U.S. Treasury Market Reacts: Yields Fall On Fed's 2025 Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reacts: Yields Fall on Fed's 2025 Rate Cut Outlook

The U.S. Treasury market experienced a significant shift on [Date of News], with yields falling sharply following the Federal Reserve's (Fed) updated economic projections. The central bank signaled a potential rate cut as early as 2025, a departure from previous hawkish pronouncements and a major catalyst for the market's reaction. This shift in expectations has sent ripples through the financial world, prompting analysts to reassess their forecasts for interest rates and economic growth.

This article delves into the details of the market reaction, exploring the reasons behind the yield drop and analyzing its potential implications for investors and the broader economy.

Understanding the Yield Curve Shift

The Fed's projection of rate cuts in 2025 directly impacted the yield curve – the relationship between the yields of Treasury bonds with different maturities. Longer-term Treasury yields, which are particularly sensitive to expectations about future interest rates, experienced a more pronounced decline than shorter-term yields. This flattening of the yield curve reflects investors' belief that the Fed's anticipated rate cuts will reduce future inflation and slow economic growth.

- Lower Long-Term Yields: The decrease in longer-term yields suggests that investors are less concerned about future inflation and are pricing in the possibility of lower interest rates. This is a significant shift from the previous environment where concerns about persistent inflation drove yields higher.

- Impact on the Yield Curve: The flattening of the yield curve is a key indicator of investor sentiment and can signal potential economic slowdowns. Historically, an inverted yield curve (where short-term yields exceed long-term yields) has often preceded recessions. While the current curve isn't inverted, the significant flattening warrants close monitoring.

Why the Market Reacted So Strongly

The Fed's revised outlook wasn't entirely unexpected. Recent economic data, including softening inflation figures and slowing job growth, has led many economists to predict a more dovish approach from the central bank. However, the explicit mention of potential rate cuts in 2025 surprised some market participants who anticipated a longer period of higher interest rates.

Several factors contributed to the strong market reaction:

- Unexpected Rate Cut Projections: The timing of potential rate cuts was earlier than many anticipated, catching some investors off guard.

- Inflation Slowdown: The continued moderation of inflation, although still above the Fed's target, played a key role in influencing the Fed's decision and subsequent market reaction.

- Economic Growth Concerns: Concerns about a potential economic slowdown, fuelled by recent economic indicators, further contributed to the shift in investor sentiment.

Implications for Investors and the Economy

The fall in Treasury yields has significant implications for various sectors:

- Bond Investors: Existing bondholders benefit from the increased value of their holdings, while new investors can potentially secure higher yields compared to recent levels.

- Mortgage Rates: The change in Treasury yields could influence mortgage rates, potentially making borrowing more affordable.

- Economic Growth: Lower interest rates can stimulate economic growth by making borrowing cheaper for businesses and consumers. However, this could also lead to renewed inflationary pressures if not carefully managed.

Looking Ahead:

The market's reaction to the Fed's rate cut outlook highlights the interconnectedness of monetary policy, economic data, and investor sentiment. Closely monitoring economic indicators and the Fed's future communications will be crucial in understanding the trajectory of interest rates and the overall economic outlook. Further analysis is needed to determine whether this shift signals a sustained trend or a temporary market adjustment. It remains essential for investors to maintain a diversified portfolio and to consult with financial advisors to make informed investment decisions. The coming months will be critical in determining the full impact of this significant market shift.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reacts: Yields Fall On Fed's 2025 Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thunders Impressive Game 7 Win A Complete Domination Over Denver

May 20, 2025

Thunders Impressive Game 7 Win A Complete Domination Over Denver

May 20, 2025 -

Win Big Best Mlb Walk Off Wager Predictions For White Sox Cubs And Red Sox Braves Games

May 20, 2025

Win Big Best Mlb Walk Off Wager Predictions For White Sox Cubs And Red Sox Braves Games

