Understanding The Recent Rise In GameStop (GME) Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Recent Rise in GameStop (GME) Stock: A Rollercoaster Ride Explained

GameStop (GME) stock has once again captured the attention of investors and the media, experiencing significant price swings. This volatile behavior, reminiscent of the "meme stock" frenzy of 2021, raises questions about the underlying factors driving these fluctuations. Understanding the current situation requires examining both the company's transformation efforts and the ongoing influence of retail investor sentiment.

The Resurgence of Retail Investor Power:

The recent surge in GME's stock price is largely attributed to the continued involvement of retail investors, many active on platforms like Reddit's r/WallStreetBets. These investors, often referred to as "apes," have demonstrated a remarkable ability to influence market dynamics, defying traditional financial analysis. Their collective buying power can create short squeezes, forcing short sellers to buy back shares to limit their losses, driving the price even higher. This dynamic played a significant role in the 2021 surge and continues to be a factor today. However, it's crucial to understand that this strategy is highly risky and can lead to substantial losses. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions.

GameStop's Transformation Efforts: A Long-Term Play?

Beyond the speculative trading, GameStop is undergoing a significant transformation. The company is attempting to shift from its traditional brick-and-mortar retail model to a more diversified business encompassing e-commerce, gaming technology, and NFT marketplaces. These strategic moves aim to attract a broader customer base and improve long-term profitability. While these efforts are promising, their success remains uncertain and depends on several factors, including:

- Competitive Landscape: The gaming industry is highly competitive, with established players like Amazon and Microsoft posing significant challenges.

- Execution of Strategy: GameStop's success hinges on effectively implementing its transformation plan, which requires significant investment and operational expertise.

- Market Acceptance: The adoption of GameStop's new offerings, particularly its foray into NFTs and the metaverse, remains to be seen.

H2: Analyzing the Risks:

While the potential for further price increases exists, investors should be aware of the considerable risks involved in investing in GME. The stock's price is highly volatile and susceptible to dramatic swings based on sentiment rather than fundamental company performance. This makes it a highly speculative investment, unsuitable for risk-averse individuals.

H3: Key Factors to Consider:

- Short Interest: Monitoring the level of short interest in GME remains crucial, as high short interest can fuel further short squeezes. However, relying solely on this metric is risky.

- Financial Performance: Analyzing GameStop's financial statements, including revenue, earnings, and debt levels, provides a more grounded perspective on the company's long-term prospects.

- News and Events: Staying updated on company news, announcements, and regulatory developments can significantly impact the stock price.

H2: Conclusion: Navigating the Volatility

The recent rise in GameStop stock highlights the complex interplay between retail investor sentiment and a company's transformation efforts. While the potential for significant gains exists, the inherent risks cannot be ignored. Investors should approach GME with caution, conducting thorough due diligence and considering their individual risk tolerance before making any investment decisions. Remember, past performance is not indicative of future results. Consult with a financial advisor for personalized guidance.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Recent Rise In GameStop (GME) Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

