US Treasury Yields Fall After Fed Hints At One 2025 Rate Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Dip as Fed Signals Potential 2025 Rate Cut

US Treasury yields experienced a noticeable decline following the Federal Reserve's recent comments hinting at a potential interest rate reduction in 2025. This move sent ripples through the financial markets, prompting analysts to reassess their economic forecasts and investment strategies. The implication of a future rate cut suggests a potential shift in the Fed's aggressive stance on inflation, raising questions about the future trajectory of the US economy.

The market reacted swiftly to the Fed's less hawkish tone, signaling a potential easing of monetary policy. This shift in expectation is a significant development, particularly given the recent volatility in the bond market. Understanding the implications requires a closer look at the Fed's statement and the broader economic context.

The Fed's Subtle Shift and Market Response

The Federal Reserve's recent pronouncements, while not explicitly promising a rate cut, hinted at the possibility of easing monetary policy in 2025. This subtle shift in language was enough to trigger a sell-off in the US dollar and a subsequent drop in Treasury yields. The 10-year Treasury yield, a key benchmark for borrowing costs, fell noticeably, reflecting investor confidence in a less restrictive monetary environment.

This reaction underscores the market's sensitivity to even subtle changes in the Fed's communication strategy. Investors are constantly analyzing Fed statements, press conferences, and economic data to anticipate future policy moves. The slightest indication of a potential pivot can have a dramatic impact on asset prices.

What Does This Mean for Investors?

The potential for a rate cut in 2025 presents both opportunities and challenges for investors. Lower interest rates generally stimulate economic growth by making borrowing cheaper for businesses and consumers. However, this could also lead to increased inflation if not managed carefully.

- Bond Market: Lower yields generally mean higher bond prices, making this a potentially favorable environment for bond investors. However, the timing of any potential rate cut remains uncertain.

- Stock Market: Lower interest rates can boost stock valuations, making equities a potentially attractive investment. However, the broader economic outlook and corporate earnings also play a significant role.

- Real Estate: Lower rates can stimulate the housing market, but the impact depends on other factors like housing supply and affordability.

Economic Outlook and Uncertainties

While the Fed's hint at a potential rate cut is significant, several uncertainties remain. The actual timing and magnitude of any future rate reduction will depend on several factors, including inflation data, economic growth, and labor market conditions.

Inflation remains a key concern for the Fed, and any future rate cuts would likely be contingent on inflation moving closer to the central bank's target. The ongoing geopolitical landscape and potential global economic slowdown also introduce significant uncertainty.

Conclusion: Navigating the Shifting Landscape

The recent drop in US Treasury yields following the Fed's comments highlights the complex interplay between monetary policy, market sentiment, and economic outlook. While a potential rate cut in 2025 offers a glimmer of hope for economic stimulus, investors must remain vigilant and carefully consider the risks and opportunities presented by this evolving economic landscape. Staying informed about economic indicators and the Fed's policy decisions is crucial for making informed investment choices. Consult with a financial advisor to discuss your specific investment strategy in light of these recent developments.

Keywords: US Treasury yields, Federal Reserve, interest rate cut, 2025 rate reduction, bond market, stock market, economic outlook, inflation, monetary policy, investment strategy, financial markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Fall After Fed Hints At One 2025 Rate Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Okc Thunders Rout Of Denver A Convincing Game 7 Triumph

May 20, 2025

Okc Thunders Rout Of Denver A Convincing Game 7 Triumph

May 20, 2025 -

Fan Fury Jon Jones Faces Criticism Over His Latest Comments On Tom Aspinall

May 20, 2025

Fan Fury Jon Jones Faces Criticism Over His Latest Comments On Tom Aspinall

May 20, 2025 -

Institutional Investors Drive 5 Billion Bitcoin Etf Boom

May 20, 2025

Institutional Investors Drive 5 Billion Bitcoin Etf Boom

May 20, 2025 -

Walk Off Wagers Your Guide To Mlbs Best Bets Today White Sox Cubs Braves

May 20, 2025

Walk Off Wagers Your Guide To Mlbs Best Bets Today White Sox Cubs Braves

May 20, 2025 -

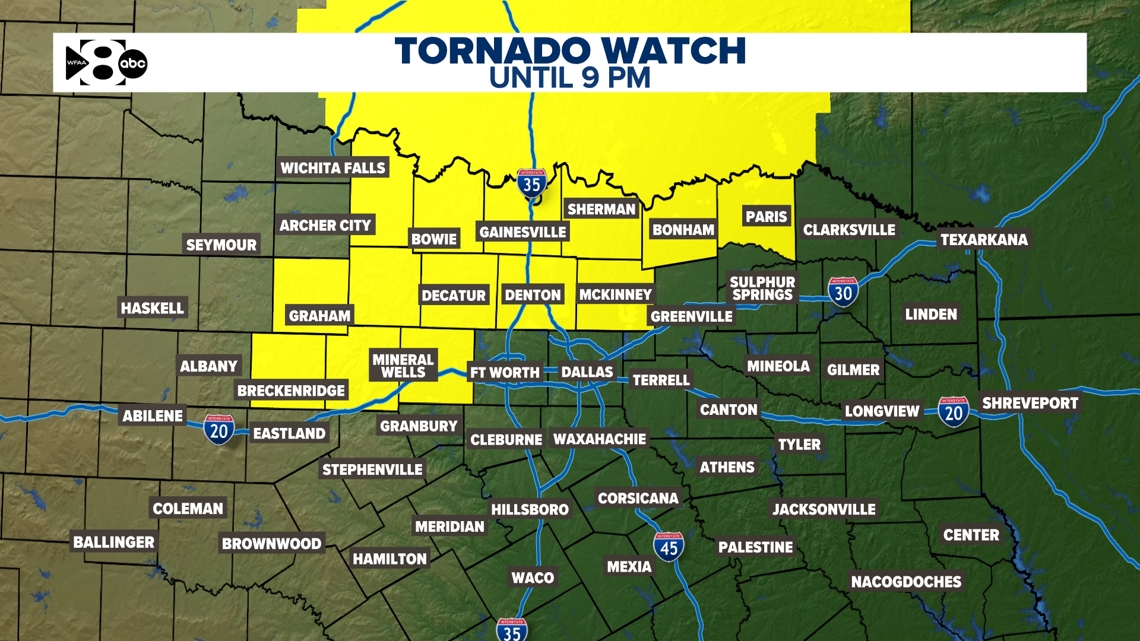

Dallas Fort Worth Weather Update Storms Clear Cold Front Incoming Tuesday

May 20, 2025

Dallas Fort Worth Weather Update Storms Clear Cold Front Incoming Tuesday

May 20, 2025