May 20, 2025 -

Wnba Responds To Fan Harassment Clark Reese Incident Prompts Inquiry

May 20, 2025

Wnba Responds To Fan Harassment Clark Reese Incident Prompts Inquiry

May 20, 2025 -

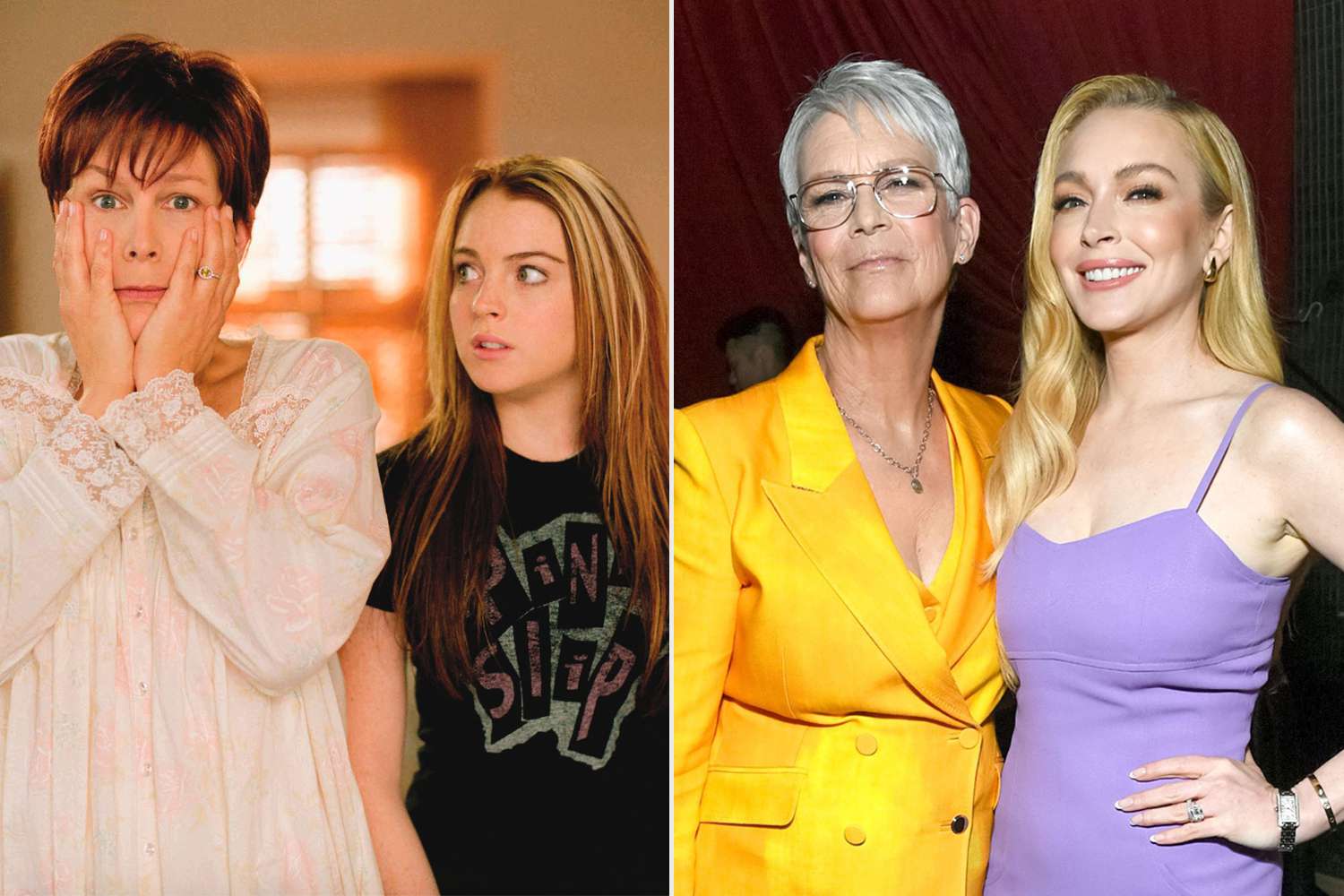

The Freaky Friday Legacy Jamie Lee Curtis Discusses Her Ongoing Friendship With Lindsay Lohan

May 20, 2025

The Freaky Friday Legacy Jamie Lee Curtis Discusses Her Ongoing Friendship With Lindsay Lohan

May 20, 2025 -

A Candid Conversation Jamie Lee Curtis On Her Relationship With Lindsay Lohan

May 20, 2025

A Candid Conversation Jamie Lee Curtis On Her Relationship With Lindsay Lohan

May 20, 2025