Understanding The 1000% Jump In SBET Stock Price: A Comprehensive Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the 1000% Jump in SBET Stock Price: A Comprehensive Analysis

The seemingly overnight surge in SBET stock price, a shocking 1000% increase in a matter of weeks, has left investors reeling. This dramatic spike demands a thorough analysis to understand the underlying factors and assess the potential for future growth or a significant correction. While such dramatic increases are often short-lived, understanding the contributing elements is crucial for navigating the volatile world of stock market investments.

What Drove the Meteoric Rise?

Several contributing factors likely fueled this unprecedented surge in SBET's stock value. It's unlikely any single event is solely responsible; rather, a confluence of circumstances likely created a perfect storm:

-

Positive Earnings Reports: Recent earnings reports, exceeding analyst expectations, likely played a significant role. Strong revenue growth, coupled with improved profitability, often boosts investor confidence and drives demand. Examining the specifics of these reports, focusing on key performance indicators (KPIs) like revenue growth, net income, and earnings per share (EPS), is vital for a complete understanding. [Link to SBET's latest earnings report - if publicly available].

-

Market Speculation and Hype: Social media chatter and online forums can significantly influence stock prices, particularly for smaller-cap companies like SBET. Positive sentiment, fueled by speculation and potentially unsubstantiated rumors, can create a self-fulfilling prophecy, driving up demand and pushing the price higher. This "pump and dump" scenario is a risk factor that investors should carefully consider.

-

Strategic Partnerships and Acquisitions: Announcements of new strategic partnerships or acquisitions can inject significant value into a company. Any recent partnerships or acquisitions by SBET need careful scrutiny. Understanding the implications of these collaborations on revenue streams and long-term growth potential is key.

-

Industry Trends and Innovation: A company’s performance is often tied to broader industry trends. Has SBET benefited from a positive shift in its sector? Are they leveraging cutting-edge technologies or innovative business models? Understanding the industry landscape and SBET's positioning within it is crucial.

-

Short Squeeze: A short squeeze occurs when a large number of investors bet against a stock (short selling), and a sudden price increase forces them to buy back shares to limit their losses, further driving up the price. This could be a factor, especially given the dramatic nature of the price jump.

Is This Sustainable? The Risks of a Correction

While the 1000% increase is undeniably impressive, the sustainability of this growth is highly questionable. Such dramatic rises often precede significant corrections. Investors should be aware of the following risks:

-

Overvaluation: The current stock price may not reflect the company's intrinsic value, leading to a potential correction. A thorough fundamental analysis is essential to determine whether the stock is truly worth its current price.

-

Market Volatility: The overall market climate plays a crucial role. Any negative economic news or broader market downturn could trigger a significant sell-off.

-

Lack of Transparency: Limited information or a lack of transparency surrounding the company's operations can create uncertainty and contribute to volatility.

Conclusion: Proceed with Caution

The 1000% jump in SBET's stock price represents an extraordinary event. While the contributing factors are multifaceted, understanding the potential risks is paramount. Investors should proceed with caution, conduct thorough due diligence, and avoid basing investment decisions solely on short-term price fluctuations. Diversification of investment portfolios is crucial in mitigating risk. This analysis serves as a starting point; further research is essential before making any investment decisions related to SBET. Remember to consult with a financial advisor before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The 1000% Jump In SBET Stock Price: A Comprehensive Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Okc In The Nba Finals Analyzing The Thunders Playoff Journey And The Timberwolves Failures

May 30, 2025

Okc In The Nba Finals Analyzing The Thunders Playoff Journey And The Timberwolves Failures

May 30, 2025 -

Althea Gibsons Legacy Celebrated 2025 Us Open Unveils Special Theme

May 30, 2025

Althea Gibsons Legacy Celebrated 2025 Us Open Unveils Special Theme

May 30, 2025 -

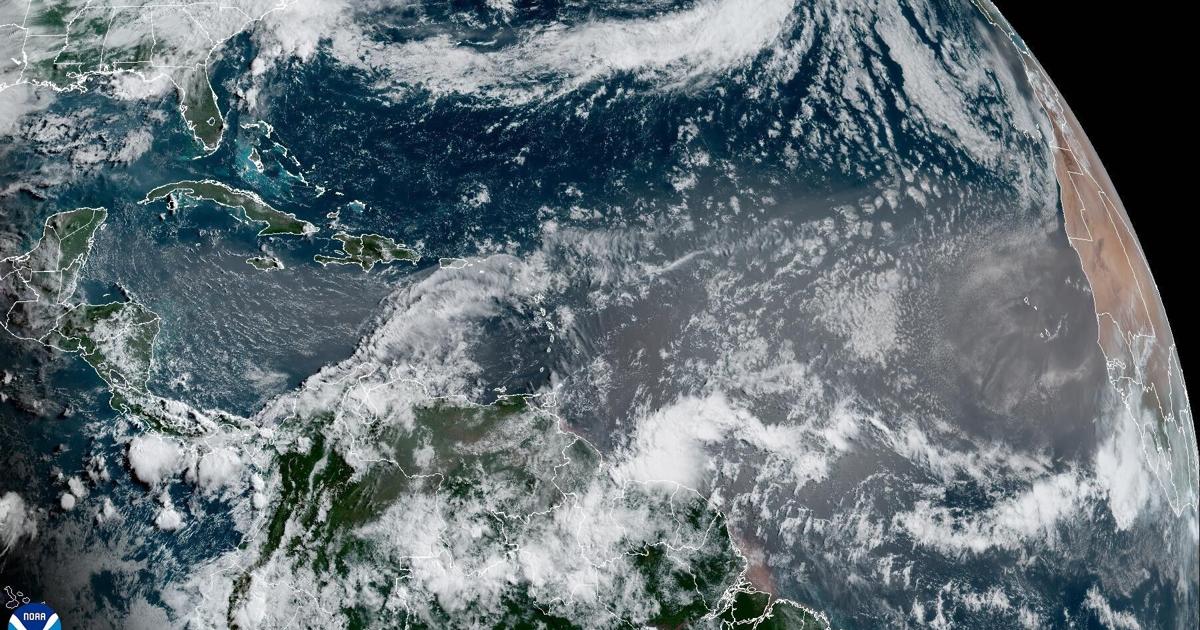

Saharan Dust Plume Dramatic Louisiana Sunsets Predicted

May 30, 2025

Saharan Dust Plume Dramatic Louisiana Sunsets Predicted

May 30, 2025 -

Nesmiths Game 4 Appearance A Surprise Boost For The Pacers Against The Knicks

May 30, 2025

Nesmiths Game 4 Appearance A Surprise Boost For The Pacers Against The Knicks

May 30, 2025 -

Detroit Grand Prix 2025 What To Expect Schedule Closures And Weather

May 30, 2025

Detroit Grand Prix 2025 What To Expect Schedule Closures And Weather

May 30, 2025