U.S. Treasury Yields Fall As Fed Hints At One 2025 Rate Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Fed Signals Potential 2025 Rate Cut

U.S. Treasury yields experienced a noticeable decline this week, fueled by the Federal Reserve's (Fed) subtle yet significant hint at a potential interest rate reduction in 2025. This shift in market sentiment marks a departure from the previously hawkish stance adopted by the central bank, sending ripples through the financial world and prompting investors to reassess their strategies.

The recent drop in yields reflects a growing expectation among market participants that the Fed's aggressive interest rate hikes, implemented to combat persistent inflation, may soon reach their peak. This anticipation is primarily driven by the Fed's latest projections, which hinted at the possibility of a single rate cut in 2025. While the Fed continues to emphasize its commitment to bringing inflation down to its 2% target, the suggestion of future rate reductions signals a potential pivot toward a more accommodative monetary policy.

<h3>What Drove the Treasury Yield Decline?</h3>

Several factors contributed to the fall in U.S. Treasury yields:

-

Fed's Dot Plot: The "dot plot," a chart showing individual Fed policymakers' projections for interest rates, revealed a notable shift in expectations. Several policymakers now foresee a rate cut in 2025, suggesting a growing belief that inflation will cool sufficiently to allow for such a move. This marked a change from previous projections, which indicated rates remaining elevated for a longer period.

-

Inflation Cooling: While inflation remains above the Fed's target, recent economic data points to a gradual cooling. This includes moderating consumer price index (CPI) figures and softening wage growth, bolstering the argument for a less aggressive monetary policy stance in the future.

-

Economic Growth Concerns: Concerns about potential economic slowdown are also contributing to the yield decline. While the labor market remains strong, there are growing anxieties about the impact of persistent high interest rates on economic growth, potentially leading to a recession. Investors are increasingly pricing in this risk.

<h3>Impact on the Markets</h3>

The fall in Treasury yields has broad implications across financial markets. Lower yields generally translate to:

-

Lower borrowing costs: Corporations and consumers may find it cheaper to borrow money, potentially stimulating investment and spending.

-

Increased demand for bonds: As yields fall, the attractiveness of bonds as a relatively safe investment increases, leading to higher demand.

-

Potential for Stock Market Gains: Lower interest rates can also boost stock market valuations, as companies benefit from reduced borrowing costs and potentially higher earnings.

<h3>Looking Ahead: Uncertainty Remains</h3>

While the Fed's hints towards a 2025 rate cut have caused a dip in Treasury yields, significant uncertainty remains. The actual timing and magnitude of any future rate cuts will depend on the evolving economic landscape, particularly the trajectory of inflation and economic growth. Investors should closely monitor key economic indicators, including inflation data, employment reports, and consumer spending figures, to gauge the Fed's future actions.

It's crucial to remember that the financial markets are complex and unpredictable. This analysis should not be considered financial advice. Investors should consult with qualified financial advisors before making any investment decisions. For more in-depth analysis on economic trends and market forecasts, visit reputable financial news sources like the and .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Fall As Fed Hints At One 2025 Rate Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mets Mendoza To Mentor Soto On Hustle

