Understanding The CoreWeave (NASDAQ: CRWV) Stock Price Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the CoreWeave (NASDAQ: CRWV) Stock Price Decline: A Deep Dive

CoreWeave (NASDAQ: CRWV), a prominent player in the rapidly expanding cloud computing market specializing in high-performance computing (HPC) and artificial intelligence (AI) workloads, has recently experienced a significant stock price decline. This downturn has sparked considerable interest and concern among investors. This article will delve into the potential reasons behind this drop, examining market trends, financial performance, and overall industry dynamics to provide a comprehensive understanding of the situation.

The Recent Dip: A Closer Look

CoreWeave's initial public offering (IPO) generated considerable buzz, but the stock price hasn't performed as initially anticipated. Several factors are contributing to this decline, and it's crucial to analyze them individually to grasp the full picture. The recent dip is not isolated; it reflects broader market anxieties surrounding the tech sector, particularly companies heavily reliant on growth and facing potential economic headwinds.

Factors Contributing to the CoreWeave Stock Price Decline:

-

Broader Market Volatility: The overall tech sector has witnessed significant volatility in recent months, impacting even established players. CoreWeave, as a relatively new public company, is more susceptible to these broader market fluctuations. The current economic climate, with concerns about inflation and interest rate hikes, has created a risk-averse environment, leading investors to re-evaluate their portfolios.

-

Increased Competition: The cloud computing market is fiercely competitive, with established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) vying for market share. CoreWeave, while innovative, is competing against deeply entrenched players with vast resources and extensive customer bases. This competitive pressure can impact investor confidence, especially if CoreWeave struggles to gain significant market traction.

-

Profitability Concerns: As a rapidly growing company, CoreWeave is currently focused on expansion and market share. This often means prioritizing growth over immediate profitability. Investors closely scrutinize financial statements, and any perceived shortfall in profitability or slower-than-expected revenue growth can negatively impact the stock price. Understanding the company's long-term financial strategy is crucial for assessing its potential.

-

Investor Sentiment: Investor sentiment plays a significant role in stock price movements. Negative news coverage, analyst downgrades, or concerns about the overall market outlook can all influence investor sentiment and trigger sell-offs. It's important to discern between well-founded concerns and short-term market noise.

Analyzing CoreWeave's Long-Term Potential:

While the recent stock price decline is concerning, it's crucial to consider CoreWeave's long-term potential. The company operates in a rapidly growing market with significant future prospects, particularly in the AI and HPC sectors. Their innovative approach and focus on specific niche markets could provide a competitive advantage.

What to Watch For:

Investors should monitor CoreWeave's:

- Financial performance: Revenue growth, profitability margins, and cash flow are critical indicators of the company's health and future prospects.

- Market share gains: Tracking CoreWeave's progress in acquiring new customers and expanding its market share is essential.

- Technological advancements: Staying informed about CoreWeave's technological innovations and competitive positioning is key.

- Industry trends: Understanding broader trends in the cloud computing and AI markets will help contextualize CoreWeave's performance.

Conclusion:

The CoreWeave (NASDAQ: CRWV) stock price decline is a complex issue influenced by a combination of market-wide factors and company-specific challenges. While the current situation presents challenges, understanding the contributing factors and monitoring CoreWeave's progress is crucial for investors seeking to make informed decisions. The long-term potential remains significant, but careful analysis and a long-term perspective are essential. Remember to consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The CoreWeave (NASDAQ: CRWV) Stock Price Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mlb Draft Surprise Nationals Select High Schooler Eli Willits First Overall

