Understanding HSBC's RetireToMore Campaign For Retirement Security

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding HSBC's RetireToMore Campaign for Retirement Security

Planning for retirement can feel daunting. The sheer complexity of pensions, investments, and healthcare costs often leaves individuals feeling overwhelmed and unsure of how to secure their future. HSBC's RetireToMore campaign aims to address these anxieties, offering a comprehensive approach to retirement planning and providing tools and resources to help individuals build a secure and comfortable retirement. But what exactly does this campaign entail, and is it right for you?

What is HSBC's RetireToMore Campaign?

HSBC's RetireToMore isn't a single product but rather a holistic approach to retirement planning. It focuses on several key areas to help clients achieve their retirement goals:

- Financial Planning: This involves assessing your current financial situation, including assets, debts, and income, to create a personalized retirement plan. This often includes projecting future income needs and identifying potential gaps.

- Investment Strategies: HSBC offers a range of investment options tailored to different risk tolerances and retirement timelines. They guide clients on diversifying their portfolios to mitigate risk and maximize returns.

- Pension Advice: Navigating the complexities of pension schemes can be challenging. RetireToMore provides expert advice to help clients understand their pension options and make informed decisions.

- Healthcare Planning: Healthcare costs are a significant consideration in retirement planning. HSBC's campaign may incorporate strategies for managing these costs, potentially including advice on health insurance and long-term care.

Key Benefits of the RetireToMore Approach

The campaign emphasizes several key benefits to attract clients:

- Personalized Planning: The focus is on creating individualized plans based on individual circumstances and financial goals. This ensures a tailored approach, unlike generic retirement solutions.

- Expert Guidance: HSBC leverages its financial expertise to provide clients with informed guidance and support throughout the retirement planning process.

- Comprehensive Approach: RetireToMore addresses various aspects of retirement, encompassing financial planning, investments, pensions, and healthcare considerations.

- Long-Term Security: The ultimate goal is to help clients build a financially secure and comfortable retirement, allowing them to enjoy their later years without financial worries.

Who is RetireToMore For?

While the specifics may vary, the RetireToMore campaign is generally targeted towards individuals nearing retirement or those who are already in retirement and looking to optimize their financial situation. It's particularly beneficial for those who:

- Lack Confidence in Their Retirement Planning: If you feel overwhelmed or unsure about your retirement savings, RetireToMore can provide much-needed structure and guidance.

- Need Personalized Advice: A generic "one-size-fits-all" approach won't work for everyone. RetireToMore offers tailored plans to meet specific needs.

- Seek Expert Financial Guidance: Accessing professional financial advice can be expensive. HSBC aims to make this accessible and affordable through their campaign.

Beyond the Basics: Considering Alternatives and Further Research

While HSBC's RetireToMore offers a comprehensive approach, it's crucial to remember that exploring other options is essential. Compare different retirement planning services and consult independent financial advisors before making any significant financial decisions. Consider researching government pension schemes and other retirement savings options available in your region. Always read the fine print and understand any associated fees or charges.

Conclusion:

HSBC's RetireToMore campaign represents a significant effort to simplify and personalize retirement planning. By focusing on individual needs and offering comprehensive guidance, the campaign aims to empower individuals to build a secure financial future. However, independent research and comparison shopping remain crucial steps in securing your retirement. Remember to plan ahead and seek professional advice tailored to your specific circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding HSBC's RetireToMore Campaign For Retirement Security. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ten Defining Moments In Sports Mays Must Know Headlines

