US Treasury Market Reacts To Fed's 2025 Rate Cut Prediction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Market Reacts Cautiously to Fed's 2025 Rate Cut Prediction

The US Treasury market displayed a measured response to the Federal Reserve's recent projection of interest rate cuts beginning in 2025. While the announcement hinted at a potential easing of monetary policy, investors remain wary, highlighting the persistent uncertainty surrounding the economic outlook. This cautious optimism underscores the complex interplay between inflation, economic growth, and the Fed's evolving strategy.

Fed's Projection: A Glimpse into the Future?

The Federal Open Market Committee (FOMC) projected that interest rates, currently hovering near a 22-year high, would begin to decline in 2025. This prediction, embedded within the updated Summary of Economic Projections (SEP), signals a belief that inflation will eventually cool and economic growth will remain stable, albeit at a slower pace. However, the timing and magnitude of these potential rate cuts remain subject to significant data dependency. The Fed’s commitment to bringing inflation down to its 2% target remains paramount, and any deviation from that goal could significantly alter their future course of action.

Treasury Yields: A Tale of Two Reactions

The immediate market reaction to the Fed's announcement was nuanced. While longer-term Treasury yields initially dipped slightly, reflecting the expectation of future rate cuts, the decline was relatively modest. This muted response suggests that investors are not fully convinced that the 2025 timeline is set in stone. Several factors contribute to this cautious optimism:

- Persistent Inflationary Pressures: Despite recent improvements, inflation remains stubbornly above the Fed's target. Any resurgence of inflation could force the Fed to maintain higher rates for longer, potentially negating the projected cuts.

- Economic Uncertainty: The global economic landscape remains fraught with uncertainty, with geopolitical risks and potential recessionary pressures impacting investor sentiment.

- Labor Market Strength: The persistently strong US labor market could prompt the Fed to remain more hawkish than anticipated, delaying any rate cuts.

What Lies Ahead for the Treasury Market?

The future trajectory of Treasury yields will largely depend on the interplay of these economic factors. Consistent signs of cooling inflation, coupled with a more moderate pace of economic growth, could bolster confidence in the Fed's projections and lead to further declines in yields. Conversely, any indication of persistent inflation or renewed economic weakness could trigger a surge in yields as investors seek safer havens.

Navigating the Uncertainty: A Call for Vigilance

For investors, navigating this uncertain environment requires a vigilant approach. Closely monitoring key economic indicators, including inflation data, employment figures, and GDP growth, is crucial for making informed investment decisions. Furthermore, diversifying portfolios and employing strategies to mitigate risk are essential for weathering potential market volatility. Seeking advice from qualified financial professionals can also provide invaluable insights into managing risk and optimizing investment strategies within this dynamic market environment.

Further Reading:

-

- Access the latest FOMC statements and economic data.

-

- Stay updated on market analysis and expert commentary.

This article provides general information and should not be considered financial advice. Consult a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Market Reacts To Fed's 2025 Rate Cut Prediction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pectra Upgrade Fuels Ethereum Investment 200 M Rush

