UBS And The Swiss Government: Clash Over New Capital Requirements

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UBS and the Swiss Government Clash Over New Capital Requirements: A Banking Showdown

Switzerland's largest bank, UBS, is locked in a high-stakes battle with the Swiss government over proposed increases in capital requirements. The disagreement underscores growing tensions between regulators and financial institutions in the wake of the Credit Suisse takeover and highlights the complexities of maintaining financial stability in a rapidly changing global landscape. This clash could have significant implications for UBS, the Swiss financial system, and potentially even the broader European banking sector.

The Core of the Conflict: Higher Capital Buffers

At the heart of the dispute lies the Swiss government's push for significantly higher capital buffers for UBS, exceeding the already stringent Basel III requirements. The government argues that these increased reserves are necessary to mitigate systemic risk and protect the stability of the Swiss financial system, particularly after the tumultuous events surrounding Credit Suisse's forced merger with UBS earlier this year. This merger, orchestrated by the Swiss government to prevent a wider financial crisis, created a banking giant of unprecedented size and influence within Switzerland.

The Swiss Financial Market Supervisory Authority (FINMA) is reportedly pushing for these stricter capital requirements, aiming to ensure UBS can withstand future unforeseen shocks and maintain solvency. However, UBS argues that the proposed levels are excessive and could stifle its lending capacity, hindering economic growth and harming its competitiveness in the global banking arena.

UBS's Counterarguments: Stifling Growth and Competitiveness

UBS contends that the proposed capital increase is unnecessarily burdensome. They argue that their current capital levels already comfortably exceed regulatory minimums and that the proposed increase would significantly limit their ability to lend to businesses and individuals, ultimately harming the Swiss economy. Furthermore, UBS claims that such stringent requirements would put them at a competitive disadvantage compared to international banking counterparts.

This argument highlights a key tension in global banking regulation: the balance between ensuring financial stability and promoting economic growth. Overly stringent regulations can hinder lending and investment, potentially harming economic activity. However, insufficient regulation can leave the system vulnerable to future crises.

Potential Impacts and Future Outlook

The outcome of this clash will have far-reaching consequences. If the Swiss government prevails, it could set a precedent for increased capital requirements for other large global banks, potentially leading to a tightening of credit conditions worldwide. Conversely, if UBS succeeds in challenging the regulations, it could signal a more lenient approach to capital requirements, potentially increasing systemic risk.

This situation also raises questions about the broader regulatory landscape for systemically important banks. The debate over optimal capital levels is ongoing globally, with different jurisdictions adopting varying approaches. The UBS-Swiss government dispute provides a case study of the ongoing tensions and complexities inherent in balancing financial stability with economic growth in the global banking system.

What's next? The situation remains fluid. Further negotiations between UBS and the Swiss government are expected, and the final decision will likely depend on a careful weighing of the risks and benefits involved. We will continue to monitor this developing story and provide updates as they become available. Stay informed by subscribing to our newsletter for the latest news in the finance sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UBS And The Swiss Government: Clash Over New Capital Requirements. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Evaluating Trade Offers For Top Draft Prospect Cooper Flagg 2025

