U.S. Treasury Yields Fall As Fed Hints At One Rate Cut In 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Fall as Fed Hints at One Rate Cut in 2025: Easing Inflation Concerns?

U.S. Treasury yields tumbled following the Federal Reserve's latest meeting minutes, which hinted at a potential single interest rate cut in 2025. This development signals a shift in the market's perception of the Fed's future monetary policy, potentially indicating a more optimistic outlook on inflation and economic growth. The move sent ripples through the financial markets, affecting everything from bond prices to the stock market.

The minutes, released on [Insert Date of Release], revealed a less hawkish stance than some analysts had anticipated. While the Fed maintained its commitment to fighting inflation, the suggestion of only one rate cut next year surprised investors who had priced in more aggressive action. This subtle shift in language suggests the central bank believes it's closer to achieving its inflation targets than previously thought.

What Drove the Yield Decline?

Several factors contributed to the fall in Treasury yields:

-

Softening Inflation Data: Recent economic data, including the [mention specific recent inflation reports, e.g., Consumer Price Index (CPI) or Producer Price Index (PPI)], showed signs of cooling inflation, supporting the Fed's more cautious approach. This reduction in inflationary pressure reduces the need for aggressively high interest rates.

-

Market Reaction to Fed's Tone: The market interpreted the minutes as a less aggressive signal than previously expected. This led investors to reduce their bets on future rate hikes, pushing Treasury yields lower. The shift in sentiment was swift and significant.

-

Increased Demand for Bonds: With the prospect of fewer future rate hikes, the demand for U.S. Treasury bonds – considered a safe haven asset – increased. Increased demand naturally drives prices up and yields down.

Implications for Investors:

The decline in Treasury yields has significant implications for various investment strategies:

-

Bond Investors: Bondholders saw increased value in their holdings as yields fell. This is particularly relevant for those holding long-term Treasury bonds.

-

Stock Market: Lower yields can be positive for the stock market, as lower borrowing costs can boost corporate investment and economic growth. However, the impact can be complex and depends on other economic factors.

-

Mortgage Rates: While not directly linked, the fall in Treasury yields can indirectly influence mortgage rates, potentially making borrowing cheaper for homebuyers.

Looking Ahead: Uncertainty Remains

While the Fed's hint at a single rate cut in 2025 suggests a more optimistic outlook, significant uncertainties remain. The path of inflation, future economic data releases, and unforeseen geopolitical events could all influence the Fed's future decisions. Analysts continue to monitor key economic indicators closely to gauge the true trajectory of the economy and monetary policy.

Further Reading:

- [Link to a relevant article on the Federal Reserve's website]

- [Link to an article analyzing inflation data]

- [Link to an article on the impact of interest rates on the stock market]

Disclaimer: This article provides general information and should not be considered financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Fall As Fed Hints At One Rate Cut In 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thunders Dominant Win Sends Them Back To Western Conference Finals After 7 Year Drought

May 20, 2025

Thunders Dominant Win Sends Them Back To Western Conference Finals After 7 Year Drought

