Wall Street Defies Moody's: S&P 500, Dow, And Nasdaq Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street Defies Moody's Downgrade: S&P 500, Dow, and Nasdaq Surge

Wall Street shrugged off Moody's downgrade of US government debt, with the major indices experiencing a significant surge. The unexpected rally confounded analysts who predicted a negative market reaction following the credit rating agency's decision. This surprising resilience highlights the complex interplay of factors influencing investor sentiment and the ongoing debate about the US economy's strength.

The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closed higher on [Date of Market Close], defying expectations and marking a strong show of confidence from investors. This counterintuitive market response raises crucial questions about the perceived impact of Moody's action and the overall health of the US financial system.

Moody's Downgrade and Market Reaction: A Deeper Dive

Moody's cited the US government's increasing debt burden and the erosion of fiscal strength as reasons for the downgrade. This was not entirely unexpected; however, the market's reaction was a surprising deviation from the anticipated negative response. Several factors likely contributed to this resilience:

- Resilient Corporate Earnings: Strong second-quarter earnings reports from major corporations continue to bolster investor confidence, outweighing concerns about the debt ceiling and the Moody's downgrade.

- Federal Reserve Policy Expectations: The market seems to be factoring in the likelihood of the Federal Reserve pausing interest rate hikes in the near future, potentially limiting further upward pressure on borrowing costs. This expectation is heavily influencing investor decisions.

- Inflation Cooling: While inflation remains a concern, recent data suggests a cooling trend, which could alleviate pressure on the Federal Reserve to continue aggressively raising rates. This eases concerns about a potential recession.

- Market Optimism: Despite the headwinds, a general air of optimism persists in the market. Many investors believe the US economy is strong enough to weather the challenges presented by increased debt and potential interest rate increases.

Analyzing the Unexpected Rally: What Does it Mean?

The market's positive response to Moody's negative assessment underscores the complexities of financial markets. While the downgrade is undoubtedly a significant event, it's clearly not the sole determinant of market performance. The interplay between macroeconomic factors, corporate performance, and investor sentiment creates a dynamic and often unpredictable environment.

This unexpected surge raises questions about whether the market has accurately assessed the long-term implications of the downgrade. While the short-term reaction is positive, the long-term impact remains to be seen.

Looking Ahead: Navigating Uncertainty

The future remains uncertain. While the immediate market response has been positive, continued monitoring of economic indicators and Federal Reserve policy is crucial. Investors should remain vigilant and consider diversifying their portfolios to mitigate risk. The resilience displayed today doesn't negate the underlying fiscal challenges facing the US.

For further analysis on the US economy and the impact of Moody's downgrade, you might find these resources helpful:

- [Link to a reputable financial news source analyzing the downgrade]

- [Link to a government website providing economic data]

- [Link to a reputable financial analysis firm]

This unexpected rally highlights the intricate and often unpredictable nature of the financial markets. While the Moody's downgrade is a significant development, it's crucial to consider the broader economic context and the various factors influencing investor sentiment. Only time will tell the true impact of this event on the long-term trajectory of the US economy and its markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street Defies Moody's: S&P 500, Dow, And Nasdaq Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Robert Shwartzmans Indy 500 Odds Surge After Dominant Pole Qualification

May 21, 2025

Robert Shwartzmans Indy 500 Odds Surge After Dominant Pole Qualification

May 21, 2025 -

Ufl Week 8 Highlights Renegades Wr Tyler Vaughns Spectacle

May 21, 2025

Ufl Week 8 Highlights Renegades Wr Tyler Vaughns Spectacle

May 21, 2025 -

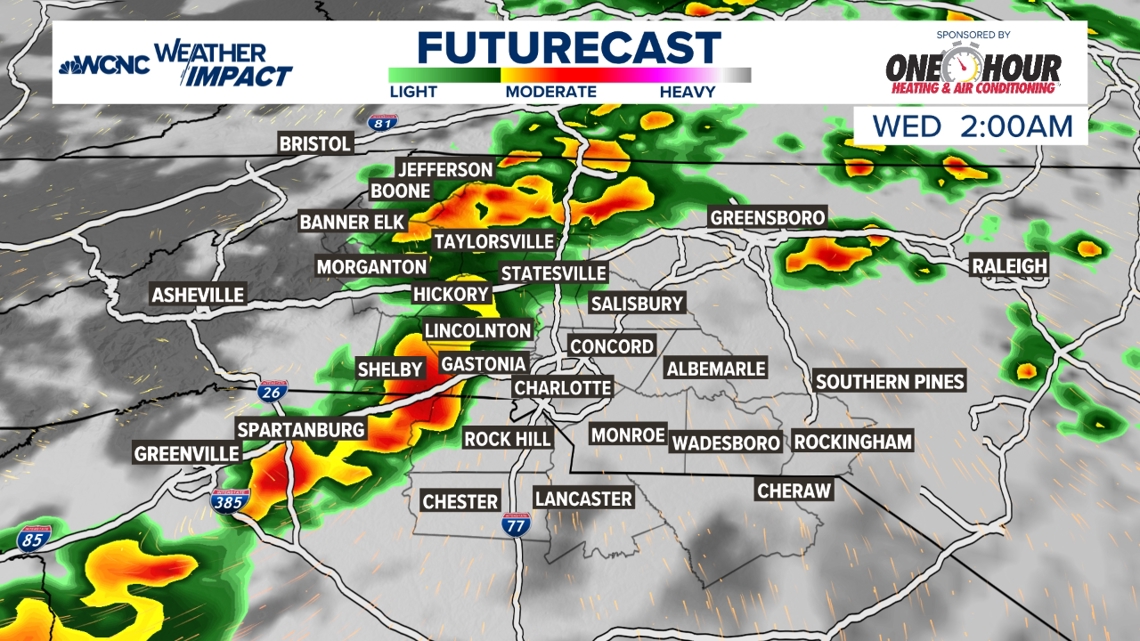

Few Strong Storms Possible Tuesday Night Localized Risk

May 21, 2025

Few Strong Storms Possible Tuesday Night Localized Risk

May 21, 2025 -

Nfl Rookie Life A First Month Look Inside Espn

May 21, 2025

Nfl Rookie Life A First Month Look Inside Espn

May 21, 2025 -

Increased Strength Elevated Expectations Marvin Harrison Jr S Path To A Breakout Sophomore Season

May 21, 2025

Increased Strength Elevated Expectations Marvin Harrison Jr S Path To A Breakout Sophomore Season

May 21, 2025