Jul 16, 2025

Mlb Draft Surprise Nationals Select High Schooler Eli Willits First Overall

Jul 16, 2025 -

Chelsea Dominates Psg 3 0 Victory Analyzed

Jul 16, 2025

Chelsea Dominates Psg 3 0 Victory Analyzed

Jul 16, 2025 -

Analyst Upgrades Amd Stock Price Target Doubled Expectations

Jul 16, 2025

Analyst Upgrades Amd Stock Price Target Doubled Expectations

Jul 16, 2025 -

Sources Cooper Flaggs Summer League Participation Concludes Prematurely

Jul 16, 2025

Sources Cooper Flaggs Summer League Participation Concludes Prematurely

Jul 16, 2025 -

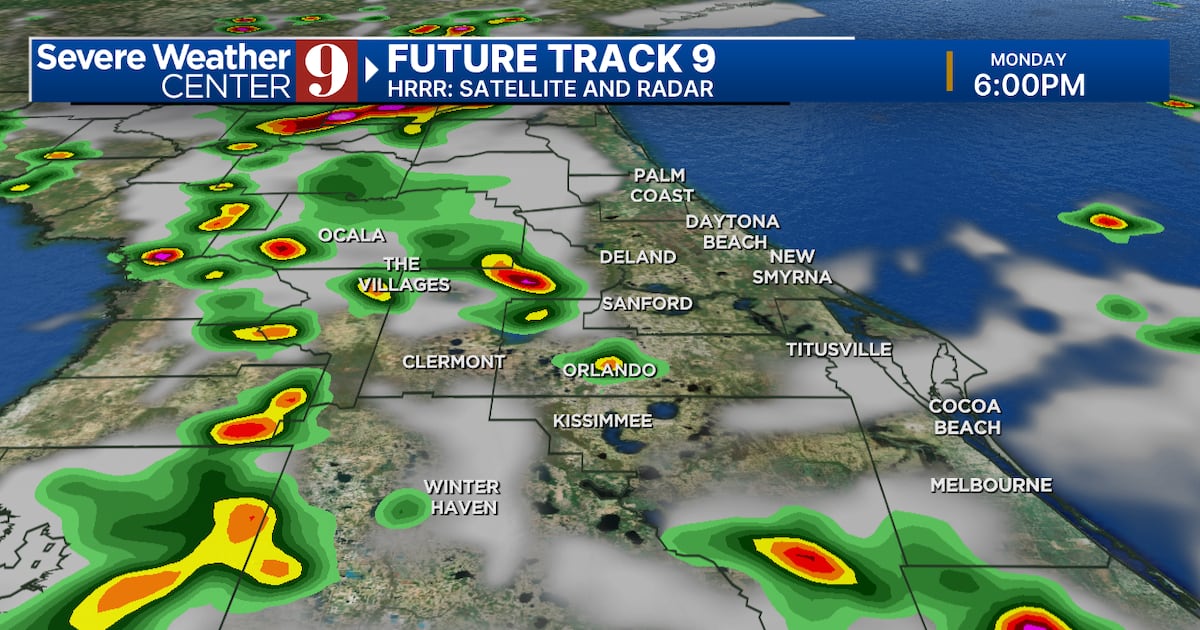

Showers And Thunderstorms To Drench Central Florida Through Mid Week

Jul 16, 2025

Showers And Thunderstorms To Drench Central Florida Through Mid Week

Jul 16, 2025

Latest Posts

-

Tahoe Celebrity Golf Tournament Results Pavelski Takes Home The Trophy

Jul 16, 2025

Tahoe Celebrity Golf Tournament Results Pavelski Takes Home The Trophy

Jul 16, 2025 -

2025 Mlb Draft Willits Joins Nationals As Number One Overall Selection

Jul 16, 2025

2025 Mlb Draft Willits Joins Nationals As Number One Overall Selection

Jul 16, 2025 -

Tracking The Chase Managers Poised To Join Terry Franconas 2 000 Win Legacy

Jul 16, 2025

Tracking The Chase Managers Poised To Join Terry Franconas 2 000 Win Legacy

Jul 16, 2025 -

Tropical Disturbance Invest 93 L Monitoring The Threat To Florida

Jul 16, 2025

Tropical Disturbance Invest 93 L Monitoring The Threat To Florida

Jul 16, 2025 -

Brooklyn Detention Center Migrant Population Surge Alongside High Profile Inmates

Jul 16, 2025

Brooklyn Detention Center Migrant Population Surge Alongside High Profile Inmates

Jul 16, 2025