Understanding The Phenomenal 1000% Jump In SBET Stock Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Phenomenal 1000% Jump in SBET Stock Price: A Deep Dive

The stock market is notorious for its volatility, but a recent surge in SBET stock has left investors and analysts reeling. A staggering 1000% increase in a relatively short period has sparked intense speculation and demands for explanation. This article delves into the factors behind this dramatic price jump, examining the potential catalysts and exploring the risks and opportunities associated with this volatile investment.

What is SBET?

Before examining the dramatic price increase, let's briefly understand SBET. (Insert a concise and factual description of SBET here, including its industry, business model, and any relevant background information. This section should include relevant keywords like "SBET stock," "SBET share price," "SBET investment," etc.)

The 1000% Surge: Unpacking the Reasons

Several contributing factors likely fueled this unprecedented surge in SBET's stock price. It's crucial to remember that pinpointing a single cause is likely an oversimplification; rather, a confluence of events probably triggered this dramatic rise.

1. Positive Earnings Reports and Financial Performance:

Strong financial performance often drives stock prices upward. Did SBET recently release unexpectedly positive earnings reports, surpassing analysts' predictions? (Insert data or links to financial reports if available. This section needs concrete evidence to support the claim.) This would significantly boost investor confidence and attract new buyers, driving up demand and, consequently, the price.

2. Market Sentiment and Investor Hype:

Social media buzz and general market sentiment can play a significant role. (Mention any social media trends or news stories that contributed to the hype. Be cautious and avoid spreading misinformation.) This "hype" can lead to a self-fulfilling prophecy, with increased demand further driving up the price, even beyond what the fundamentals would suggest. This is often seen in meme stocks and reflects the power of collective investor behavior.

3. Strategic Partnerships or Acquisitions:

Did SBET announce any significant strategic partnerships or acquisitions? Such announcements can dramatically alter market perception, leading to a surge in investor interest. (Include details if such announcements were made, including links to official press releases.)

4. Technological Breakthroughs or Product Launches:

Innovative companies often experience stock price jumps following successful product launches or groundbreaking technological advancements. (This section should explore if SBET released a new product or made a technological breakthrough that impacted investor confidence.)

5. Industry Trends and Macroeconomic Factors:

Broader industry trends and macroeconomic conditions can also influence SBET's performance. (Discuss any relevant industry trends or macroeconomic factors that may have contributed. For example, is the company in a growing sector? Are interest rates affecting investor behaviour?)

Risks and Opportunities

While the 1000% jump represents a phenomenal return for early investors, it also highlights significant risks. Such dramatic increases are often unsustainable and prone to corrections. Investors need to carefully consider the potential for a sharp decline.

Before investing in SBET or any other volatile stock, it is crucial to:

- Conduct thorough due diligence.

- Diversify your portfolio.

- Understand your risk tolerance.

- Seek advice from a qualified financial advisor.

Conclusion:

The 1000% jump in SBET stock price is a complex event with likely multiple contributing factors. While the reasons outlined above offer plausible explanations, investors should approach this situation with caution, understanding that such rapid growth often comes with considerable risk. This article provides a comprehensive overview but does not constitute financial advice. Always conduct your own research before making any investment decisions.

(Optional) Call to Action: Want to stay updated on the latest developments in SBET and other volatile stocks? (Link to a relevant newsletter or financial news source).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Phenomenal 1000% Jump In SBET Stock Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigating The 1000 Increase Whats Fueling Sbet Stocks Growth

May 31, 2025

Investigating The 1000 Increase Whats Fueling Sbet Stocks Growth

May 31, 2025 -

Edmonton Oilers Return To Stanley Cup Final After Game 5 Victory

May 31, 2025

Edmonton Oilers Return To Stanley Cup Final After Game 5 Victory

May 31, 2025 -

Us Open Ticket Scandal 2025 Presale Under Investigation After Fan Complaints

May 31, 2025

Us Open Ticket Scandal 2025 Presale Under Investigation After Fan Complaints

May 31, 2025 -

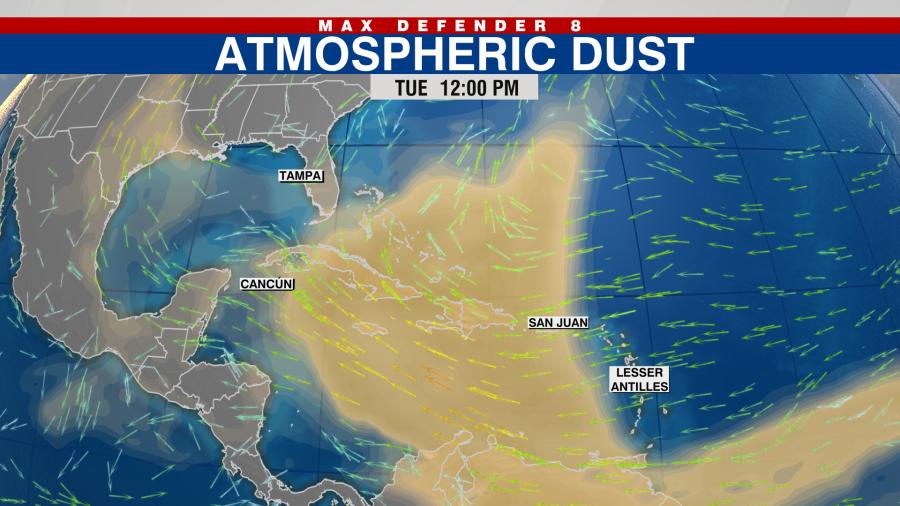

Saharan Dust Storm Approaching Florida Health And Visibility Concerns

May 31, 2025

Saharan Dust Storm Approaching Florida Health And Visibility Concerns

May 31, 2025 -

2025 Ufl Mvp Power Rankings A Three Man Battle For Glory

May 31, 2025

2025 Ufl Mvp Power Rankings A Three Man Battle For Glory

May 31, 2025