US Treasury Market Reacts: Fed Hints At Limited Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Market Reacts: Fed Hints at Limited Rate Cuts, Sending Yields Higher

The US Treasury market experienced a notable shift following recent comments from the Federal Reserve, hinting at a more cautious approach to future interest rate cuts. This tempered expectation of aggressive easing sent Treasury yields climbing, impacting everything from long-term investments to short-term borrowing costs. Understanding this shift is crucial for investors and economic observers alike.

Fed's Cautious Tone Sparks Market Reaction

The Federal Reserve's recent statements, while acknowledging the possibility of future rate cuts, emphasized a data-dependent approach. This means the timing and magnitude of any reductions will hinge heavily on incoming economic indicators like inflation and job growth. This departure from previous, more overtly dovish rhetoric triggered a sell-off in the Treasury market, pushing yields upward. The market's reaction underscores the sensitivity of bond prices to even subtle changes in the Fed's outlook.

What Does This Mean for Treasury Yields?

Higher Treasury yields generally reflect increased investor confidence in the economy's ability to handle higher interest rates. This confidence, however, is partially tempered by the ongoing uncertainty surrounding inflation. The current situation presents a complex interplay between economic growth and inflationary pressures, making it difficult to predict the trajectory of yields with complete certainty.

- Impact on Long-Term Bonds: Investors holding long-term Treasury bonds are likely to see decreased value as yields rise. This is because bond prices and yields move inversely; as yields increase, prices fall.

- Impact on Short-Term Borrowing: Businesses and consumers may face slightly higher borrowing costs as short-term interest rates adjust to reflect the changed expectations surrounding Fed policy.

- Impact on Inflation Expectations: The market's reaction suggests a recalibration of inflation expectations, possibly indicating a belief that inflation might remain stubbornly high for longer than previously anticipated.

Analyzing the Economic Landscape

Several factors contribute to the current market dynamics:

- Persistent Inflation: Inflation remains a key concern, with the Fed closely monitoring various price indices to gauge its progress towards its 2% target. [Link to a relevant inflation report from a reputable source, e.g., Bureau of Labor Statistics].

- Strong Labor Market: A robust labor market, while positive for overall economic health, can also contribute to upward pressure on wages and inflation, potentially influencing the Fed's decision-making. [Link to a relevant employment report].

- Geopolitical Uncertainty: Global geopolitical events can also create uncertainty in the market, impacting investor sentiment and influencing Treasury yields.

Looking Ahead: Uncertainty Remains

The future trajectory of Treasury yields remains uncertain. The Fed's commitment to a data-dependent approach suggests that future rate cuts are not guaranteed, and their timing and magnitude will depend on the evolving economic landscape. Investors should carefully monitor economic indicators and Fed communications for further clues regarding the future direction of interest rates. This situation highlights the importance of diversification and a well-defined investment strategy in navigating the complexities of the current market environment.

Call to Action: Stay informed about market developments by subscribing to our newsletter for regular updates on economic news and financial market analysis. [Link to newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Market Reacts: Fed Hints At Limited Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sundance Film Together At Center Of Copyright Lawsuit Against Alison Brie And Dave Franco

May 20, 2025

Sundance Film Together At Center Of Copyright Lawsuit Against Alison Brie And Dave Franco