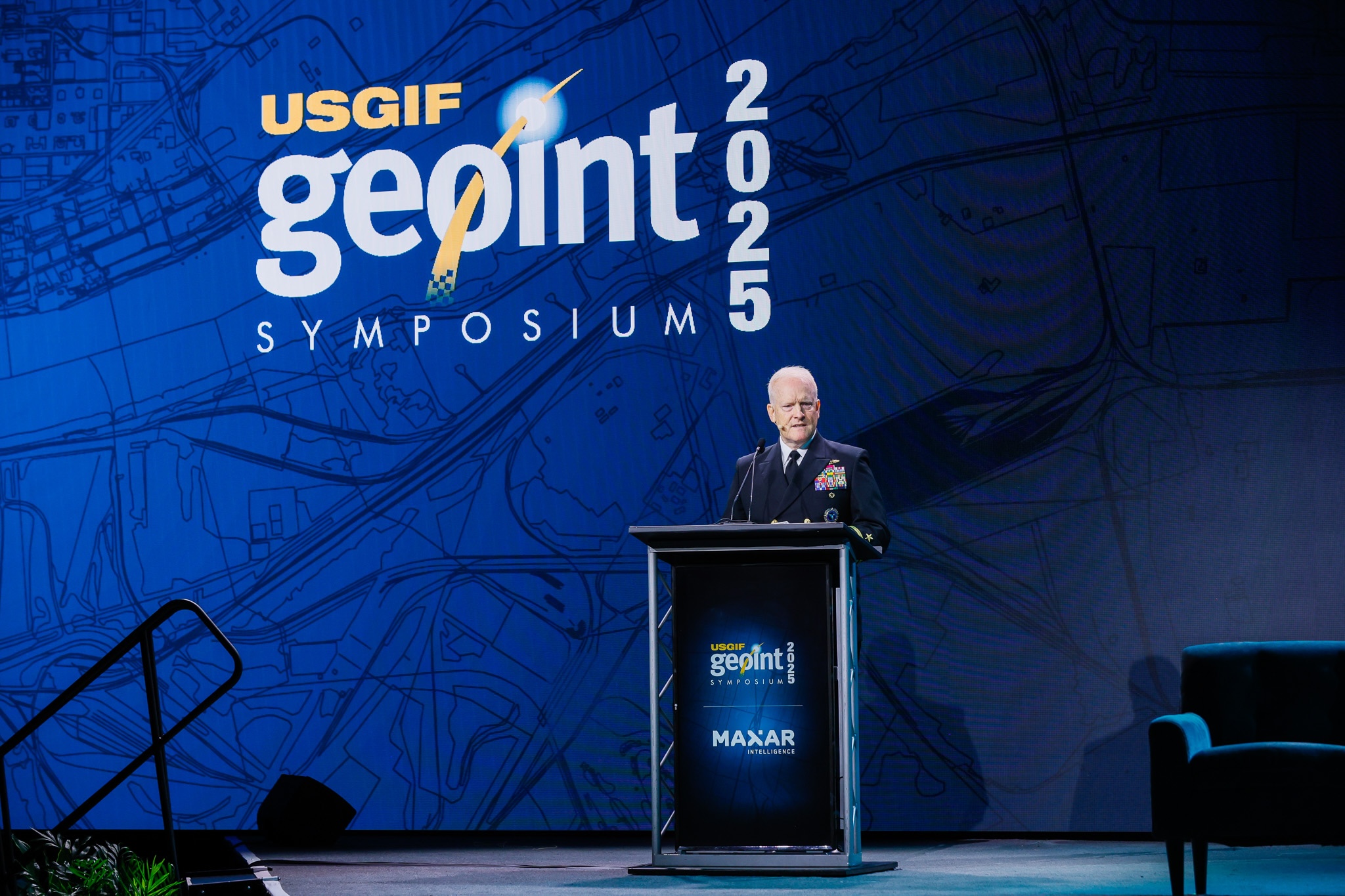

Increased Pentagon Spending On Palantir Ai For Project Maven

May 28, 2025

Increased Pentagon Spending On Palantir Ai For Project Maven

May 28, 2025 -

Kyle Larson Crashes Out Of Indy 500 Pivots To Coca Cola 600 Challenge

May 28, 2025

Kyle Larson Crashes Out Of Indy 500 Pivots To Coca Cola 600 Challenge

May 28, 2025 -

Streaming Roland Garros 2025 Guarda Tutte Le Partite Di Sinner Sfida A Gasquet

May 28, 2025

Streaming Roland Garros 2025 Guarda Tutte Le Partite Di Sinner Sfida A Gasquet

May 28, 2025 -

When Will My Social Security Check Arrive In 2025

May 28, 2025

When Will My Social Security Check Arrive In 2025

May 28, 2025 -

Nfl Playoff Bubble A Deep Dive Into The Contenders Most Likely To Qualify In 2023

May 28, 2025

Nfl Playoff Bubble A Deep Dive Into The Contenders Most Likely To Qualify In 2023

May 28, 2025