Understanding HSBC's RetireToMore Campaign: Your Path To A Secure Future

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding HSBC's RetireToMore Campaign: Your Path to a Secure Future

Planning for retirement can feel overwhelming. Navigating financial complexities, considering healthcare costs, and ensuring a comfortable lifestyle in your golden years requires careful planning and often, expert guidance. HSBC's RetireToMore campaign aims to simplify this process, offering a comprehensive suite of services designed to help you build a secure and fulfilling retirement. But what exactly does the campaign entail, and is it right for you?

What is HSBC's RetireToMore Campaign?

HSBC's RetireToMore isn't just a single product; it's a holistic approach to retirement planning. The campaign encompasses a range of financial solutions tailored to different retirement needs and stages. This typically includes:

- Retirement planning consultations: Personalized guidance from financial advisors to help you assess your current financial situation, set realistic retirement goals, and develop a tailored strategy.

- Pension and investment options: Access to a variety of pension schemes and investment opportunities designed to help your savings grow over time. This may include options suitable for different risk tolerances.

- Healthcare and long-term care planning: Understanding and planning for potential healthcare expenses in retirement is crucial. HSBC's campaign often incorporates advice and solutions to address these significant costs.

- Estate planning services: Ensuring your assets are distributed according to your wishes is a key element of retirement planning. The campaign may include access to legal and financial professionals to help with this process.

Key Features and Benefits:

- Personalized advice: The campaign emphasizes individualized plans, recognizing that everyone's retirement needs are unique. Advisors work with you to create a bespoke strategy.

- Comprehensive solutions: It's not just about investments; it covers all aspects of retirement planning, from pensions and healthcare to estate planning.

- Access to experts: You'll have access to experienced financial advisors who can provide guidance and support throughout the process.

- Flexibility and choice: HSBC typically offers a variety of options to suit different financial situations and risk profiles.

Is RetireToMore Right For You?

HSBC's RetireToMore campaign is particularly beneficial for:

- Individuals approaching retirement: Those nearing retirement age can use the campaign to refine their plans and ensure a smooth transition.

- Those with complex financial situations: The personalized advice is ideal for individuals with multiple income streams, significant assets, or complex estate planning needs.

- People seeking professional guidance: Anyone who prefers expert assistance in navigating the complexities of retirement planning will find this valuable.

Beyond the Campaign: Essential Retirement Planning Steps

While HSBC's RetireToMore provides a strong foundation, remember that proactive retirement planning requires individual effort. Here are some crucial steps to complement the campaign's services:

- Assess your current financial situation: Understand your income, expenses, assets, and debts.

- Set realistic retirement goals: Determine your desired lifestyle and the financial resources needed to support it.

- Develop a savings and investment plan: Create a strategy to achieve your retirement goals, considering your risk tolerance and time horizon.

- Regularly review and adjust your plan: Life circumstances change; your retirement plan should adapt accordingly.

Conclusion:

HSBC's RetireToMore campaign offers a valuable resource for anyone planning for retirement. By providing personalized advice and comprehensive solutions, it aims to empower individuals to secure their financial future. However, remember that this campaign should be considered alongside your own proactive planning efforts to ensure a truly secure and fulfilling retirement. For more detailed information, it's advisable to visit the official HSBC website and consult with a financial advisor. Start planning your secure future today!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding HSBC's RetireToMore Campaign: Your Path To A Secure Future. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Teyana Taylor On Straw Escape Room And Her Creative Evolution