Jun 05, 2025

Ten Defining Moments In Sports Mays Must Know Headlines

Jun 05, 2025 -

Soundbites Grace Potter Discusses Her Newly Released Album

Jun 05, 2025

Soundbites Grace Potter Discusses Her Newly Released Album

Jun 05, 2025 -

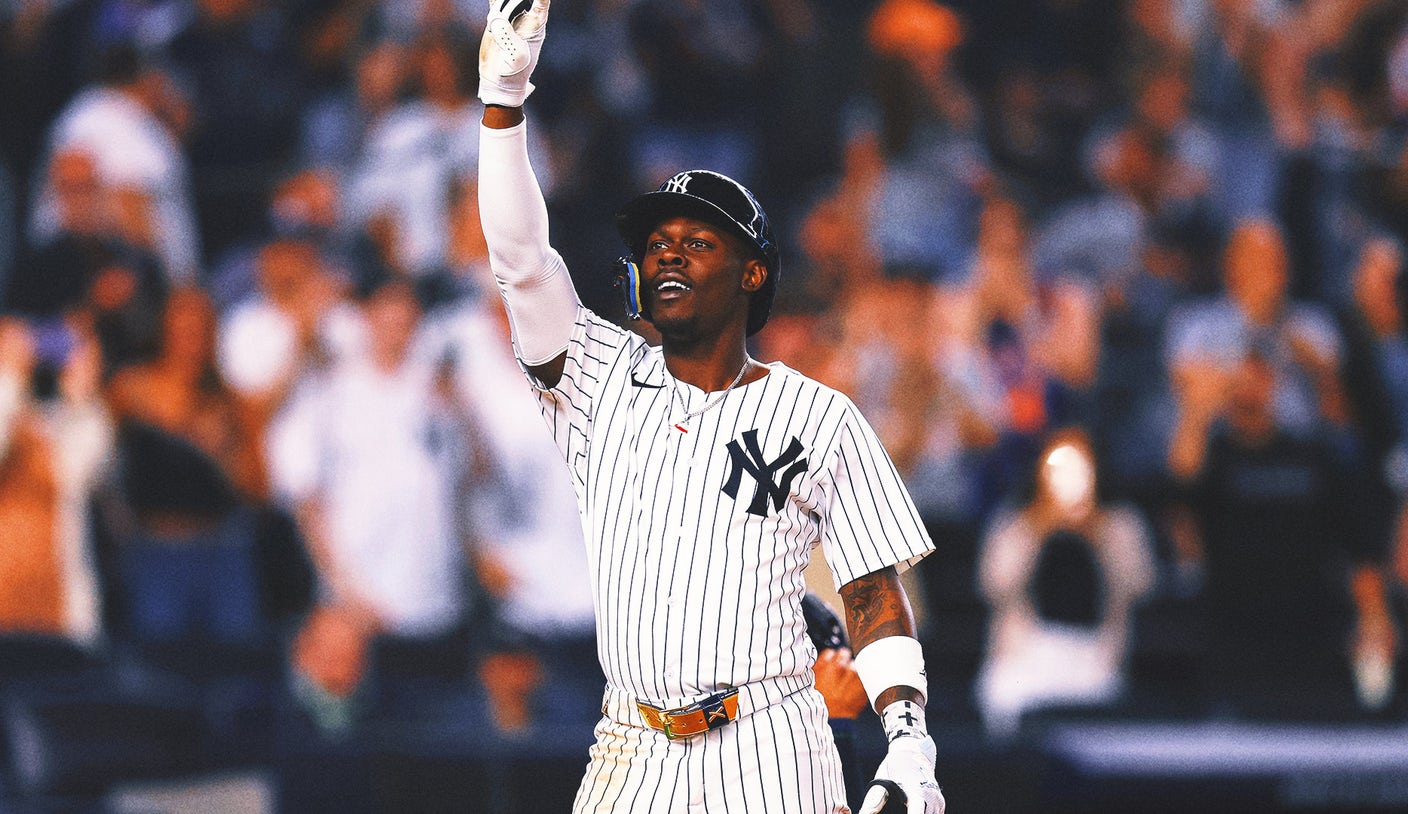

Chisholm Jr S Injury Comeback Sparks Yankees Win

Jun 05, 2025

Chisholm Jr S Injury Comeback Sparks Yankees Win

Jun 05, 2025 -

2025 Nfl Season Dallas Cowboys Game By Game Predictions And Playoff Path

Jun 05, 2025

2025 Nfl Season Dallas Cowboys Game By Game Predictions And Playoff Path

Jun 05, 2025 -

New York Knicks Announce Firing Of Head Coach Tom Thibodeau

Jun 05, 2025

New York Knicks Announce Firing Of Head Coach Tom Thibodeau

Jun 05, 2025