May 21, 2025

Mets Mendoza To Mentor Soto On Hustle

May 21, 2025 -

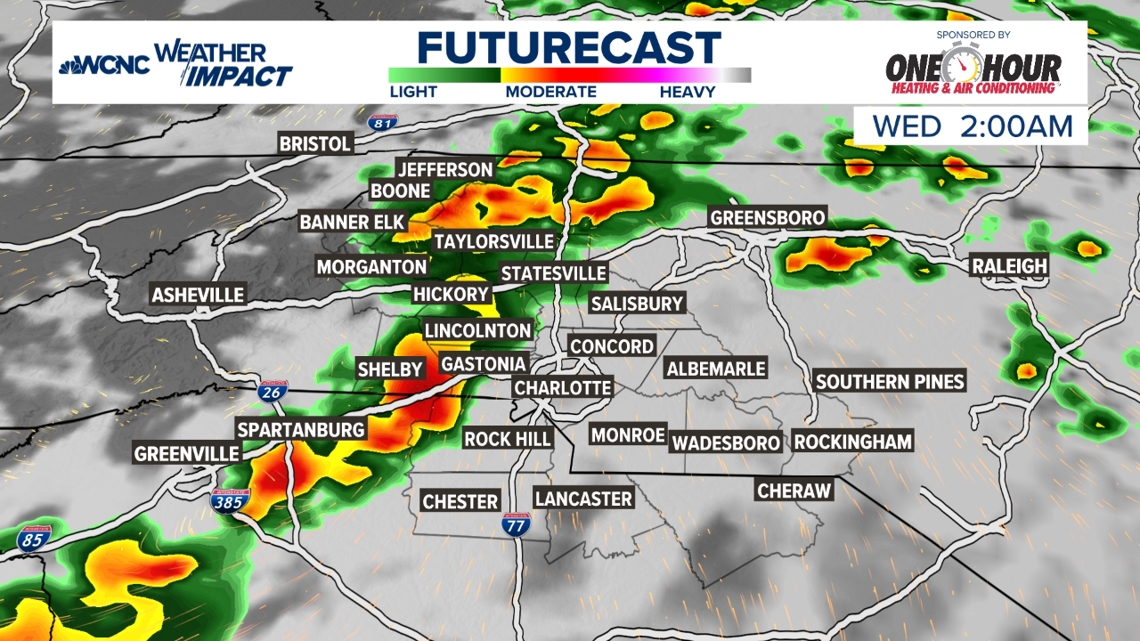

Tuesday Night Weather Outlook Very Isolated Severe Storm Chance

May 21, 2025

Tuesday Night Weather Outlook Very Isolated Severe Storm Chance

May 21, 2025 -

Putins Demise Of Trumps Influence A New Era In Global Politics

May 21, 2025

Putins Demise Of Trumps Influence A New Era In Global Politics

May 21, 2025 -

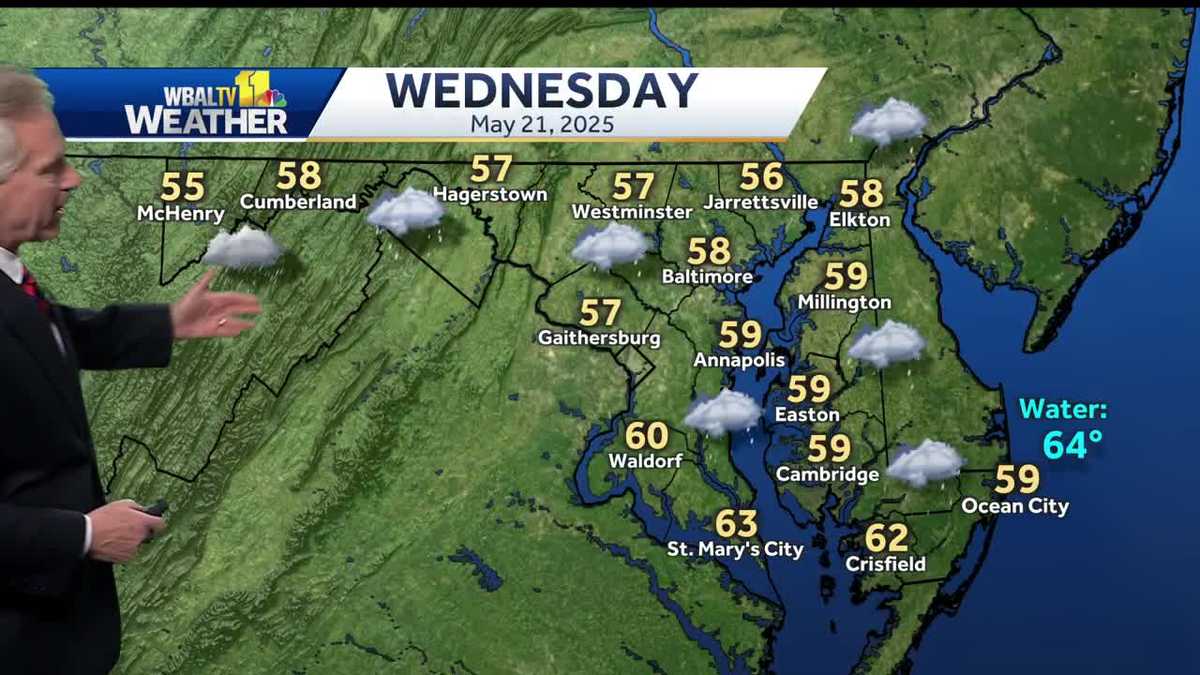

Chilly Rain Expected Across The Region On Wednesday

May 21, 2025

Chilly Rain Expected Across The Region On Wednesday

May 21, 2025 -

Post Ohtani Power Plays Which Mlb Team Will Reign Supreme This Offseason

May 21, 2025

Post Ohtani Power Plays Which Mlb Team Will Reign Supreme This Offseason

May 21, 2025