May 20, 2025 -

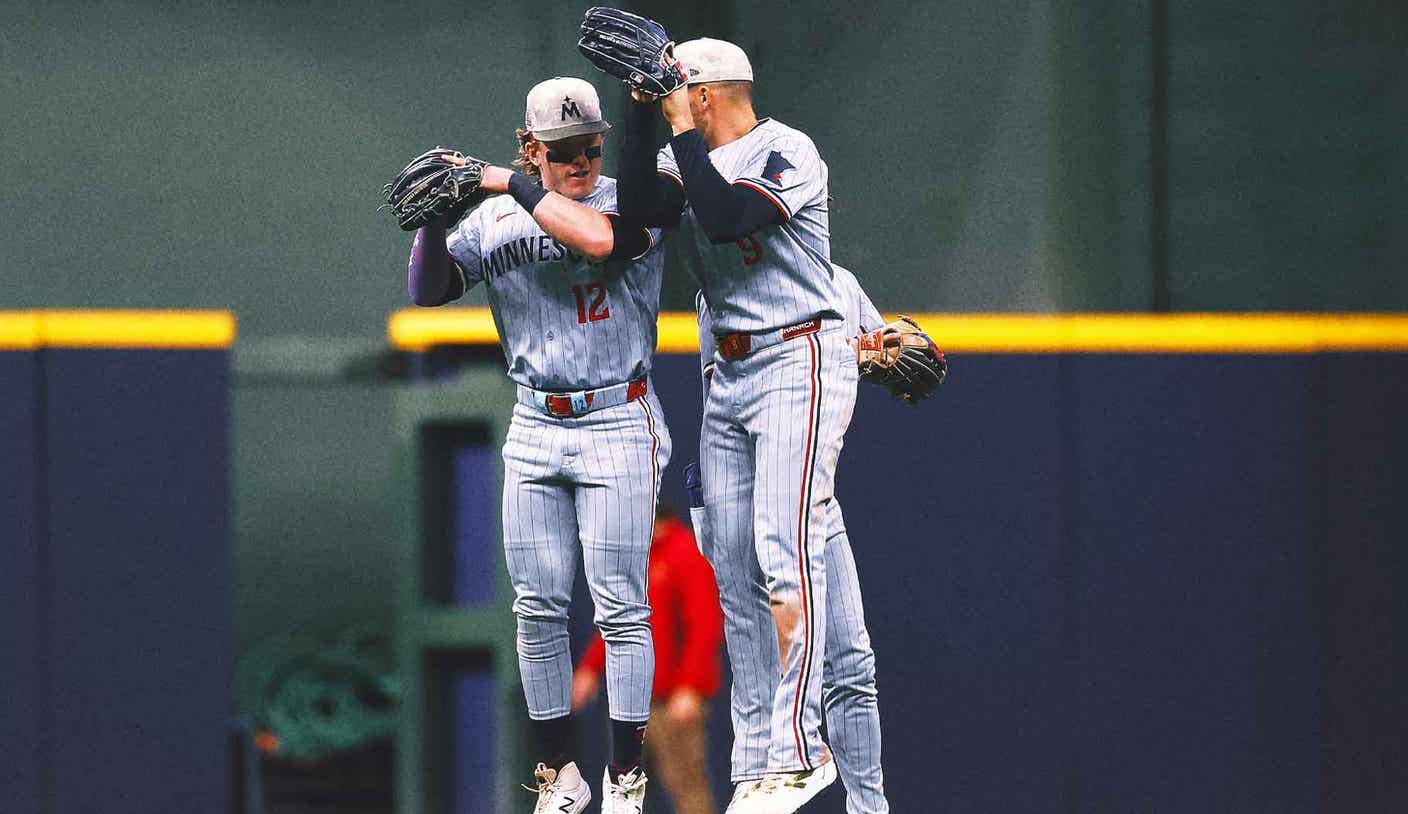

13 And Counting Minnesota Twins Winning Streak Surpasses 1991 Record

May 20, 2025

13 And Counting Minnesota Twins Winning Streak Surpasses 1991 Record

May 20, 2025 -

Updated Indy 500 2025 Odds Shwartzmans Pole A Game Changer

May 20, 2025

Updated Indy 500 2025 Odds Shwartzmans Pole A Game Changer

May 20, 2025 -

Wnba Fan Misconduct Under Scrutiny Clark Reese Incident Sparks Investigation

May 20, 2025

Wnba Fan Misconduct Under Scrutiny Clark Reese Incident Sparks Investigation

May 20, 2025 -

The Fallout A J Perez On The Brett Favre Documentary And Subsequent Threats

May 20, 2025

The Fallout A J Perez On The Brett Favre Documentary And Subsequent Threats

May 20, 2025