May 20, 2025 -

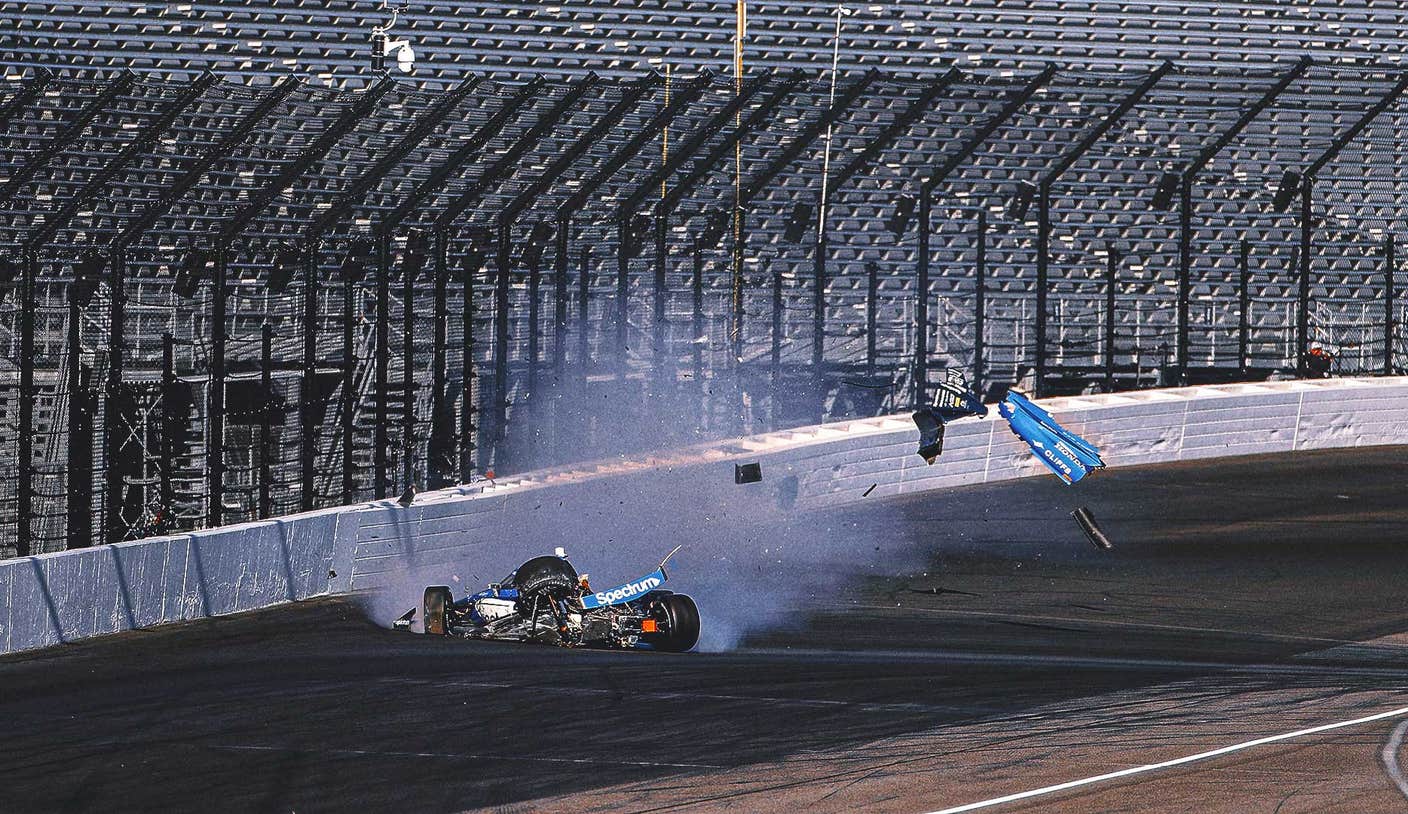

Indy 500 A Tumultuous Weekend Of Testing Crashes

May 20, 2025

Indy 500 A Tumultuous Weekend Of Testing Crashes

May 20, 2025 -

Strip The Duck Jon Jones Aspinall Comments Spark Heated Debate Among Mma Fans

May 20, 2025

Strip The Duck Jon Jones Aspinall Comments Spark Heated Debate Among Mma Fans

May 20, 2025 -

Did The Ufc Mislead Fans Jon Jones Speaks Out On Aspinall Fight Details

May 20, 2025

Did The Ufc Mislead Fans Jon Jones Speaks Out On Aspinall Fight Details

May 20, 2025 -

Indy 500 2025 Betting Analyzing Shwartzmans Odds After Securing Pole

May 20, 2025

Indy 500 2025 Betting Analyzing Shwartzmans Odds After Securing Pole

May 20, 2025