Wall Street Rebounds: S&P 500's Six-Day Rally, Dow And Nasdaq Gains Despite Moody's

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Rebounds: S&P 500's Six-Day Rally Defies Moody's Downgrade

Wall Street experienced a significant rebound this week, with the S&P 500 enjoying a remarkable six-day rally. Despite a negative outlook from Moody's, the Dow Jones Industrial Average and the Nasdaq also saw considerable gains, defying expectations and injecting a dose of optimism into the market. This unexpected surge leaves investors wondering what fueled this positive shift and what the future holds.

Moody's Downgrade and Market Resilience

The recent downgrade of several US banking giants by Moody's, citing concerns about the credit quality of banks and the rising interest rate environment, had initially sent shockwaves through the market. Many analysts predicted further declines, but the market's response has been surprisingly robust. This resilience suggests a level of underlying strength that may be underappreciated. The question remains: is this a temporary reprieve or a sign of a broader market turnaround?

Factors Contributing to the Rally

Several factors likely contributed to this unexpected rally:

-

Stronger-than-Expected Earnings Reports: Several major companies have recently released better-than-anticipated earnings reports, boosting investor confidence. These positive results suggest that despite economic headwinds, many businesses are navigating the current climate successfully. This positive news countered the negative sentiment stemming from Moody's downgrade.

-

Easing Inflation Concerns: While inflation remains a concern, recent data suggests a potential slowdown in price increases. This easing of inflationary pressure reduces the likelihood of further aggressive interest rate hikes by the Federal Reserve, a factor that has significantly impacted market sentiment in recent months. [Link to relevant inflation data source]

-

Increased Investor Appetite for Risk: Despite the Moody's downgrade, investors seem to be exhibiting a renewed appetite for risk. This could be attributed to bargain hunting after recent declines or a belief that the market has already priced in much of the negative news.

-

Technical Factors: The rally may also be partially attributed to technical factors, such as short-covering and buying pressure at support levels. These technical indicators often play a significant role in short-term market movements.

What Does This Mean for Investors?

The recent rally provides a much-needed boost to investor confidence after a period of uncertainty. However, it's crucial to remember that market fluctuations are normal and that this six-day rally doesn't guarantee sustained growth. Investors should approach the market with caution and consider diversifying their portfolios to mitigate risk. While the positive momentum is encouraging, a thorough assessment of the underlying economic conditions remains essential.

Looking Ahead: Challenges Remain

Despite the recent gains, significant challenges persist. High interest rates, ongoing geopolitical uncertainty, and the potential for further economic slowdown all pose risks to the market. Investors should continue to monitor economic indicators closely and adjust their investment strategies accordingly. [Link to relevant economic forecast]

Conclusion:

The S&P 500's six-day rally, alongside gains in the Dow and Nasdaq, represents a surprising turnaround in the face of Moody's downgrade. While this positive momentum is encouraging, investors should remain vigilant and adopt a cautious approach. The market's resilience highlights the complexity of predicting market behavior, emphasizing the importance of long-term investment strategies and careful risk management. Stay informed and consult with a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Rebounds: S&P 500's Six-Day Rally, Dow And Nasdaq Gains Despite Moody's. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Assessing Backup Quarterbacks Who Could Lead An Nfl Playoff Team In 2024

May 21, 2025

Assessing Backup Quarterbacks Who Could Lead An Nfl Playoff Team In 2024

May 21, 2025 -

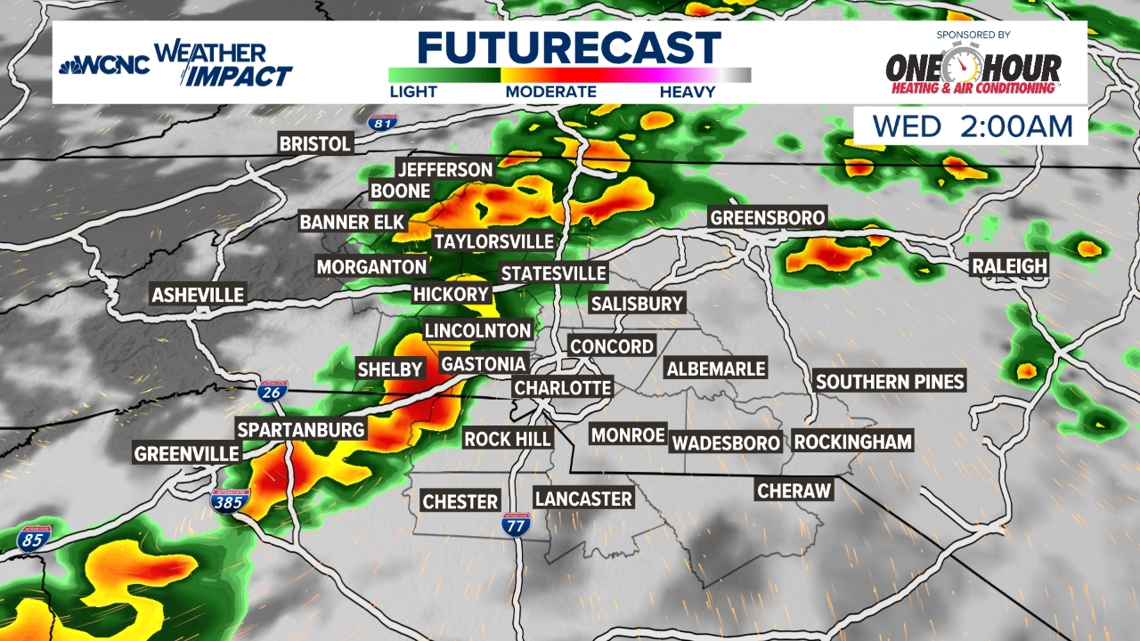

Limited Severe Weather Threat Tuesday Night Localized Storm Outlook

May 21, 2025

Limited Severe Weather Threat Tuesday Night Localized Storm Outlook

May 21, 2025 -

Angel Reese And The Postgame Fallout Analyzing The Controversy On Espn

May 21, 2025

Angel Reese And The Postgame Fallout Analyzing The Controversy On Espn

May 21, 2025 -

Trumps Legal Battles And The Doj Probe New York Ag Letitia Jamess Divided Loyalties

May 21, 2025

Trumps Legal Battles And The Doj Probe New York Ag Letitia Jamess Divided Loyalties

May 21, 2025 -

Marvin Harrison Jr Increased Strength Elevated Expectations For 2023

May 21, 2025

Marvin Harrison Jr Increased Strength Elevated Expectations For 2023

May 21, 2025