US-China Deal Fails To Boost Nasdaq 100 To New High; Rate Cut Probability Increases

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US-China Deal Fails to Spark Nasdaq 100 Rally; Rate Cut Speculation Intensifies

The much-anticipated US-China trade deal, while offering a temporary reprieve from escalating trade tensions, failed to propel the Nasdaq 100 to new highs, leaving investors questioning the market's next move. The lackluster response highlights a complex interplay of factors beyond trade negotiations, fueling speculation about an impending interest rate cut by the Federal Reserve.

The initial market optimism surrounding the "phase one" agreement quickly dissipated, with the tech-heavy Nasdaq 100 index closing relatively flat. This subdued reaction suggests that investors remain cautious, prioritizing other macroeconomic indicators and potential risks over the immediate benefits of the trade deal.

Why the Nasdaq 100 Didn't Soar:

Several factors contributed to the Nasdaq 100's underwhelming performance following the US-China deal announcement:

- Lingering Trade Uncertainties: While the "phase one" deal addressed some immediate concerns, significant trade disputes remain unresolved. The uncertainty surrounding future negotiations continues to weigh on investor sentiment.

- Global Economic Slowdown: Concerns about a global economic slowdown, particularly in Europe and China, are overshadowing the positive impact of the trade deal. These concerns are impacting corporate earnings expectations, dampening investor enthusiasm.

- High Valuations: The Nasdaq 100, already trading at historically high valuations, may be less sensitive to positive news compared to more undervalued sectors. Investors might be taking profits or adopting a wait-and-see approach.

- Federal Reserve's Stance: The Federal Reserve's monetary policy plays a crucial role in influencing market performance. The lack of a significant boost from the trade deal reinforces expectations of a potential interest rate cut to stimulate economic growth.

Increased Probability of a Rate Cut:

The muted market reaction to the US-China trade deal significantly increases the probability of a Federal Reserve interest rate cut. Economists and market analysts are increasingly predicting a rate reduction in the coming months, citing weakening economic data and subdued inflation.

A rate cut would aim to inject liquidity into the market, reduce borrowing costs for businesses, and potentially boost investor confidence. However, the effectiveness of a rate cut in addressing the current economic slowdown is still debated. Some argue that other factors, such as trade wars and geopolitical uncertainties, are beyond the Fed's control.

What's Next for the Nasdaq 100 and the Market?

The future trajectory of the Nasdaq 100 and the broader market remains uncertain. While the US-China trade deal offers a degree of stability, other macroeconomic factors will continue to shape investor sentiment. Close monitoring of economic indicators, corporate earnings reports, and the Federal Reserve's policy decisions is crucial for navigating the current market environment.

Investors are advised to diversify their portfolios and consider a long-term investment strategy, rather than reacting solely to short-term market fluctuations. Consult with a qualified financial advisor for personalized advice tailored to your specific financial goals and risk tolerance.

Keywords: Nasdaq 100, US-China trade deal, interest rate cut, Federal Reserve, stock market, economic slowdown, global economy, investment strategy, market volatility, trade war, investor sentiment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US-China Deal Fails To Boost Nasdaq 100 To New High; Rate Cut Probability Increases. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Three Wideouts The Steelers Could Draft Or Sign After Aaron Rodgers Arrival

