Understanding The 1000% Jump In SBET Stock Price: Key Market Influences

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the 1000% Jump in SBET Stock Price: Key Market Influences

The seemingly meteoric rise of SBET stock, experiencing a staggering 1000% increase in price, has left many investors both astonished and curious. This dramatic surge wasn't a spontaneous event; rather, a confluence of factors contributed to this unprecedented growth. Understanding these influences is crucial for navigating the complexities of the market and making informed investment decisions.

The Speculative Frenzy: Social Media's Impact

One of the most significant drivers behind SBET's explosive growth is the undeniable power of social media. Platforms like Reddit's WallStreetBets and Twitter became breeding grounds for speculation, with enthusiastic traders hyping up the stock and creating a self-fulfilling prophecy. This phenomenon, often referred to as a "short squeeze," saw investors aggressively buying the stock, driving the price higher and forcing short-sellers (who bet against the stock's success) to cover their positions, further fueling the rally. This highlights the increasingly significant role social media plays in shaping market sentiment and driving stock prices, a trend that requires careful consideration.

Positive Company Developments: Fueling the Fire

While social media undoubtedly played a crucial role, it's important to note that SBET’s price surge wasn't entirely detached from company performance. Several positive developments contributed to the increased investor confidence. These included:

- Strong Q3 Earnings Report: The release of unexpectedly strong third-quarter earnings results showcased significant revenue growth and improved profitability, exceeding analysts' expectations. This provided tangible evidence to support the bullish sentiment already circulating online.

- New Product Launch: The successful launch of a highly anticipated new product line generated significant buzz and positive media coverage, further boosting investor confidence.

- Strategic Partnerships: The announcement of several key strategic partnerships solidified SBET's position within its industry, signaling future growth potential.

External Market Factors: A Favorable Climate

The broader economic climate also contributed to SBET's success. A period of low interest rates and increased liquidity in the market provided fertile ground for speculative investments, making assets like SBET more attractive to risk-seeking investors. This overall market environment, coupled with the aforementioned company-specific factors, created a perfect storm for exponential growth.

Risks and Volatility: A Word of Caution

While the 1000% increase is impressive, it's essential to acknowledge the inherent risks associated with such rapid growth. The volatility experienced by SBET highlights the potential for dramatic price swings and the importance of careful risk management. Investors should be aware of the possibility of significant corrections and avoid impulsive decisions driven solely by hype. Conduct thorough due diligence and consider diversifying your portfolio to mitigate risk.

Looking Ahead: Sustainable Growth or Bubble Bursting?

The question remains: is this rapid growth sustainable? While the positive company developments provide a foundation for long-term growth, the significant influence of speculative trading raises concerns about the possibility of a market correction. Monitoring SBET's performance closely, paying attention to future earnings reports and market sentiment, will be crucial in determining the long-term trajectory of the stock. Consult with a financial advisor to make informed decisions based on your individual risk tolerance and investment goals.

Call to Action: Stay informed about market trends and company developments by following reputable financial news sources. Remember, responsible investing involves thorough research and understanding the associated risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The 1000% Jump In SBET Stock Price: Key Market Influences. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unraveling Connections Sports Edition Puzzle 248 Hints For May 29 2025

May 30, 2025

Unraveling Connections Sports Edition Puzzle 248 Hints For May 29 2025

May 30, 2025 -

The Meteoric Rise Of Sbet Stock A Deep Dive Into A 1000 Increase

May 30, 2025

The Meteoric Rise Of Sbet Stock A Deep Dive Into A 1000 Increase

May 30, 2025 -

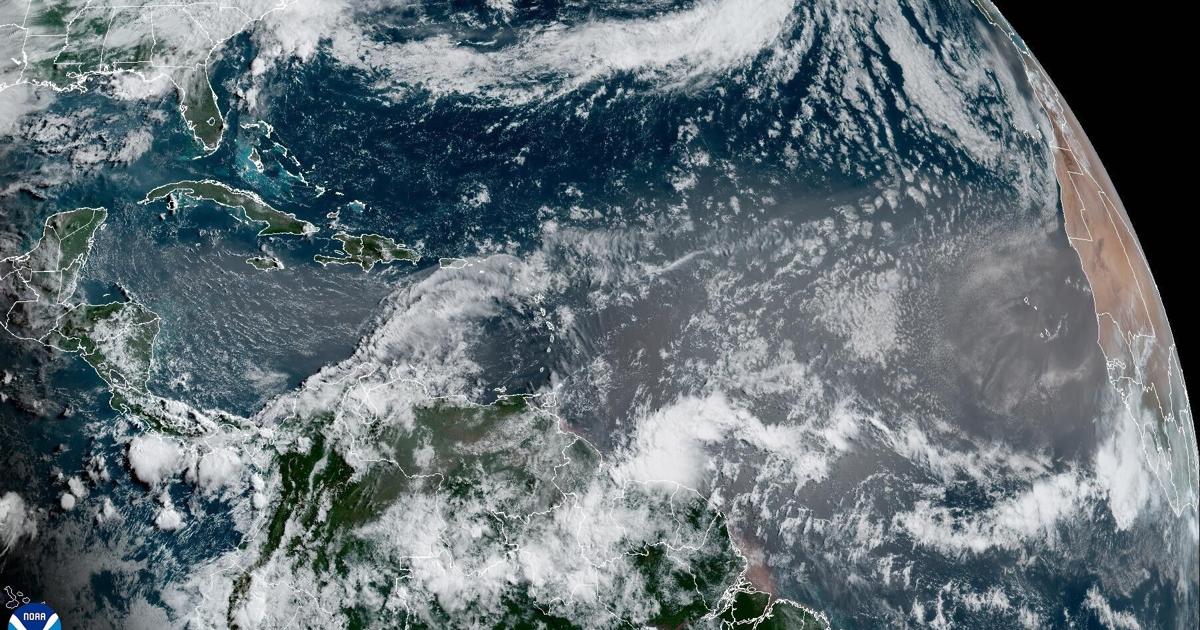

Intense Louisiana Sunsets Expected As Saharan Dust Approaches

May 30, 2025

Intense Louisiana Sunsets Expected As Saharan Dust Approaches

May 30, 2025 -

Caleb Williams Chicago Bears Affection A New Book Reveals All

May 30, 2025

Caleb Williams Chicago Bears Affection A New Book Reveals All

May 30, 2025 -

Pacers On The Verge Of Victory Will The Knicks Force A Game 6 In The Eastern Conference Finals

May 30, 2025

Pacers On The Verge Of Victory Will The Knicks Force A Game 6 In The Eastern Conference Finals

May 30, 2025