Jun 06, 2025

Evaluating Trade Offers For Top Draft Prospect Cooper Flagg 2025

Jun 06, 2025 -

Reese Atwood And Texas Longhorns Secure Wcws Game 1 Win Against Texas Tech

Jun 06, 2025

Reese Atwood And Texas Longhorns Secure Wcws Game 1 Win Against Texas Tech

Jun 06, 2025 -

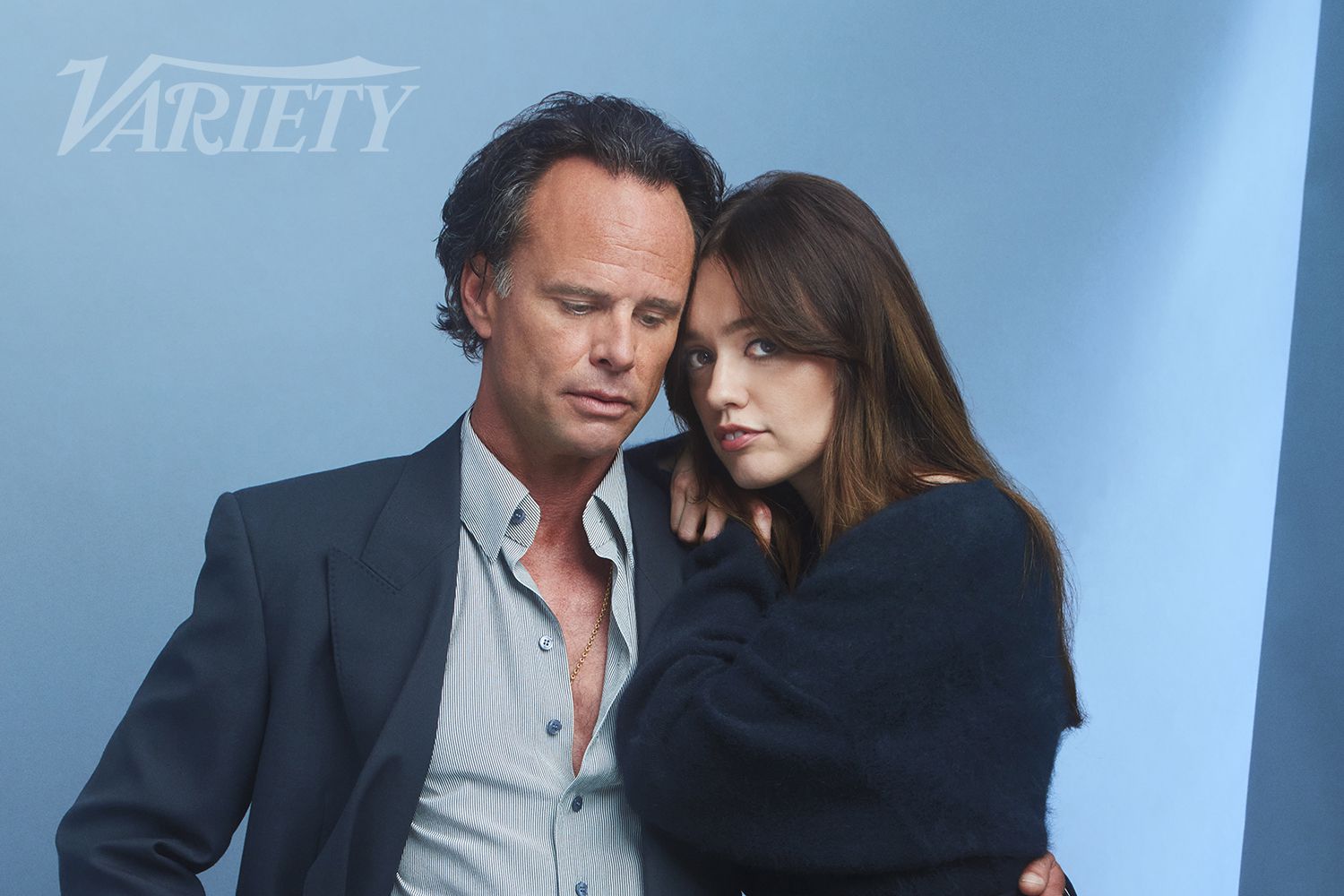

New Interview Walton Goggins And Aimee Lou Wood Clear The Air On Relationship Issues

Jun 06, 2025

New Interview Walton Goggins And Aimee Lou Wood Clear The Air On Relationship Issues

Jun 06, 2025 -

Uswnt Dominates Jamaica 4 0 Completing Unbeaten International Window

Jun 06, 2025

Uswnt Dominates Jamaica 4 0 Completing Unbeaten International Window

Jun 06, 2025 -

French Open 2024 Gauffs Triumph Over Keys Sends Her To Semifinals

Jun 06, 2025

French Open 2024 Gauffs Triumph Over Keys Sends Her To Semifinals

Jun 06, 2025