Unexpected GameStop (GME) Stock Rise: Exploring The Contributing Factors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unexpected GameStop (GME) Stock Rise: Exploring the Contributing Factors

GameStop (GME) stock has once again surprised investors with an unexpected surge, leaving many wondering what's driving this volatile rollercoaster. While the meme-stock frenzy of 2021 might spring to mind, this recent rise presents a more nuanced picture, demanding a closer look at the contributing factors. This article delves into the potential reasons behind GME's unexpected climb, analyzing market sentiment, financial performance, and the ever-present influence of social media.

The Resurgence of Retail Investor Interest

One key factor fueling the recent GME stock rise is the renewed interest from retail investors. These individual traders, often active on platforms like Reddit's r/WallStreetBets, have historically played a significant role in the stock's volatility. While the scale of their involvement might not match the frenzy of 2021, their continued belief in GameStop's potential, or perhaps even a desire to defy Wall Street, remains a potent force. This renewed retail investor enthusiasm is frequently amplified through social media, creating a self-reinforcing cycle of hype and speculation.

Shifting Market Sentiment and Short Squeeze Potential

Market sentiment plays a crucial role in driving stock prices. Positive news, however small, can trigger a surge in buying, especially for volatile stocks like GME. Furthermore, the lingering possibility of a short squeeze continues to cast a shadow over the stock. A short squeeze occurs when investors who have bet against a stock (shorted it) are forced to buy it back to cover their positions, driving the price up further. While the current short interest in GME might not be as high as it was during the 2021 peak, the potential remains a catalyst for further price increases. [Link to reputable financial news source discussing short interest data].

GameStop's Transformation Efforts and Business Strategy

It's important to note that GameStop's business strategy and transformation efforts also contribute to the narrative. The company has been actively trying to reinvent itself, shifting away from its traditional brick-and-mortar model and focusing on e-commerce and the burgeoning market for NFTs and video game collectibles. While the success of this transformation is yet to be fully realized, the ongoing efforts provide a counter-narrative to the purely speculative aspects of the stock price movement. [Link to GameStop's investor relations page].

The Influence of Social Media and Meme Culture

Social media platforms remain a key driver of the narrative surrounding GameStop. News, speculation, and opinions spread rapidly, influencing trading decisions and creating a self-fulfilling prophecy. The meme-stock culture, while perhaps less intense than in the past, continues to have a significant impact on the stock's volatility. This constant flow of information and opinion, amplified by social media algorithms, creates an environment where sentiment can shift rapidly.

Understanding the Risks: Volatility and Uncertainty

It's crucial to acknowledge the inherent risks involved in investing in highly volatile stocks like GME. The unpredictable nature of the price movements necessitates a thorough understanding of your risk tolerance before considering any investment. The recent surge, while exciting for some, highlights the potential for significant losses as well as gains. [Link to article on responsible investing].

Conclusion: A Complex Equation

The recent unexpected rise in GameStop's stock price is a multifaceted event, influenced by a combination of retail investor sentiment, market speculation, the potential for a short squeeze, the company's ongoing transformation, and the persistent power of social media. Understanding these contributing factors is crucial for navigating the complexities of the market and making informed investment decisions. While the future remains uncertain, one thing is clear: GameStop continues to be a stock that demands close attention and careful consideration.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unexpected GameStop (GME) Stock Rise: Exploring The Contributing Factors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tenis Henrique Rocha Conquista Primeira Vitoria Em Grand Slam

May 29, 2025

Tenis Henrique Rocha Conquista Primeira Vitoria Em Grand Slam

May 29, 2025 -

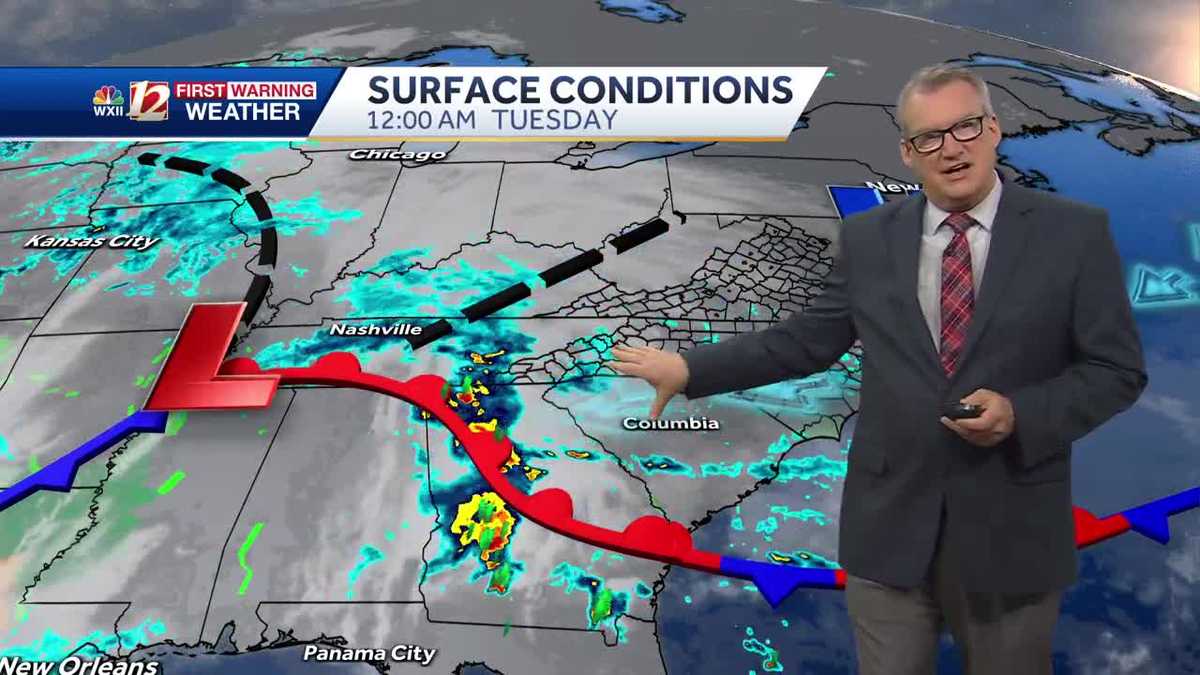

Cool Wet Tuesday Brings Travel Chaos Across The Region

May 29, 2025

Cool Wet Tuesday Brings Travel Chaos Across The Region

May 29, 2025 -

Trump Administrations Tougher Stance On Cuban Immigration What You Need To Know

May 29, 2025

Trump Administrations Tougher Stance On Cuban Immigration What You Need To Know

May 29, 2025 -

Cool Temperatures And Intermittent Rain To Continue Weather Summary

May 29, 2025

Cool Temperatures And Intermittent Rain To Continue Weather Summary

May 29, 2025 -

Predicting The Future Landing Spots For Key Players In The 2023 Transfer Portal

May 29, 2025

Predicting The Future Landing Spots For Key Players In The 2023 Transfer Portal

May 29, 2025