Wall Street Eyes Broadcom: $250 Stock Price Before Earnings Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Eyes Broadcom: $250 Stock Price Before Earnings Report

Will Broadcom's Q3 results send its stock soaring past $250? Investors are holding their breath.

Broadcom (AVGO), a titan in the semiconductor industry, is on the cusp of releasing its third-quarter earnings report, and Wall Street is buzzing with anticipation. The stock price has already climbed steadily, flirting with the $250 mark, fueled by strong investor confidence and positive market sentiment. But can the company deliver the numbers to justify this bullish prediction and propel the stock even higher? The upcoming report will undoubtedly be a pivotal moment, potentially shaping the trajectory of Broadcom's stock price in the coming months.

A Strong Run-Up to Earnings:

Broadcom's stock has demonstrated impressive resilience in a challenging market environment. Several factors have contributed to this positive performance:

- Strong Demand for Semiconductors: The ongoing demand for chips across various sectors, from data centers to smartphones, continues to benefit Broadcom's business. This consistent demand has translated into robust revenue growth and profitability.

- Strategic Acquisitions: Broadcom's history of strategic acquisitions, such as its takeover of VMware, has further solidified its position as a market leader, diversifying its revenue streams and expanding its technological capabilities.

- Positive Analyst Sentiment: Leading financial analysts have expressed generally optimistic outlooks for Broadcom, citing strong fundamentals and a promising outlook for the semiconductor industry. Many have issued buy ratings and price targets exceeding the current market value.

What to Expect from the Earnings Report:

Investors will be closely scrutinizing several key metrics in Broadcom's Q3 earnings report:

- Revenue Growth: Any significant deviation from analyst expectations regarding revenue growth could trigger a market reaction. Sustained strong revenue growth will be crucial in validating the current high stock price.

- Profitability: Maintaining robust profit margins in the face of potential inflationary pressures will be another key indicator of Broadcom's financial health.

- Guidance for Q4 and Beyond: The company's outlook for the next quarter and the following year will likely play a significant role in shaping investor sentiment and driving future stock performance. Positive guidance could fuel further upward momentum.

Risks and Potential Downsides:

While the outlook appears positive, investors should remain aware of potential risks:

- Geopolitical Uncertainty: Global macroeconomic conditions and geopolitical instability, particularly concerning the semiconductor industry's reliance on global supply chains, remain potential headwinds.

- Competition: The semiconductor industry is highly competitive, and new entrants or aggressive strategies from established rivals could impact Broadcom's market share.

- Economic Slowdown: A potential broader economic slowdown could reduce demand for semiconductors, impacting Broadcom's revenue and profitability.

The $250 Question:

The question remains: will Broadcom's Q3 earnings report justify the current market valuation and push its stock price beyond the $250 mark? The upcoming report is likely to be volatile, offering opportunities and risks for investors. A strong performance will likely solidify the bullish sentiment, while a disappointing report could trigger a sell-off. Investors are advised to carefully consider the risks before making any investment decisions. Stay tuned for updates following the release of Broadcom's official earnings report.

Further Reading:

-

- Access official company information and financial releases.

-

- Stay updated on market analysis and expert opinions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Eyes Broadcom: $250 Stock Price Before Earnings Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Belmont Stakes Post Time Tv Channel And Horse Draw Results

Jun 05, 2025

2025 Belmont Stakes Post Time Tv Channel And Horse Draw Results

Jun 05, 2025 -

Secure Your Retirement Conducting A Thorough Retirement Plan Stress Test

Jun 05, 2025

Secure Your Retirement Conducting A Thorough Retirement Plan Stress Test

Jun 05, 2025 -

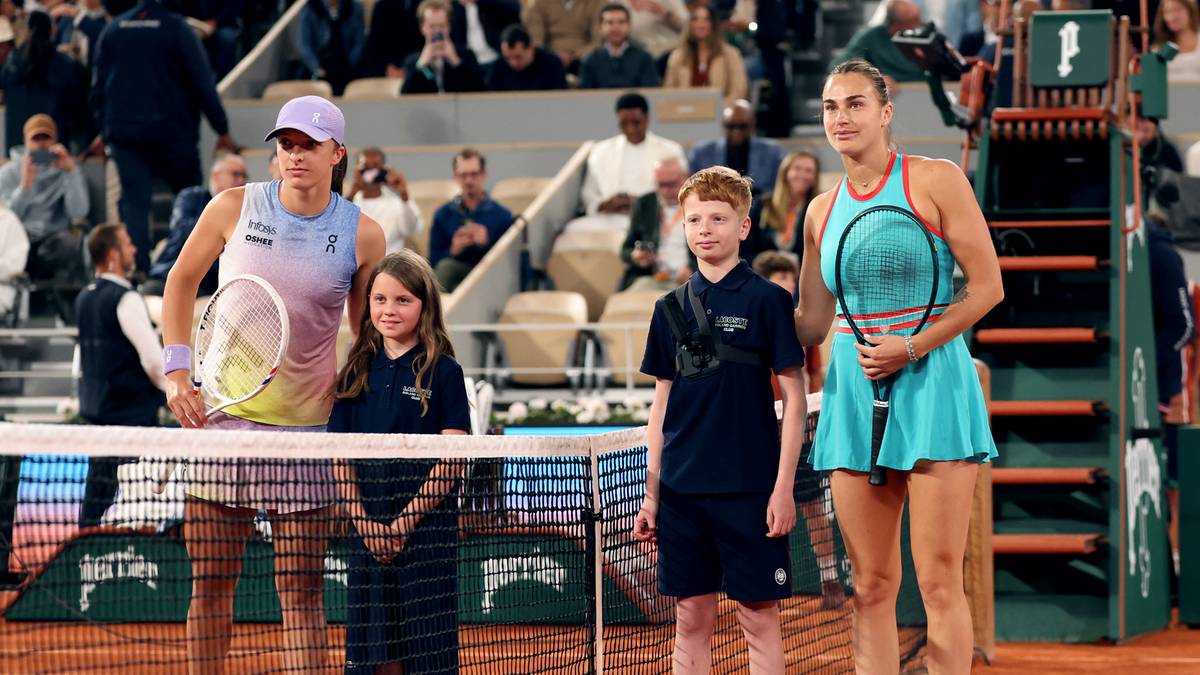

Roland Garros Sledz Mecz Swiatek Sabalenka Online Wynik I Relacja

Jun 05, 2025

Roland Garros Sledz Mecz Swiatek Sabalenka Online Wynik I Relacja

Jun 05, 2025 -

Aryna Sabalenkas French Open Semifinal Berth Confirmed

Jun 05, 2025

Aryna Sabalenkas French Open Semifinal Berth Confirmed

Jun 05, 2025 -

Stefon Diggs Controversy Patriots Decide Against Cutting Wide Receiver

Jun 05, 2025

Stefon Diggs Controversy Patriots Decide Against Cutting Wide Receiver

Jun 05, 2025