Jun 12, 2025

Three Wideouts The Steelers Could Draft Or Sign After Aaron Rodgers Arrival

Jun 12, 2025 -

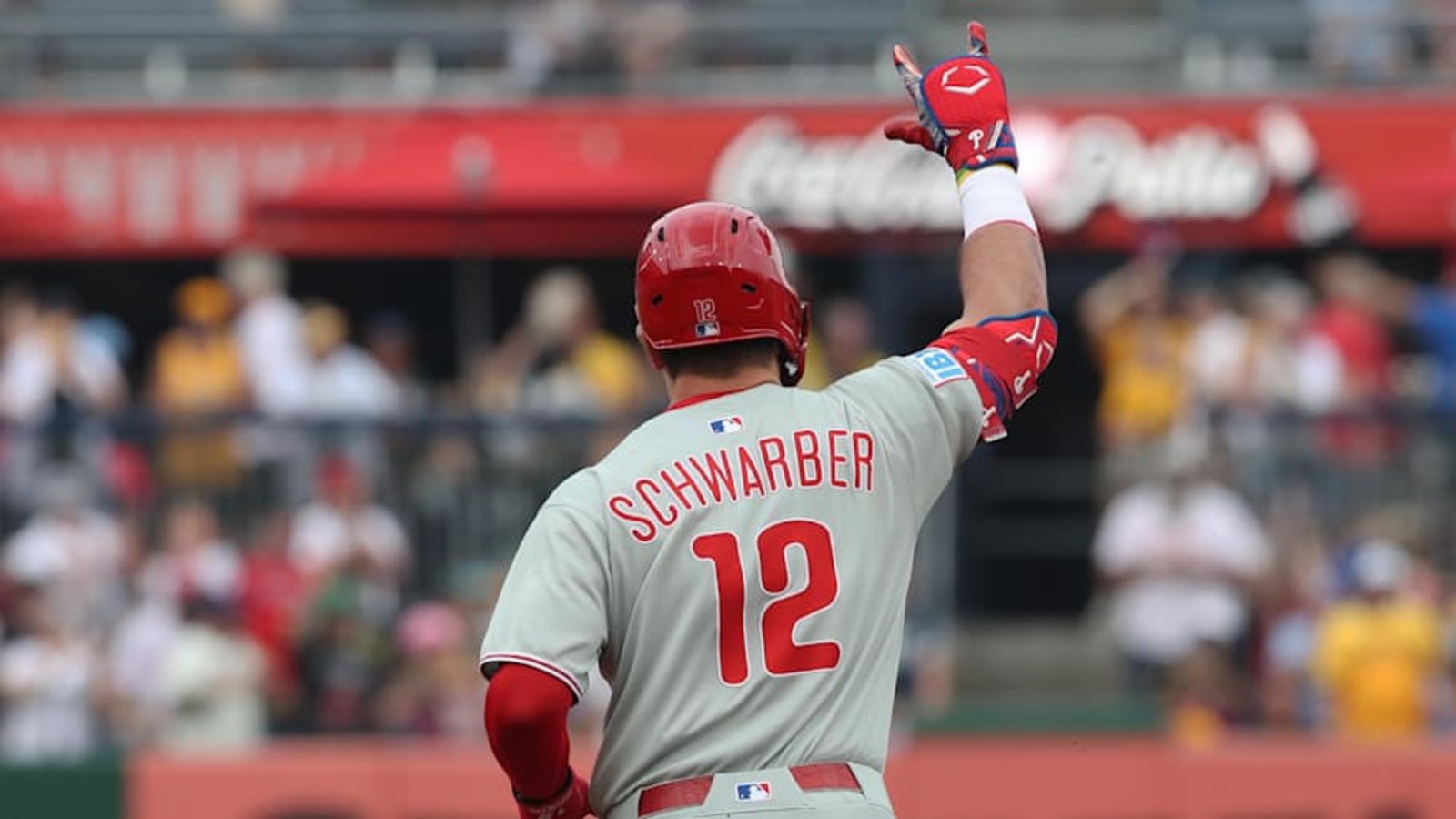

Philadelphia Phillies A Lone All Star In The Nl

Jun 12, 2025

Philadelphia Phillies A Lone All Star In The Nl

Jun 12, 2025 -

Espn James Cooks Minicamp Performance Impresses Bills Coach Mc Dermott

Jun 12, 2025

Espn James Cooks Minicamp Performance Impresses Bills Coach Mc Dermott

Jun 12, 2025 -

How To Bet On The 2025 Ufl Championship Panthers Defenders Matchup Odds

Jun 12, 2025

How To Bet On The 2025 Ufl Championship Panthers Defenders Matchup Odds

Jun 12, 2025 -

Milwaukee Brewers Bolster Bullpen Misiorowskis Call Up Signals Roster Shakeup

Jun 12, 2025

Milwaukee Brewers Bolster Bullpen Misiorowskis Call Up Signals Roster Shakeup

Jun 12, 2025