U.S. Treasury Yield Decline Follows Fed's 2025 Rate Cut Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Dip as Fed Hints at 2025 Rate Cuts

U.S. Treasury yields experienced a noticeable decline following the Federal Reserve's projection of potential interest rate cuts in 2025. This move sent ripples through the financial markets, prompting speculation about the future direction of the economy and inflation. The shift signals a potential change in the Fed's aggressive monetary tightening strategy implemented to combat inflation.

The recent dip in Treasury yields, a key indicator of borrowing costs and investor sentiment, follows the Federal Open Market Committee (FOMC)'s latest statement. While maintaining its commitment to controlling inflation, the Fed hinted at the possibility of rate cuts as early as 2025, depending on the evolving economic landscape. This projection contrasts with previous forecasts that suggested interest rates would remain elevated for a longer period.

Understanding the Impact of the Fed's Projection

The Fed's suggestion of future rate cuts has several implications:

-

Reduced Borrowing Costs: Lower interest rates generally translate to cheaper borrowing for businesses and consumers. This could stimulate economic activity and potentially fuel inflation, creating a delicate balancing act for the central bank.

-

Impact on Investment Strategies: Investors are reassessing their portfolios in light of the projected rate cuts. This may lead to shifts in investment strategies, with some potentially moving away from fixed-income securities towards assets expected to perform better in a lower-rate environment.

-

Dollar's Strength: The prospect of lower U.S. interest rates might weaken the dollar relative to other currencies. This can impact international trade and investment flows.

-

Inflation Concerns: While rate cuts aim to boost economic activity, they also carry the risk of reigniting inflationary pressures. The Fed will need to carefully monitor inflation data to ensure its policies remain effective.

Market Reactions and Future Outlook

The bond market reacted swiftly to the Fed's projection, with Treasury yields falling across the maturity spectrum. This indicates a shift in investor expectations, reflecting a belief that the current tightening cycle is nearing its end. However, analysts remain divided on the precise timing and magnitude of future rate cuts. Many believe that the Fed's forecast is highly dependent on future economic data, particularly inflation figures and employment reports.

Several factors could influence the trajectory of Treasury yields in the coming months:

-

Inflation Data: Persistent high inflation could force the Fed to maintain a more hawkish stance, delaying or even eliminating the possibility of rate cuts in 2025.

-

Economic Growth: A significant slowdown in economic growth could also prompt the Fed to act sooner to stimulate the economy.

-

Geopolitical Events: Unexpected geopolitical developments can significantly impact market sentiment and Treasury yields.

The Fed's projection of potential rate cuts in 2025 marks a significant shift in monetary policy. While this offers some relief to borrowers and potentially boosts economic activity, the path ahead remains uncertain. Careful monitoring of economic indicators will be crucial for understanding the full impact of this decision and the future trajectory of Treasury yields. Stay tuned for further updates as the economic landscape evolves.

Keywords: U.S. Treasury Yields, Federal Reserve, Interest Rate Cuts, 2025 Rate Projections, Bond Market, Inflation, Economic Growth, Monetary Policy, FOMC, Investment Strategies, Dollar, Financial Markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yield Decline Follows Fed's 2025 Rate Cut Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Renegades Tyler Vaughns Steals The Show In Ufl Week 8

