US Treasury Market Reacts: Fed Predicts Only One Rate Cut By 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Market Reacts: Fed Predicts Only One Rate Cut by 2025

The US Treasury market experienced a noticeable shift following the Federal Reserve's latest projections, which indicated only one interest rate cut is anticipated by the end of 2025. This prediction, a stark contrast to previous market expectations, sent ripples through the bond market, impacting yields and investor sentiment. The unexpected announcement highlights the Fed's ongoing commitment to combating inflation, even amidst growing economic uncertainty.

A Surprise Shift in Fed Policy

The Federal Open Market Committee (FOMC) statement surprised many analysts who had anticipated a more dovish approach, potentially involving multiple rate cuts in the coming years. Instead, the Fed's “dot plot,” which shows individual policymakers' interest rate projections, suggests a significantly more hawkish stance. This unexpected turn reflects the Fed's continued focus on bringing inflation down to its 2% target, a goal that remains elusive despite recent progress.

The decision underscores the complexity of the current economic landscape. While inflation is cooling, it's still above the Fed's target, and the labor market remains robust. This combination presents a challenging environment for monetary policy, forcing the Fed to strike a delicate balance between curbing inflation and avoiding a recession.

Impact on Treasury Yields and the Bond Market

The immediate reaction in the Treasury market was a rise in yields across the maturity spectrum. Longer-term Treasury yields, which are particularly sensitive to interest rate expectations, saw a more pronounced increase. This reflects investors' recalibration of their expectations for future interest rate movements. The market is now pricing in a higher probability of interest rates remaining elevated for an extended period.

This shift has implications for various sectors of the economy. Higher yields on government bonds can influence borrowing costs for businesses and consumers, potentially impacting investment and spending decisions. The real estate market, particularly sensitive to interest rates, could also experience further adjustments.

What This Means for Investors

For investors, the Fed's projection necessitates a reassessment of their portfolios. The reduced expectation of rate cuts diminishes the attractiveness of longer-term bonds, which are more vulnerable to rising interest rates. Investors may need to consider diversifying their holdings and potentially shifting towards shorter-term instruments or assets that are less sensitive to interest rate fluctuations. Professional financial advice should be sought to navigate this evolving market landscape.

Looking Ahead: Uncertainty and Volatility

The coming months are likely to be marked by continued uncertainty and volatility in the Treasury market. The Fed's projection is just one piece of the puzzle, and several factors could influence future rate decisions. These include the ongoing trajectory of inflation, the strength of the labor market, and the overall global economic outlook. Closely monitoring economic indicators and Fed communications will be crucial for investors navigating this dynamic environment. Stay informed by following reputable financial news sources and seeking professional guidance.

Keywords: US Treasury Market, Federal Reserve, interest rates, rate cut, bond market, Treasury yields, inflation, economic outlook, FOMC, dot plot, investment strategy, financial advice, market volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Market Reacts: Fed Predicts Only One Rate Cut By 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Watch This Critically Acclaimed Wwi Movie Starring Daniel Craig

May 21, 2025

Watch This Critically Acclaimed Wwi Movie Starring Daniel Craig

May 21, 2025 -

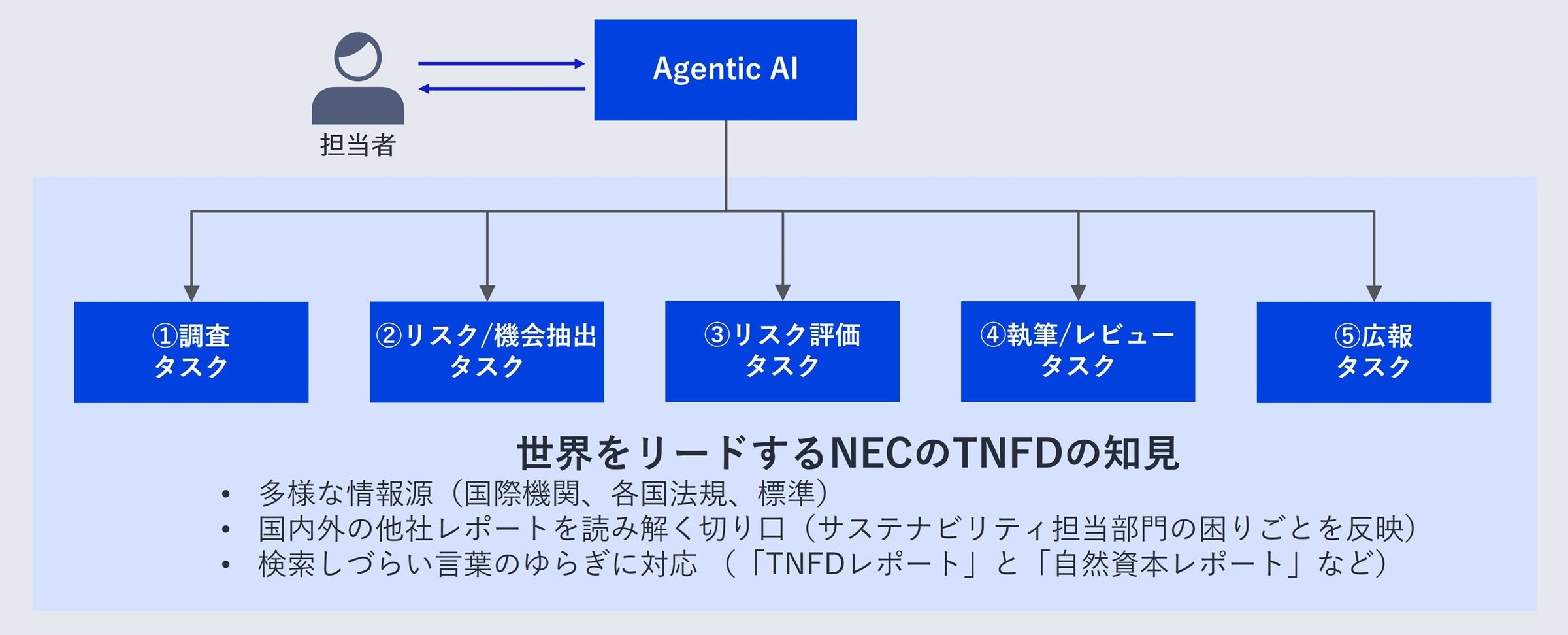

Nec Tnfd Ai Agentic Ai

May 21, 2025

Nec Tnfd Ai Agentic Ai

May 21, 2025 -

Breaking Trump Initiates Russia Ukraine Peace Talks Immediate Start Planned

May 21, 2025

Breaking Trump Initiates Russia Ukraine Peace Talks Immediate Start Planned

May 21, 2025 -

Trumps Intervention Russia And Ukraine To Hold Immediate Truce Negotiations

May 21, 2025

Trumps Intervention Russia And Ukraine To Hold Immediate Truce Negotiations

May 21, 2025 -

Revised Tush Push Rule Expanded Playoffs And Flag Football On Nfl Agenda

May 21, 2025

Revised Tush Push Rule Expanded Playoffs And Flag Football On Nfl Agenda

May 21, 2025