U.S. Treasury Yields Dip As Federal Reserve Hints At Limited Rate Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Federal Reserve Hints at Limited Rate Cuts

U.S. Treasury yields experienced a decline this week following Federal Reserve Chair Jerome Powell's comments suggesting a more cautious approach to future interest rate cuts. The market reaction reflects a shift in expectations surrounding the pace and extent of monetary policy easing. This development has significant implications for investors and the broader economy.

The recent dip in yields follows a period of relative stability and even upward pressure in the bond market. This change signifies a renewed focus on the Fed's commitment to controlling inflation, even as economic growth shows signs of slowing. The cautious optimism surrounding a potential recession has been tempered by the Fed's indication that rate cuts won't be a rapid or aggressive response to economic headwinds.

Powell's Comments Spark Market Re-evaluation

During a recent press conference, Chair Powell emphasized the Fed's data-dependent approach to monetary policy. He highlighted the need to carefully assess incoming economic data before making any decisions regarding interest rate adjustments. This nuanced approach, diverging from some market analysts' predictions of a more aggressive easing cycle, led to a reassessment of future yield trajectories. Instead of anticipating multiple rate cuts, the market is now pricing in a more limited reduction, impacting Treasury yield curves.

Keywords: U.S. Treasury Yields, Federal Reserve, Interest Rate Cuts, Monetary Policy, Bond Market, Jerome Powell, Inflation, Recession, Economic Growth, Yield Curve

Implications for Investors and the Economy

The shift in market sentiment carries several implications:

-

Bond Prices: The dip in Treasury yields translates to an increase in bond prices. This is because bond yields and prices move inversely. Investors seeking fixed-income investments may find this an opportune moment.

-

Mortgage Rates: While not directly tied to Treasury yields, movements in the latter can influence mortgage rates. A less aggressive rate-cutting path by the Fed might suggest mortgage rates remaining relatively elevated for longer.

-

Economic Growth: The Fed's cautious approach suggests a prioritization of inflation control over immediate economic stimulus. This strategy, while potentially impacting short-term growth, aims to prevent a more prolonged period of high inflation.

-

Investment Strategies: Investors will need to adapt their strategies based on the revised outlook for interest rates. This could involve reassessing allocations between bonds and equities, considering the implications for risk and return.

Looking Ahead: Uncertainty Remains

While the recent dip in Treasury yields provides a snapshot of current market sentiment, considerable uncertainty remains. The ongoing economic data releases, including inflation figures and employment reports, will play a crucial role in shaping the Fed's future decisions. Any unexpected shifts in economic indicators could lead to further volatility in the bond market and Treasury yields.

Further Reading: For a deeper understanding of monetary policy and its impact on the economy, we recommend exploring resources from the Federal Reserve Board website . You can also find insightful analysis from reputable financial news sources.

Call to Action: Stay informed about economic developments and the Fed's actions to make informed investment decisions. Consult with a financial advisor to tailor your investment strategy based on your individual risk tolerance and financial goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Dip As Federal Reserve Hints At Limited Rate Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Imposing Galactus Design Marvels Fantastic Four First Steps Art Revealed

May 20, 2025

Imposing Galactus Design Marvels Fantastic Four First Steps Art Revealed

May 20, 2025 -

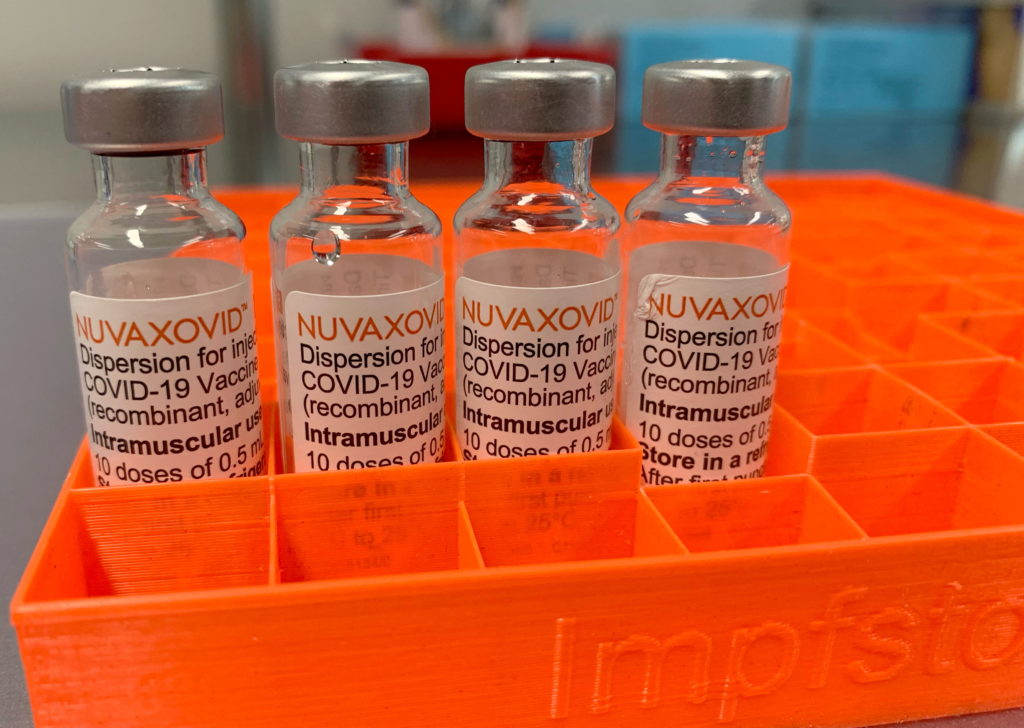

Fda Approval For Novavax Covid 19 Vaccine Comes With Strict Conditions

May 20, 2025

Fda Approval For Novavax Covid 19 Vaccine Comes With Strict Conditions

May 20, 2025 -

Concussion Concerns Correa And Buxton Hit The Il Following Twins Collision

May 20, 2025

Concussion Concerns Correa And Buxton Hit The Il Following Twins Collision

May 20, 2025 -

Twins Win Streak Hits 13 Brewers Shut Out Once More

May 20, 2025

Twins Win Streak Hits 13 Brewers Shut Out Once More

May 20, 2025 -

Indy 500 Shwartzmans Historic Pole Position Defies Expectations

May 20, 2025

Indy 500 Shwartzmans Historic Pole Position Defies Expectations

May 20, 2025