U.S. Treasury Yields Fall As Fed Hints At One 2025 Rate Decrease

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Fall as Fed Hints at Potential 2025 Rate Decrease

U.S. Treasury yields experienced a significant drop following the Federal Reserve's latest policy statement, hinting at a possible interest rate cut in 2025. This move sent ripples through the financial markets, prompting analysts to reassess their economic forecasts and investment strategies. The shift suggests a potential softening of the Fed's aggressive stance on inflation, raising questions about the future trajectory of monetary policy.

The Federal Open Market Committee (FOMC) statement, released [insert date], signaled a more cautious approach to future rate hikes. While acknowledging persistent inflationary pressures, the committee's language indicated a growing awareness of the potential economic slowdown. This subtle shift in tone was enough to trigger a sell-off in the U.S. dollar and a decline in Treasury yields, reflecting investor expectations of lower future interest rates.

Understanding the Impact of Falling Treasury Yields

The decrease in U.S. Treasury yields has significant implications for various sectors of the economy:

-

Mortgage rates: Lower Treasury yields typically translate to lower mortgage rates, potentially boosting the housing market. This could lead to increased home buying activity and a renewed surge in construction. However, the impact depends on other factors, such as the availability of credit and overall economic conditions.

-

Corporate borrowing costs: Reduced Treasury yields can lower borrowing costs for corporations, potentially stimulating business investment and economic growth. This could lead to increased hiring and expansion plans, benefiting the overall economy.

-

Investment strategies: Falling yields might prompt investors to re-evaluate their portfolios, shifting towards assets perceived as higher-yielding or less sensitive to interest rate changes. This could impact stock markets and other asset classes.

-

Dollar's value: The weakening dollar, a consequence of falling yields, might benefit U.S. exporters by making their goods more competitive in the global market. However, it could also increase the price of imported goods.

The Fed's Balancing Act: Inflation vs. Recession

The Fed's decision reflects a delicate balancing act between combating inflation and preventing a recession. While inflation remains above the central bank's target, recent economic data suggests a slowdown in economic growth. The potential for a single rate cut in 2025 suggests the Fed is prepared to adjust its monetary policy in response to evolving economic conditions. This proactive approach demonstrates a willingness to prioritize stability over an unwavering commitment to aggressive inflation control.

What Lies Ahead for the U.S. Economy?

The future trajectory of U.S. Treasury yields and the overall economy remains uncertain. Several factors, including inflation data, employment figures, and global economic developments, will influence the Fed's future decisions. Analysts are closely monitoring these indicators to predict the direction of interest rates and their impact on various sectors.

To stay updated on the latest developments in the financial markets, follow [link to your financial news website or relevant financial news source]. Understanding these complex economic shifts is crucial for informed decision-making in today's dynamic environment. This evolving situation requires continuous monitoring and careful consideration of multiple economic indicators. It's vital to consult with financial professionals for personalized advice tailored to individual circumstances.

Keywords: US Treasury yields, Federal Reserve, interest rates, inflation, recession, monetary policy, FOMC, economic growth, mortgage rates, investment strategies, dollar value, economic forecasts.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Fall As Fed Hints At One 2025 Rate Decrease. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kevin Spacey Makes Comeback Accepting Award At Cannes

