U.S. Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Decrease

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Fed Hints at Single 2025 Rate Decrease

Yields on U.S. Treasury bonds experienced a noticeable dip following recent comments from the Federal Reserve suggesting a potential single interest rate cut in 2025. This shift marks a subtle change in the narrative surrounding the Fed's monetary policy, sparking considerable debate among market analysts and investors. The implications for the economy and future investment strategies are far-reaching and warrant close attention.

The Fed's Subtle Shift in Tone:

The Federal Reserve's recent pronouncements, while cautiously optimistic about the ongoing efforts to curb inflation, hinted at a less aggressive approach to future interest rate adjustments. Instead of projecting multiple rate cuts, the central bank signaled a potential single decrease in 2025, contingent on economic data and the evolving inflationary landscape. This departure from previous, more hawkish projections sent ripples through the financial markets.

This shift in tone can be attributed to several factors, including:

- Easing Inflationary Pressures: While inflation remains above the Fed's target, recent data suggests a gradual cooling. This allows the central bank to consider a more measured approach to monetary policy.

- Concerns about Economic Slowdown: The Fed is also mindful of the potential for an economic slowdown, and aggressive rate hikes could exacerbate this risk. A single rate cut offers a safety net while still maintaining control over inflation.

- Data Dependency: The Fed has repeatedly emphasized its data-dependent approach. Future rate decisions will heavily depend on incoming economic indicators, including inflation figures, employment data, and consumer spending.

Impact on Treasury Yields:

The prospect of a less aggressive rate-hiking cycle, and the potential for a single rate cut in 2025, directly influenced the yields on U.S. Treasury bonds. Lower yields generally reflect increased investor demand, as bonds become more attractive when interest rates are expected to fall. This dip in yields signifies a shift in investor sentiment, with many believing the worst of the inflation surge may be behind us.

What This Means for Investors:

The recent dip in Treasury yields presents both opportunities and challenges for investors. For those seeking stability and income, Treasury bonds may appear more attractive. However, it's crucial to consider the broader economic outlook and the possibility of unforeseen events that could impact interest rates. Diversification remains a key strategy for mitigating risk.

Looking Ahead:

The coming months will be crucial in determining the accuracy of the Fed's projections. Closely monitoring economic indicators and the Fed's subsequent communication will be essential for investors to make informed decisions. The interplay between inflation, economic growth, and the Fed's policy response will continue to shape the trajectory of Treasury yields and the broader financial markets. Consult with a financial advisor to determine the best investment strategy for your individual needs and risk tolerance.

Keywords: U.S. Treasury yields, Federal Reserve, interest rates, inflation, economic slowdown, monetary policy, bond yields, investment strategy, financial markets, economic data, data dependency, rate cuts, 2025 economic forecast.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Dip As Federal Reserve Hints At Single 2025 Rate Decrease. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From College Star To Nfl Rookie The First Months Reality Check

May 21, 2025

From College Star To Nfl Rookie The First Months Reality Check

May 21, 2025 -

Pacers Star Tyrese Haliburtons Class Act Inviting A Nyc Heckler

May 21, 2025

Pacers Star Tyrese Haliburtons Class Act Inviting A Nyc Heckler

May 21, 2025 -

Solo Leveling Award Winning Web Novel Continues Its Rise

May 21, 2025

Solo Leveling Award Winning Web Novel Continues Its Rise

May 21, 2025 -

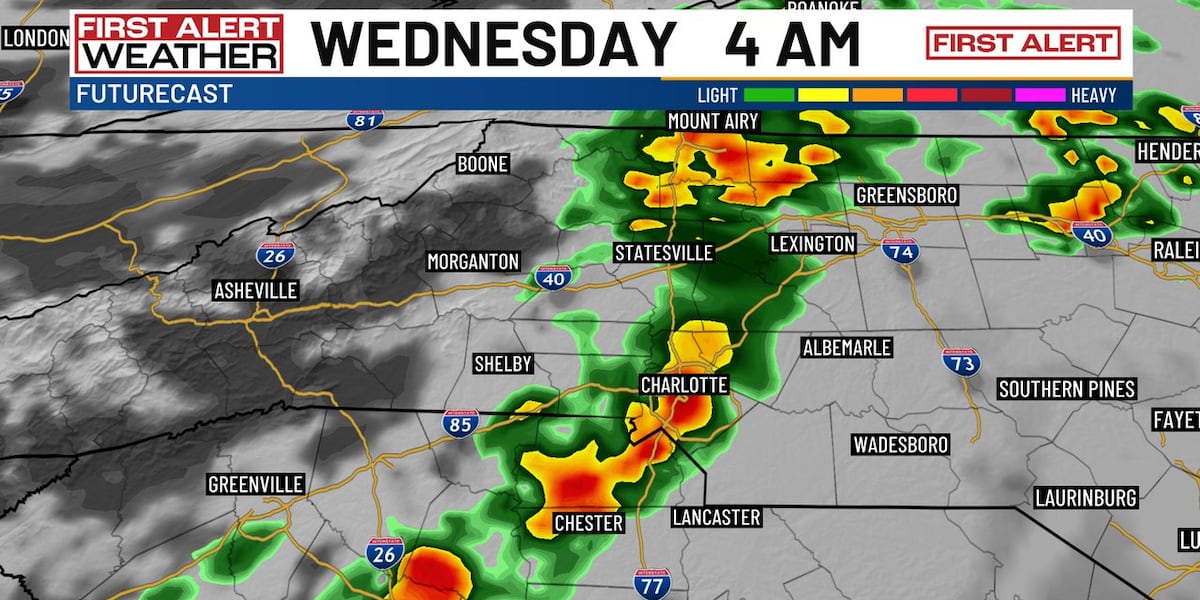

Charlotte Weather Alert Overnight Storms And Coming Cooldown

May 21, 2025

Charlotte Weather Alert Overnight Storms And Coming Cooldown

May 21, 2025 -

Church Desecration Santa Rosa Police Apprehend Teens Who Defecated And Urinated Inside

May 21, 2025

Church Desecration Santa Rosa Police Apprehend Teens Who Defecated And Urinated Inside

May 21, 2025