government Intervention Confidence: The perceived stability offered by ongoing government intervention in the banking sector played a role. The memory of swift action taken earlier this year to prevent a broader collapse likely instilled confidence that authorities are prepared to manage any further fallout.

-

Positive Economic Data: Recent economic data, while mixed, hasn't presented catastrophic signs of a recession. This seemingly supports the narrative that the economy can withstand the pressure from banking sector headwinds.

Long-Term Implications Remain Uncertain

While Tuesday's market performance suggests resilience, the long-term implications of Moody's downgrade remain uncertain. The negative outlook issued by the rating agency implies further downgrades may be forthcoming. This poses a potential threat to lending and economic growth. Continued monitoring of credit conditions and bank balance sheets is crucial.

Furthermore, the market’s seemingly complacent reaction could be a dangerous sign. Ignoring systemic risks can lead to greater volatility later. It’s vital to remember that the current calm may be temporary.

What to Watch For:

- Further Downgrades: The coming weeks will be crucial to see if Moody's assessment proves accurate and whether additional downgrades occur.

- Commercial Real Estate Performance: The health of the commercial real estate sector will continue to be a key indicator of banking sector stability.

- Interest Rate Decisions: The Federal Reserve's decisions on interest rates will significantly influence the banking sector's ability to navigate the current challenges.

This situation underscores the complex and ever-evolving nature of the financial markets. While the initial reaction to Moody's announcement was surprisingly positive, investors and analysts should remain vigilant, monitoring key economic indicators and regulatory actions closely. The current stability might be deceptive, and a proactive approach is warranted. Stay informed and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Resilience: Stock Market Rebounds After Moody's Downgrade Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Putins Public Display Undermining Trumps Global Standing

May 20, 2025

Putins Public Display Undermining Trumps Global Standing

May 20, 2025 -

David Adelmans Coaching Praised By Nuggets Players An Espn Report

May 20, 2025

David Adelmans Coaching Praised By Nuggets Players An Espn Report

May 20, 2025 -

Toledo Mud Hens Defeat Scranton Wilkes Barre Rail Riders In Dominant Performance

May 20, 2025

Toledo Mud Hens Defeat Scranton Wilkes Barre Rail Riders In Dominant Performance

May 20, 2025 -

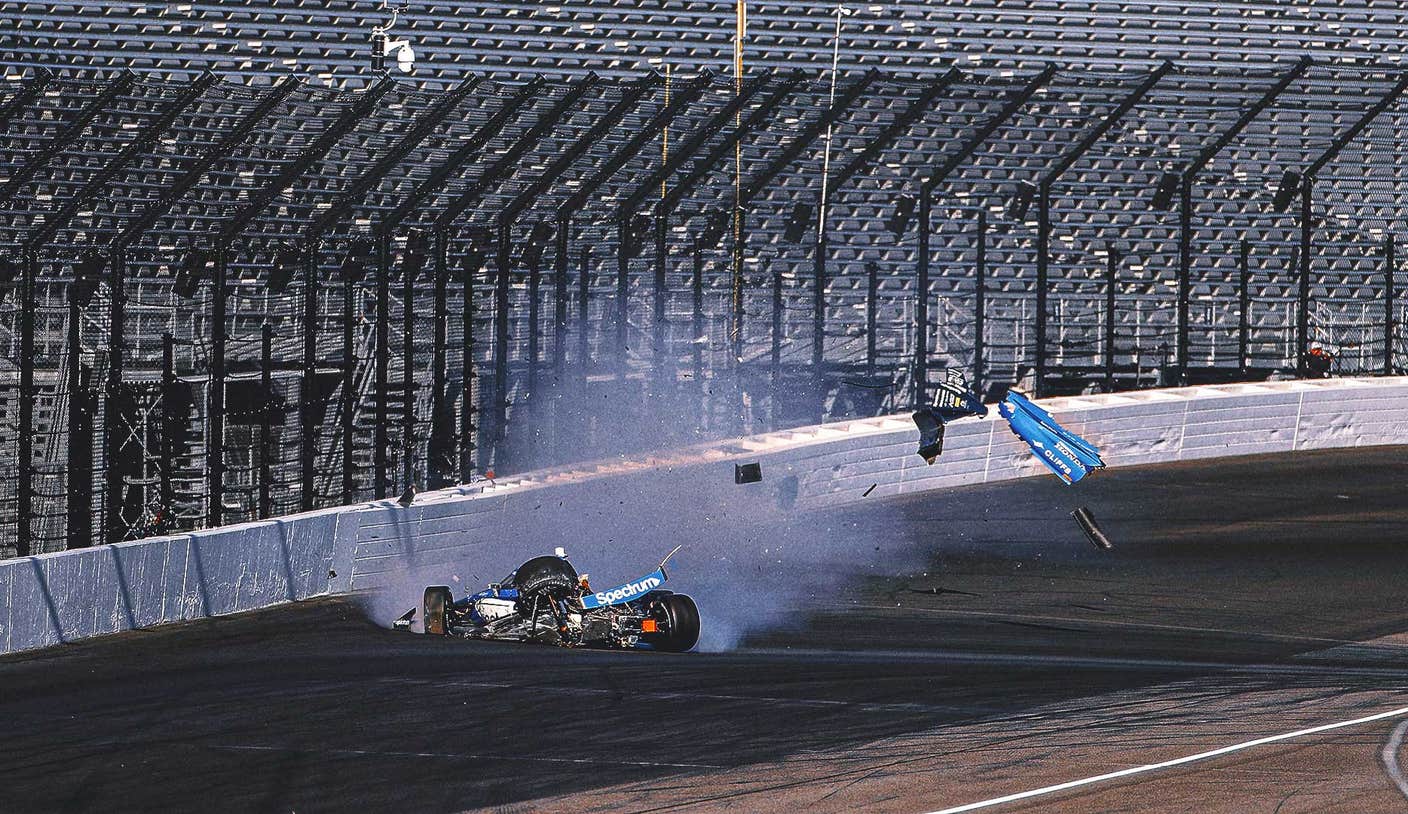

Crash Chaos A Weekend Of Wrecks Before The Indy 500

May 20, 2025

Crash Chaos A Weekend Of Wrecks Before The Indy 500

May 20, 2025 -

The Putin Trump Dynamic A Shift In Power Dynamics Revealed

May 20, 2025

The Putin Trump Dynamic A Shift In Power Dynamics Revealed

May 20, 2025