Understanding CoreWeave's (CRWV) Stock Performance: A Deep Dive

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding CoreWeave's (CRWV) Stock Performance: A Deep Dive

CoreWeave (CRWV), a leading provider of cloud computing infrastructure specializing in artificial intelligence (AI) and high-performance computing (HPC), has seen its stock performance generate significant interest since its recent IPO. Understanding the factors driving CRWV's stock price fluctuations is crucial for both current and prospective investors. This deep dive analyzes CoreWeave's performance, exploring its strengths, weaknesses, and the broader market forces at play.

CoreWeave's Business Model and Competitive Landscape:

CoreWeave distinguishes itself through its innovative use of repurposed GPUs, offering a cost-effective solution for AI and HPC workloads. This approach, while disruptive, also presents challenges. The company faces stiff competition from established cloud giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), each possessing extensive resources and market share. CRWV's success hinges on its ability to maintain a competitive edge in pricing, performance, and specialized services tailored to the burgeoning AI market.

Key Factors Influencing CRWV Stock Price:

Several factors significantly impact CoreWeave's stock performance:

- AI Market Growth: The explosive growth of the AI sector is a major tailwind for CRWV. Increased demand for powerful computing resources directly translates to higher revenue potential for CoreWeave. However, a slowdown in AI investment could negatively impact its stock price.

- GPU Supply Chain: The availability of GPUs, a critical component in CoreWeave's infrastructure, plays a crucial role. Supply chain disruptions or shortages could hinder the company's ability to meet growing demand, impacting its financial performance and stock valuation.

- Financial Performance: CRWV's quarterly earnings reports are closely scrutinized by investors. Metrics like revenue growth, operating margins, and customer acquisition costs are key indicators of its financial health and future prospects. Consistent strong financial performance is essential for maintaining investor confidence.

- Overall Market Sentiment: Broader market trends and investor sentiment towards the technology sector as a whole can influence CRWV's stock price. Periods of market uncertainty or a downturn in the tech sector could negatively impact its valuation.

- Technological Innovation: CoreWeave's ability to innovate and adapt to the ever-evolving needs of the AI and HPC markets is paramount. Maintaining a technological edge through research and development is crucial for long-term growth and investor confidence.

Risks and Opportunities:

While CoreWeave presents significant opportunities, investors should be aware of potential risks:

- Competition: Intense competition from established players in the cloud computing market is a major risk. CoreWeave needs to constantly innovate and differentiate itself to maintain its market share.

- Scalability: Meeting the ever-increasing demand for AI computing resources requires substantial scaling of infrastructure. Failure to effectively scale its operations could limit growth and impact profitability.

- Economic Downturn: A general economic downturn could reduce spending on cloud computing services, potentially impacting CoreWeave's revenue and profitability.

Looking Ahead:

CoreWeave's future performance will depend on its ability to navigate the challenges and capitalize on the opportunities within the rapidly evolving AI and HPC landscapes. Continuous innovation, strategic partnerships, and effective management of its resources will be critical for sustaining growth and delivering returns to investors. Monitoring key financial indicators, industry trends, and competitive dynamics will be essential for anyone considering investing in CRWV. For a more in-depth understanding of the company's financial health, consult their investor relations page and SEC filings.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you should conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding CoreWeave's (CRWV) Stock Performance: A Deep Dive. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can Any Active Manager Catch Terry Franconas 2 000 Win Milestone

