Understanding The GameStop (GME) Stock Rocket: Today's Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the GameStop (GME) Stock Rocket: Today's Market Analysis

The GameStop (GME) stock saga continues to captivate investors and fuel debate. Once a struggling brick-and-mortar retailer, GME's stock price has experienced unprecedented volatility, soaring to astronomical heights and then plummeting, leaving many wondering: what's really going on? This article delves into today's market analysis surrounding GME, exploring the factors driving its price fluctuations and the potential implications for investors.

The Meme Stock Phenomenon:

GME's rise to fame wasn't driven by traditional market fundamentals. It became a poster child for the "meme stock" phenomenon, propelled by social media platforms like Reddit's r/WallStreetBets. Retail investors, coordinated through online forums, collectively bought GME shares, driving up demand and creating a short squeeze. This strategy targeted hedge funds who had bet against the stock (short selling), forcing them to buy shares to cover their positions, further increasing the price.

Short Squeeze Dynamics:

Understanding the mechanics of a short squeeze is crucial to understanding GME's volatility. When a large number of investors short sell a stock, believing its price will fall, a sudden surge in demand can force them to buy back shares at a higher price to limit their losses. This buying frenzy exacerbates the price increase, creating a self-reinforcing cycle. GME's price action has repeatedly demonstrated the power of coordinated retail investor action and the potential risks associated with short selling.

Fundamental Analysis vs. Sentiment:

While traditional fundamental analysis considers a company's financials and future prospects, GME's price movements have been largely dictated by investor sentiment and social media hype. This makes predicting its future trajectory extremely challenging. While the company has shown signs of restructuring and a pivot towards e-commerce, these fundamental improvements haven't always translated directly into sustained stock price increases. The disconnect highlights the dominance of speculative trading over traditional valuation metrics in certain market segments.

Risks and Considerations for Investors:

Investing in GME carries significant risk. Its price is highly susceptible to market sentiment shifts and social media trends, making it a volatile and unpredictable investment. For long-term investors focused on consistent returns, GME might not be a suitable option. However, for those comfortable with high risk and short-term speculation, understanding the forces driving its price movements is paramount.

Today's Market Outlook:

Analyzing today's market data for GME requires considering a range of factors: recent news releases from the company, overall market sentiment, and the activity on social media platforms. While predicting the exact price movement is impossible, understanding these contributing factors offers valuable insights. News sources specializing in financial analysis, such as [link to reputable financial news site], can provide updated perspectives on GME's current market position.

Conclusion:

The GameStop story is a complex case study in the intersection of traditional finance and social media-driven investment strategies. While its future remains uncertain, understanding the forces that have shaped its past price movements is crucial for any investor considering involvement. Always conduct thorough research and seek professional financial advice before making any investment decisions. The highly volatile nature of GME necessitates a cautious and informed approach.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The GameStop (GME) Stock Rocket: Today's Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Serie A Stefano Pioli Fa Ritorno Il Suo Impatto Sul Calcio Italiano

May 29, 2025

Serie A Stefano Pioli Fa Ritorno Il Suo Impatto Sul Calcio Italiano

May 29, 2025 -

Portugal Reforca Lacos Com Mocambique Detalhes Da Nova Linha De Credito

May 29, 2025

Portugal Reforca Lacos Com Mocambique Detalhes Da Nova Linha De Credito

May 29, 2025 -

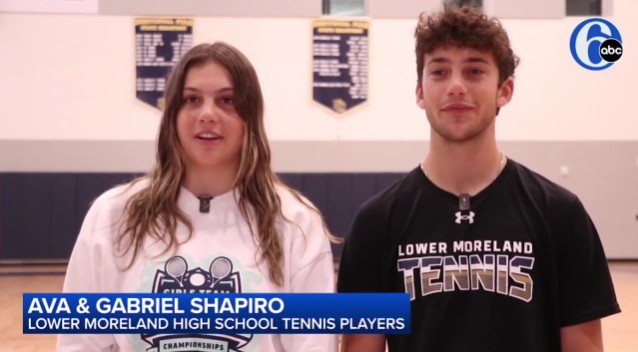

Lower Moreland High School Tennis Senior Twins State Championship Win

May 29, 2025

Lower Moreland High School Tennis Senior Twins State Championship Win

May 29, 2025 -

Assault Conviction Shawn Kemps Legal Troubles Continue

May 29, 2025

Assault Conviction Shawn Kemps Legal Troubles Continue

May 29, 2025 -

Jaheim Arrested Atlanta Police Charge R And B Singer With Dog Abuse

May 29, 2025

Jaheim Arrested Atlanta Police Charge R And B Singer With Dog Abuse

May 29, 2025