May 21, 2025

Pectra Upgrade Fuels Ethereum Investment 200 M Rush

May 21, 2025 -

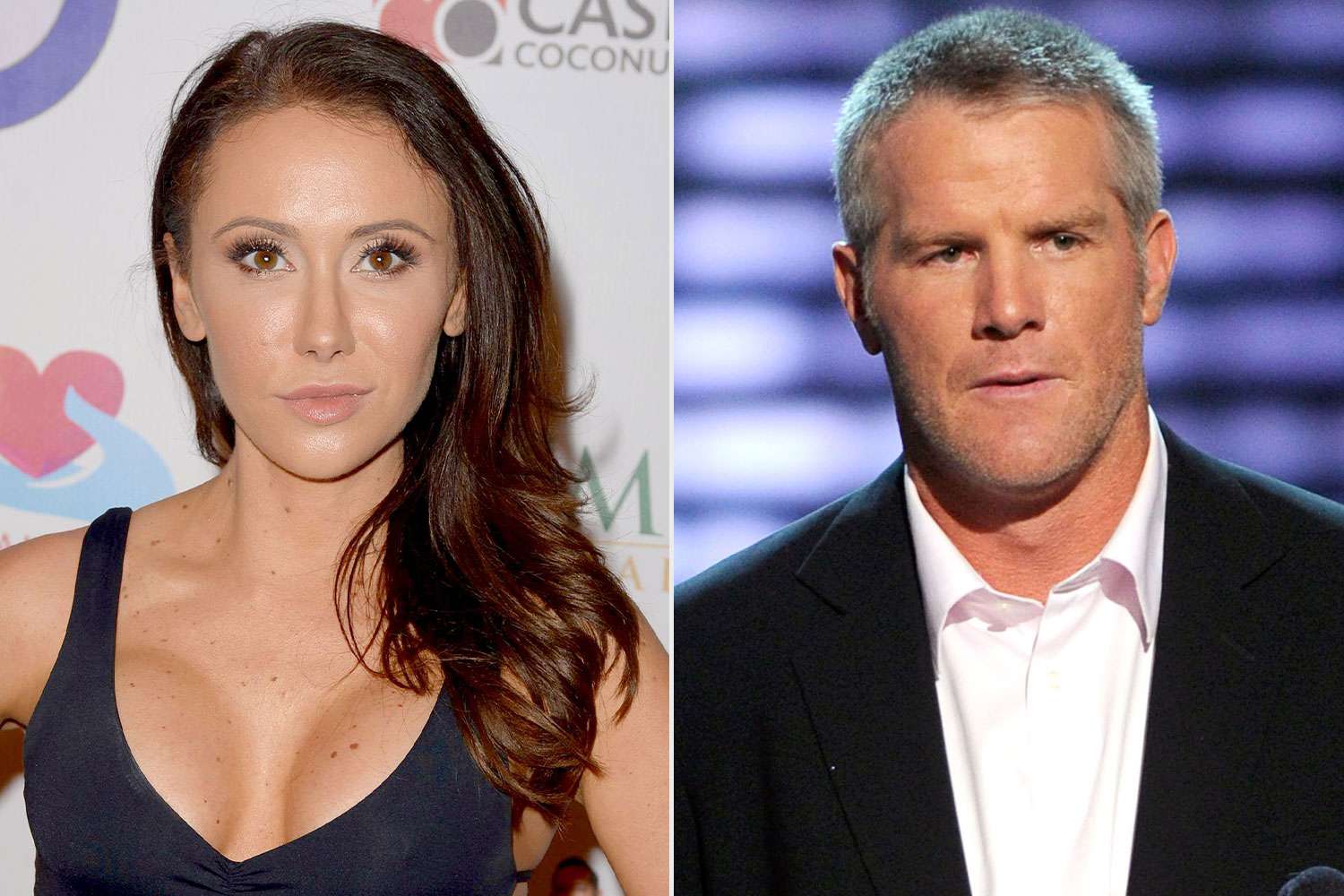

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Sexting Controversy

May 21, 2025

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Sexting Controversy

May 21, 2025 -

Freaky Friday Reunion Jamie Lee Curtis Updates On Her Bond With Lindsay Lohan

May 21, 2025

Freaky Friday Reunion Jamie Lee Curtis Updates On Her Bond With Lindsay Lohan

May 21, 2025 -

Playoff Pressure Mounts Cleveland Cavaliers Road To Success

May 21, 2025

Playoff Pressure Mounts Cleveland Cavaliers Road To Success

May 21, 2025 -

Chilly Week Ahead Prepare For Persistent Rain Showers

May 21, 2025

Chilly Week Ahead Prepare For Persistent Rain Showers

May 21, 2025