Understanding The 1000% Increase In SBET Stock Value

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the 1000% Increase in SBET Stock Value: A Deep Dive into the Phenomenon

The recent surge in SBET stock, boasting a staggering 1000% increase in value, has left investors both bewildered and ecstatic. This unprecedented growth warrants a closer examination, exploring the underlying factors contributing to this dramatic rise and considering the potential implications for the future. While past performance is never indicative of future results, understanding the current market dynamics surrounding SBET is crucial for any investor considering its stock.

What is SBET and Why the Sudden Surge?

SBET, [insert full company name here and a brief description of the company and its industry, e.g., a leading provider of innovative sports betting solutions], has experienced an explosive growth trajectory in recent months. Several key factors have contributed to this remarkable 1000% increase in stock value:

-

Strong Q[Insert Quarter] Earnings: The company's recently released financial reports showcased significantly improved earnings, exceeding analysts' expectations by a considerable margin. This positive financial performance boosted investor confidence and fueled the stock's rapid ascent. [Link to official earnings report if available].

-

Strategic Partnerships and Acquisitions: SBET's strategic partnerships with key players in the [relevant industry, e.g., gaming and entertainment] sector have broadened its market reach and enhanced its product offerings. Furthermore, strategic acquisitions have strengthened its competitive position and diversified its revenue streams. Specific examples of these partnerships and acquisitions should be mentioned here, linking to relevant press releases if available.

-

Innovative Product Development: The company's commitment to innovation, evidenced by the launch of [mention specific new products or services], has resonated strongly with consumers and investors alike. These new offerings have captured significant market share and driven considerable revenue growth.

-

Increased Market Demand: The growing popularity of [mention relevant sector, e.g., online sports betting] has created a favorable market environment for SBET, allowing the company to capitalize on increased demand for its products and services. This heightened demand has translated directly into improved financial performance and a rise in stock price.

-

Positive Market Sentiment: Overall positive market sentiment towards the [relevant industry, e.g., technology] sector has also contributed to the increased valuation of SBET. Broader market trends often influence individual stock performance.

Potential Risks and Future Outlook

While the 1000% increase is undeniably impressive, investors should remain cautious. Such dramatic growth often attracts increased scrutiny and carries inherent risks. Potential risks include:

-

Market Volatility: The stock market is inherently volatile, and rapid price increases can be followed by equally rapid declines. Investors should be prepared for potential corrections.

-

Competition: Increased competition within the [relevant industry, e.g., online sports betting] sector could negatively impact SBET's market share and future growth.

-

Regulatory Changes: Changes in regulations governing the [relevant industry, e.g., online gaming] sector could significantly impact SBET's operations and profitability.

Conclusion: A Cautious Optimism

The 1000% increase in SBET stock value is a remarkable achievement, driven by a combination of strong financial performance, strategic initiatives, and favorable market conditions. However, investors should approach this situation with a balanced perspective, acknowledging both the potential for continued growth and the inherent risks associated with such rapid appreciation. Further research and due diligence are crucial before making any investment decisions. Remember to consult with a qualified financial advisor before investing in any stock.

Keywords: SBET stock, SBET stock price, stock market, investment, [insert relevant industry keywords, e.g., sports betting, online gaming, technology], stock growth, market analysis, financial news, investment advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The 1000% Increase In SBET Stock Value. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can Anthony Edwards Lead The Timberwolves To Success An Analysis Of Their Offseason And Future Prospects

May 31, 2025

Can Anthony Edwards Lead The Timberwolves To Success An Analysis Of Their Offseason And Future Prospects

May 31, 2025 -

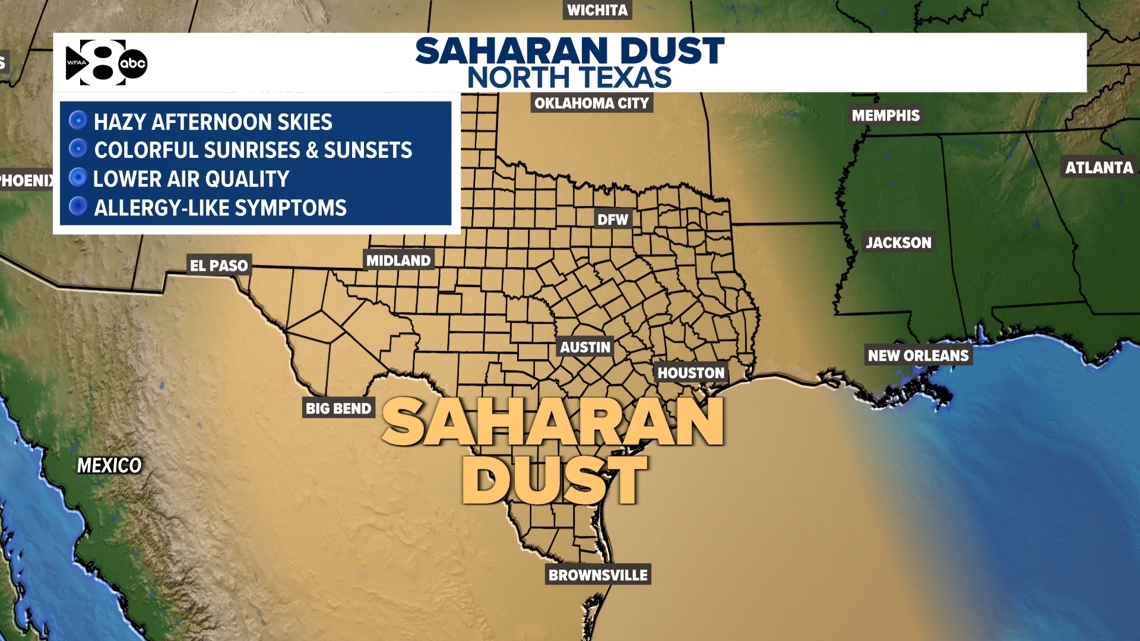

Saharan Dust 5 000 Mile Trek Reaches North Texas What You Should Know

May 31, 2025

Saharan Dust 5 000 Mile Trek Reaches North Texas What You Should Know

May 31, 2025 -

F1 Spanish Gp 2025 Qualifying Get Live Timing Results And Radio Commentary From Barcelona

May 31, 2025

F1 Spanish Gp 2025 Qualifying Get Live Timing Results And Radio Commentary From Barcelona

May 31, 2025 -

2025 Ufl Mvp Power Rankings Analyzing The Perez Perkins And Ta Amu Contention

May 31, 2025

2025 Ufl Mvp Power Rankings Analyzing The Perez Perkins And Ta Amu Contention

May 31, 2025 -

Tornado Touchdown Durbin Crossing And Liberty Pines Academy Impacted

May 31, 2025

Tornado Touchdown Durbin Crossing And Liberty Pines Academy Impacted

May 31, 2025