Understanding The GameStop (GME) Stock Increase: A Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the GameStop (GME) Stock Increase: A Market Analysis

The meteoric rise of GameStop (GME) stock in early 2021 captivated the world, becoming a symbol of the power of social media and retail investor collaboration against established Wall Street hedge funds. While the initial frenzy has subsided, understanding the factors behind this unprecedented stock increase remains crucial for investors navigating today's volatile market. This analysis delves into the key drivers, offering insights into the complexities of this fascinating market event.

The Role of Social Media and Reddit's r/WallStreetBets:

The story of GME's stock surge is inextricably linked to the online community r/WallStreetBets on Reddit. This subreddit, populated by a diverse group of retail investors, orchestrated a coordinated buying spree, aiming to drive up the price of heavily shorted stocks like GME. This "short squeeze" strategy aimed to force hedge funds, who had bet against the stock's success, to buy back shares to cover their positions, thereby further increasing the price. The power of collective action amplified by social media proved to be a game-changer, demonstrating the potential for retail investors to influence market dynamics.

Short Selling and the Squeeze Mechanism:

Understanding short selling is vital to comprehending the GME phenomenon. Short selling involves borrowing and selling shares of a stock, hoping to buy them back at a lower price later and profit from the difference. When many investors short sell a stock, it becomes heavily shorted. However, if the stock price unexpectedly rises, short sellers face significant losses and are forced to buy back shares to limit their potential losses, creating a "short squeeze" effect that accelerates the price increase. This was precisely the mechanism that fueled GME's dramatic rise.

The Impact of Institutional Investors and Hedge Funds:

The actions of large institutional investors and hedge funds played a significant role in the GME saga. While some initially bet against the stock, the short squeeze forced many to cover their positions, exacerbating the price increase. This highlighted the vulnerabilities of even the largest financial institutions to coordinated retail investor action. The event also raised questions about market manipulation and the fairness of the system.

Long-Term Implications and Lessons Learned:

The GME stock increase had far-reaching implications. It highlighted the democratizing potential of online platforms and the power of collective action in influencing financial markets. However, it also raised concerns about market volatility and the potential for speculative bubbles fueled by social media trends. Investors learned valuable lessons about the risks and rewards of short selling, the importance of due diligence, and the impact of social media on market sentiment. It serves as a potent reminder that market dynamics are constantly evolving and that traditional models of market behavior may not always apply.

Investing Wisely in a Volatile Market:

The GME saga underscores the importance of informed investment decisions. While the potential for quick gains can be alluring, it's crucial to conduct thorough research and understand the risks involved before making any investment. Diversification, risk management, and long-term investment strategies remain critical elements of sound financial planning. Staying informed about market trends and developments is essential for navigating the complexities of today's financial landscape.

Further Research: For more in-depth analysis, consider researching the SEC's investigations into the GME trading frenzy and examining academic papers on behavioral finance and the impact of social media on market behavior. Understanding the various perspectives is crucial for a complete picture.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The GameStop (GME) Stock Increase: A Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Dark Chapter To Golden Age Teslas Progress Towards Fully Autonomous Driving

May 28, 2025

From Dark Chapter To Golden Age Teslas Progress Towards Fully Autonomous Driving

May 28, 2025 -

Nios Growing Ev Infrastructure 100 New Swap Stations In Northeast China

May 28, 2025

Nios Growing Ev Infrastructure 100 New Swap Stations In Northeast China

May 28, 2025 -

Comparing Crashes Indy 500s 1992 And 2023 Starts

May 28, 2025

Comparing Crashes Indy 500s 1992 And 2023 Starts

May 28, 2025 -

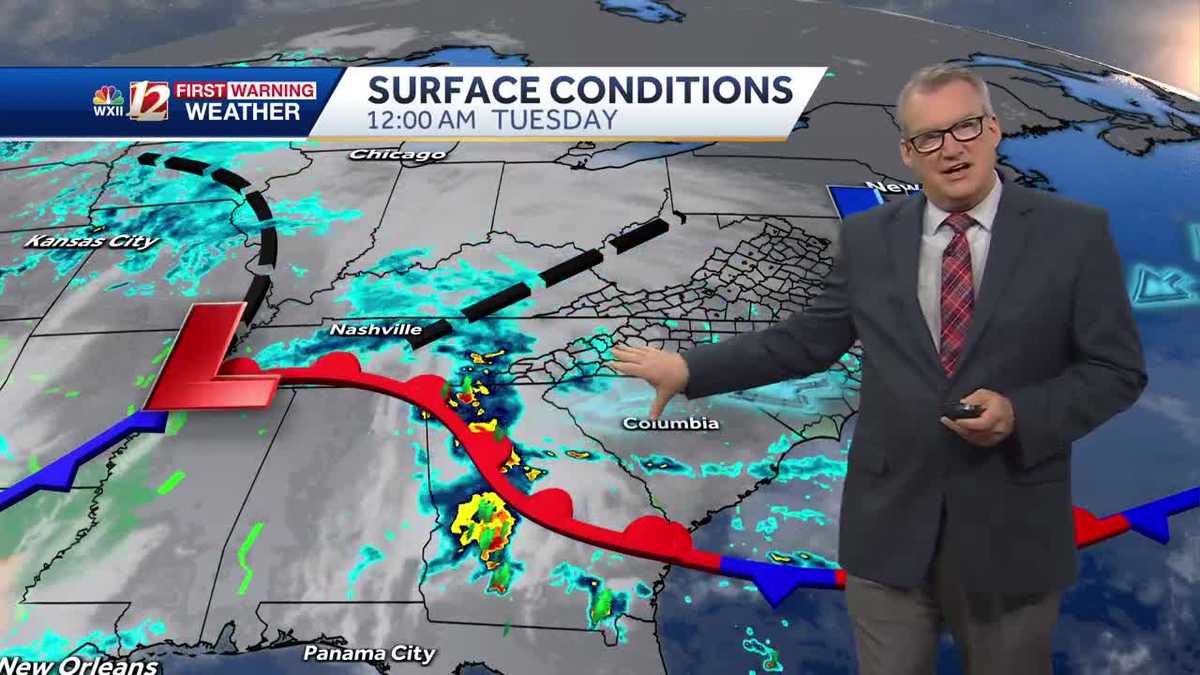

Cool Wet Tuesday Prepare For Soggy Commute

May 28, 2025

Cool Wet Tuesday Prepare For Soggy Commute

May 28, 2025 -

Beatriz Haddad Maia Vs Hailey Baptiste French Open 2025 Prediction And Odds

May 28, 2025

Beatriz Haddad Maia Vs Hailey Baptiste French Open 2025 Prediction And Odds

May 28, 2025