May 21, 2025

Renegades Tyler Vaughns Steals The Show In Ufl Week 8

May 21, 2025 -

Can The Cavaliers Overcome Obstacles And Meet Elevated Expectations

May 21, 2025

Can The Cavaliers Overcome Obstacles And Meet Elevated Expectations

May 21, 2025 -

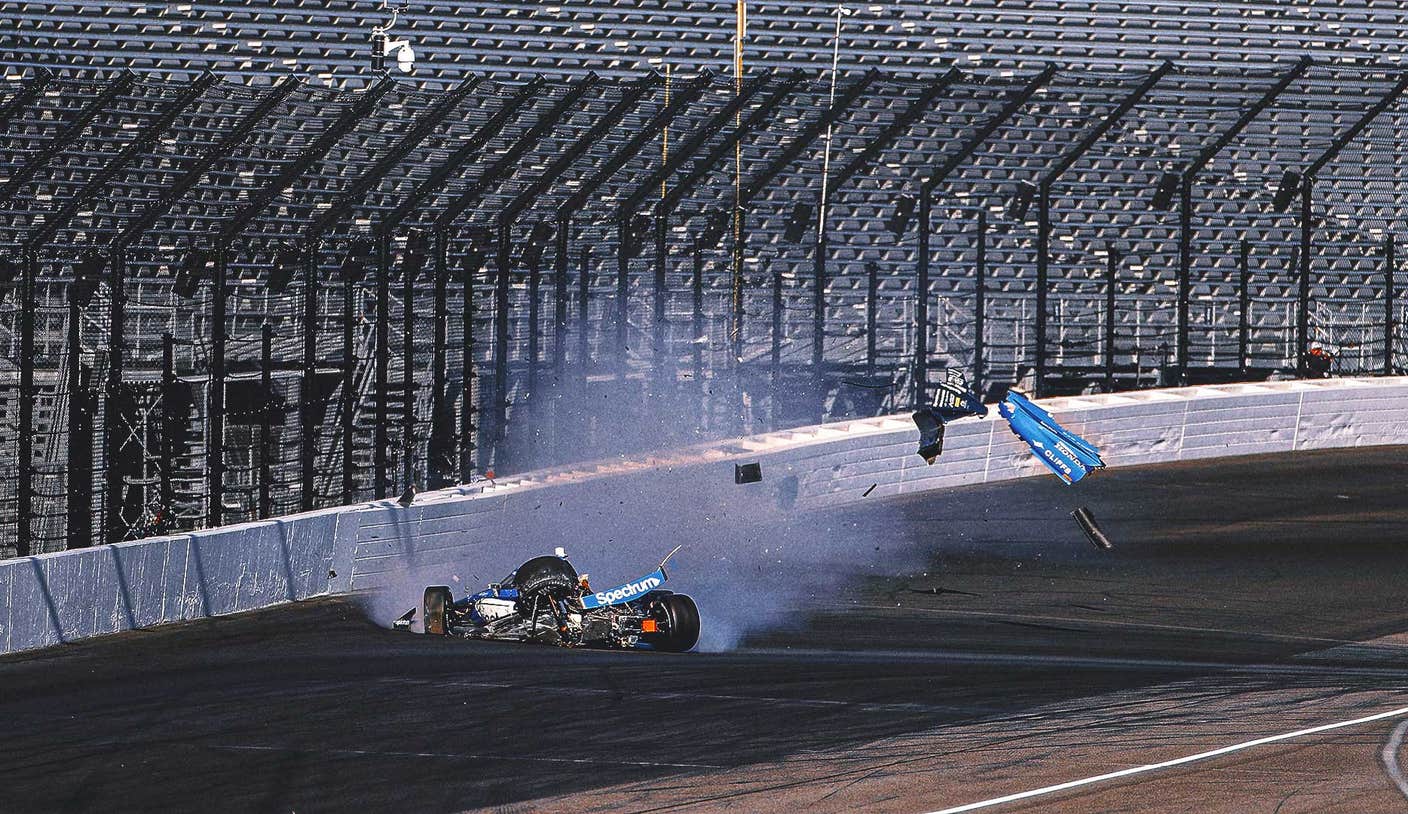

Indy 500 Crash Filled Weekend Impacts Preparations

May 21, 2025

Indy 500 Crash Filled Weekend Impacts Preparations

May 21, 2025 -

New Ww 1 Epic Daniel Craig Cillian Murphy And Tom Hardy Lead The Cast

May 21, 2025

New Ww 1 Epic Daniel Craig Cillian Murphy And Tom Hardy Lead The Cast

May 21, 2025 -

Expect Showers And Chilly Temperatures Throughout The Week

May 21, 2025

Expect Showers And Chilly Temperatures Throughout The Week

May 21, 2025