May 20, 2025

Kevin Spacey Makes Comeback Accepting Award At Cannes

May 20, 2025 -

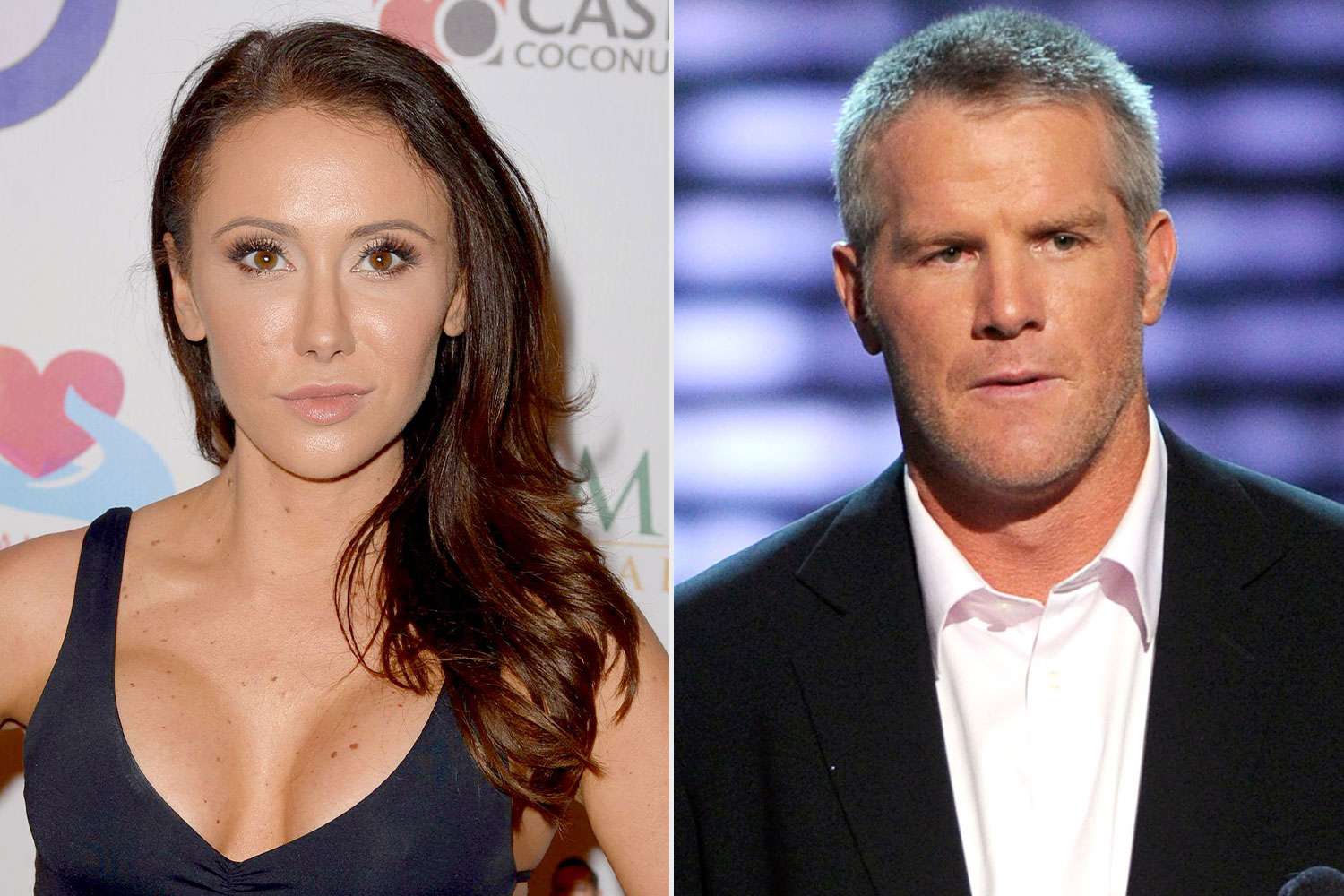

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Scandal

May 20, 2025

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Scandal

May 20, 2025 -

On The Bubble Which Nfl Teams Have The Highest Probability Of Reaching The 2023 Playoffs

May 20, 2025

On The Bubble Which Nfl Teams Have The Highest Probability Of Reaching The 2023 Playoffs

May 20, 2025 -

May 17th Mlb Player Props Home Run Predictions And Betting Odds

May 20, 2025

May 17th Mlb Player Props Home Run Predictions And Betting Odds

May 20, 2025 -

Us Japan Trade Talks Progress On Tariffs Despite Elimination Goal

May 20, 2025

Us Japan Trade Talks Progress On Tariffs Despite Elimination Goal

May 20, 2025