Jun 05, 2025

Teyana Taylor On Straw Escape Room And Her Creative Evolution

Jun 05, 2025 -

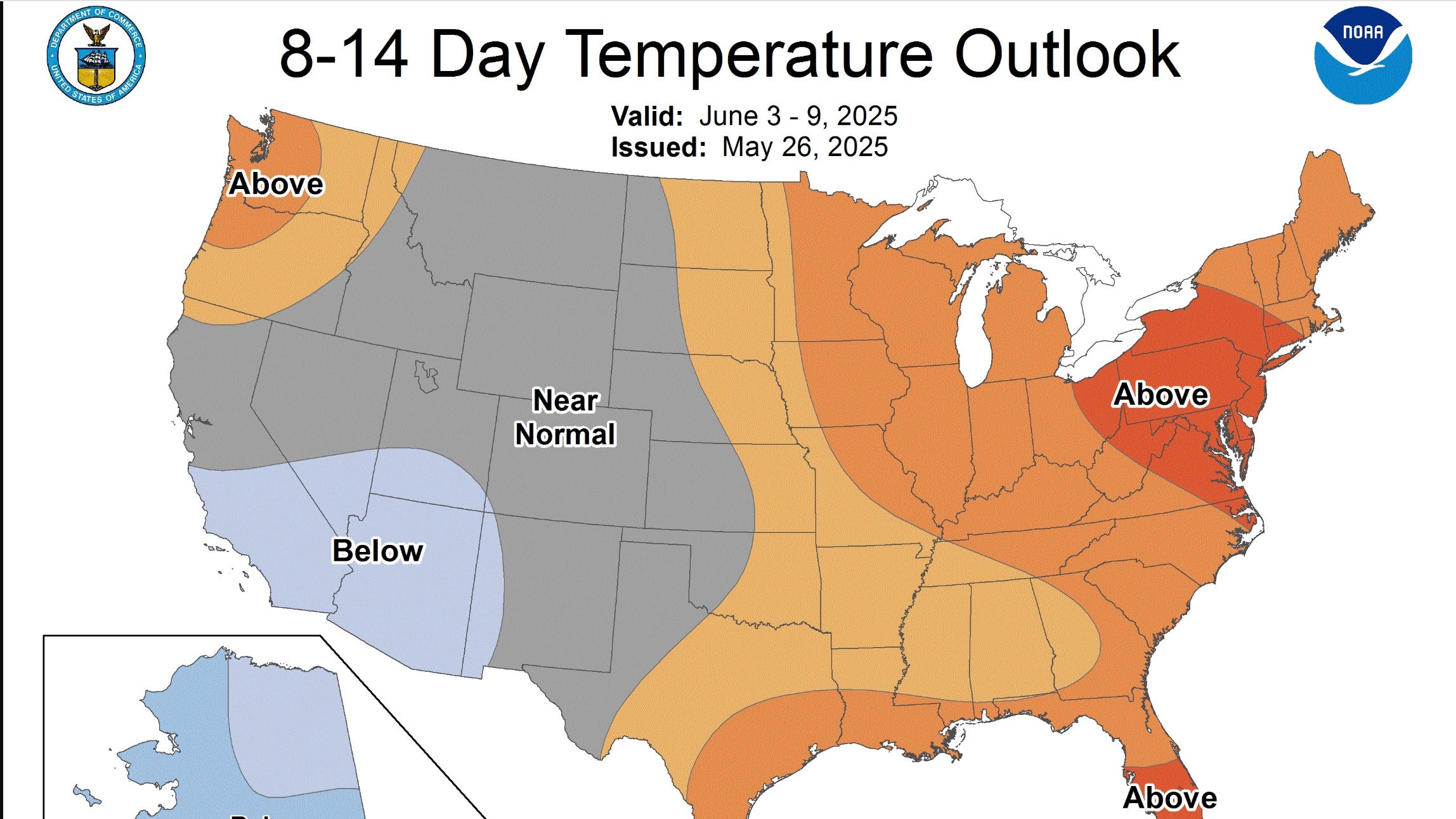

Willamette Valley Oregon Prepare For Scorching Temperatures In The 80s And 90s

Jun 05, 2025

Willamette Valley Oregon Prepare For Scorching Temperatures In The 80s And 90s

Jun 05, 2025 -

Understanding Carl Nassibs Impact On The Nfl

Jun 05, 2025

Understanding Carl Nassibs Impact On The Nfl

Jun 05, 2025 -

Mlb Offseason Outlook Analyzing The Strategies Of Blue Jays Giants Cubs And Angels

Jun 05, 2025

Mlb Offseason Outlook Analyzing The Strategies Of Blue Jays Giants Cubs And Angels

Jun 05, 2025 -

How To Trade Broadcom Options Effectively Ahead Of Earnings Announcements

Jun 05, 2025

How To Trade Broadcom Options Effectively Ahead Of Earnings Announcements

Jun 05, 2025