Jul 16, 2025

Can Any Active Manager Catch Terry Franconas 2 000 Win Milestone

Jul 16, 2025 -

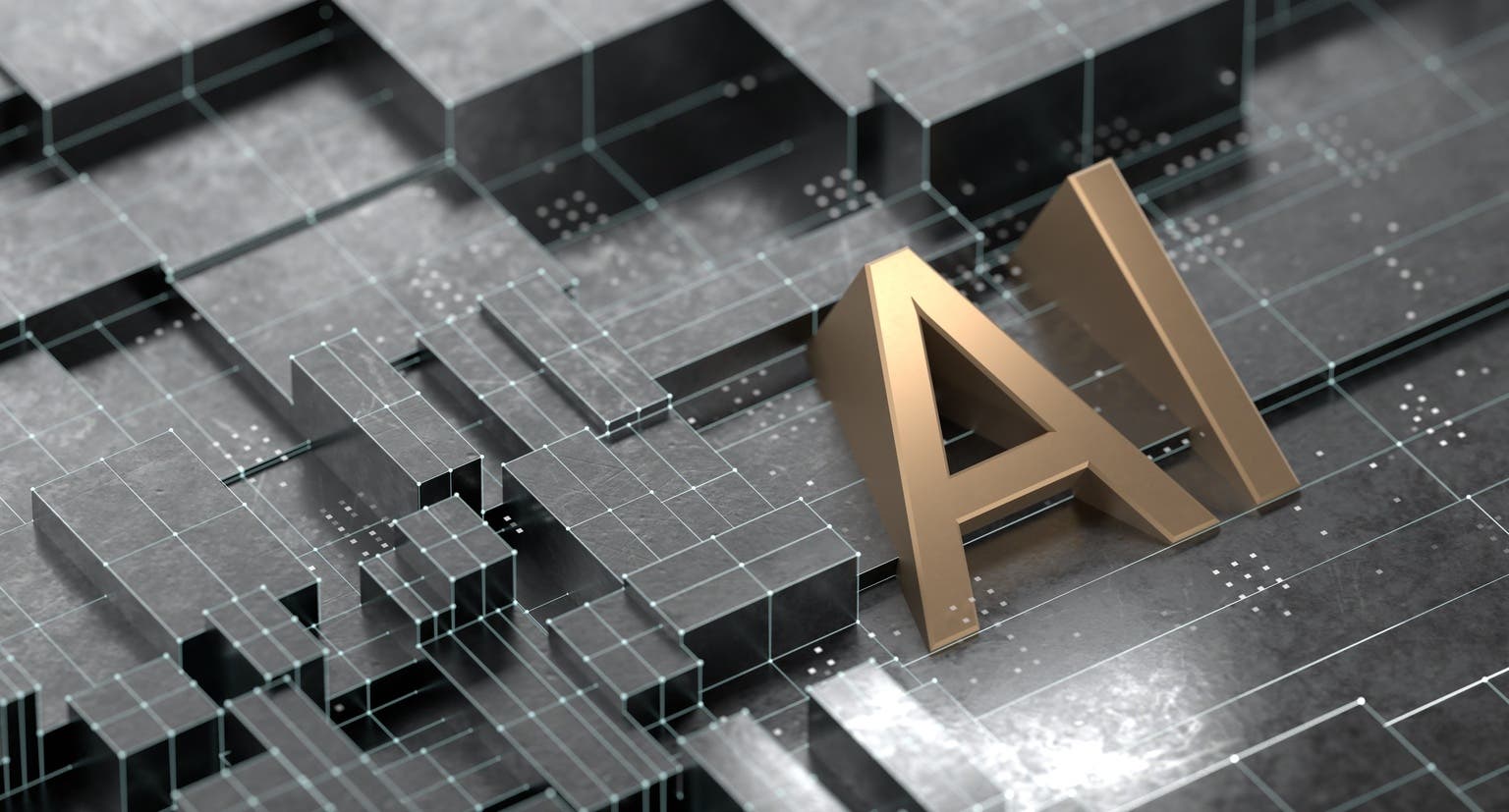

Central Florida Under Severe Storm Threat Monday Weather Update

Jul 16, 2025

Central Florida Under Severe Storm Threat Monday Weather Update

Jul 16, 2025 -

Mayors Letter Addressing Frequent Power Outages In Barberton

Jul 16, 2025

Mayors Letter Addressing Frequent Power Outages In Barberton

Jul 16, 2025 -

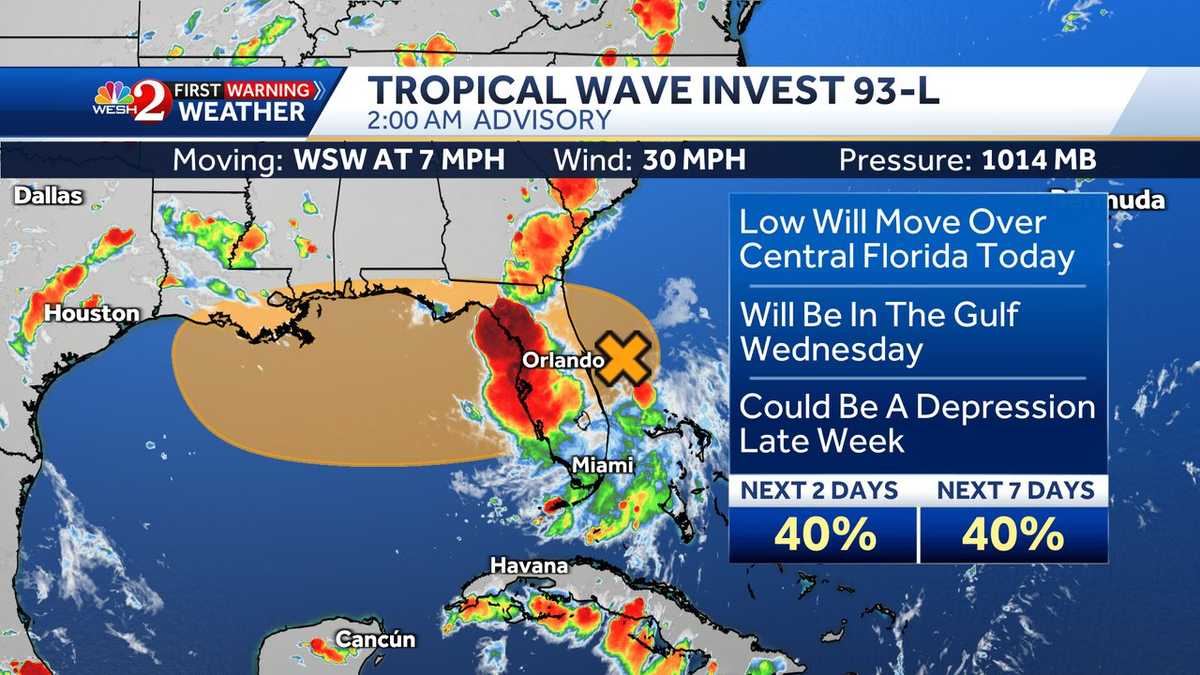

Tragic Accident Claims Life Of John Elways Former Agent Espn Report

Jul 16, 2025

Tragic Accident Claims Life Of John Elways Former Agent Espn Report

Jul 16, 2025 -

Broadway Barks 2024 Bernadette Peters And Beth Leavels Star Studded Adoption Event

Jul 16, 2025

Broadway Barks 2024 Bernadette Peters And Beth Leavels Star Studded Adoption Event

Jul 16, 2025