Two Top S&P 500 Stocks To Consider Buying On The Current Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Top S&P 500 Stocks to Consider Buying on the Current Dip

The recent market volatility has left many investors wondering where to put their money. While uncertainty remains, savvy investors often see dips as opportunities to acquire strong assets at discounted prices. Two S&P 500 giants currently appear particularly attractive for those looking to bolster their portfolios: Microsoft (MSFT) and Johnson & Johnson (JNJ). This article explores why these two stocks represent compelling buys in the current market climate.

Why Microsoft (MSFT) is a Smart Buy Now

Microsoft's consistent growth and dominance in multiple sectors make it a reliable cornerstone for any diversified portfolio. The company's cloud computing division, Azure, continues to experience phenomenal growth, competing directly with Amazon Web Services (AWS) and Google Cloud. This sustained growth, coupled with its strong position in software (Windows, Office 365), gaming (Xbox), and LinkedIn, provides a robust foundation for future gains.

- Diversified Revenue Streams: Microsoft isn't reliant on a single product or service. This diversification minimizes risk and provides resilience against market fluctuations.

- Strong Leadership: Under CEO Satya Nadella, Microsoft has undergone a successful transformation, focusing on cloud services and innovation.

- Long-Term Growth Potential: The continued growth of cloud computing and the increasing digitization of the global economy ensures long-term growth prospects for Microsoft.

While MSFT's stock price has seen some recent pullback, its fundamental strength suggests this dip presents a buying opportunity. Analysts generally maintain a positive outlook, forecasting continued growth in the coming years. [Link to reputable financial news source discussing MSFT's future projections]

Johnson & Johnson (JNJ): A Defensive Play with Long-Term Appeal

Johnson & Johnson offers a different kind of stability: a defensive position within the healthcare sector. As a consumer staples giant, JNJ’s products – from pharmaceuticals and medical devices to consumer health products – are consistently in demand, regardless of broader economic conditions. This makes it a reliable investment during periods of uncertainty.

- Consistent Dividend Payments: JNJ boasts a long history of consistent dividend payments, making it attractive to income-seeking investors. This provides a reliable stream of income even during market downturns. [Link to JNJ investor relations page regarding dividend history]

- Stable Revenue Streams: The diversified nature of its business, spanning various healthcare segments, ensures relative stability even during economic slowdowns.

- Pharmaceutical Pipeline: JNJ's robust pharmaceutical research and development pipeline offers potential for future growth and innovation, further solidifying its long-term prospects.

While the healthcare sector might face regulatory challenges, JNJ's size, scale, and established brand reputation offer considerable resilience. This makes it an ideal defensive stock to counterbalance riskier investments in your portfolio.

Considering Your Investment Strategy

Before making any investment decisions, it's crucial to consult with a qualified financial advisor. This article provides an analysis of two strong S&P 500 stocks but doesn't constitute financial advice. Remember to conduct your own thorough research and consider your individual risk tolerance and investment goals before buying any stock.

Keywords: S&P 500, stock market dip, Microsoft (MSFT), Johnson & Johnson (JNJ), investing, stock picks, defensive stocks, growth stocks, dividend stocks, market volatility, investment strategy, portfolio diversification.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Top S&P 500 Stocks To Consider Buying On The Current Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pacers Post Game 3 Analysis Lack Of Execution Cost Them Against Knicks

May 27, 2025

Pacers Post Game 3 Analysis Lack Of Execution Cost Them Against Knicks

May 27, 2025 -

Minnesota Timberwolves Fall Short Thunders Physical Play Wins Game 3

May 27, 2025

Minnesota Timberwolves Fall Short Thunders Physical Play Wins Game 3

May 27, 2025 -

Wedbush Predicts Teslas Golden Age Of Autonomous Driving With Imminent Robotaxi Launch

May 27, 2025

Wedbush Predicts Teslas Golden Age Of Autonomous Driving With Imminent Robotaxi Launch

May 27, 2025 -

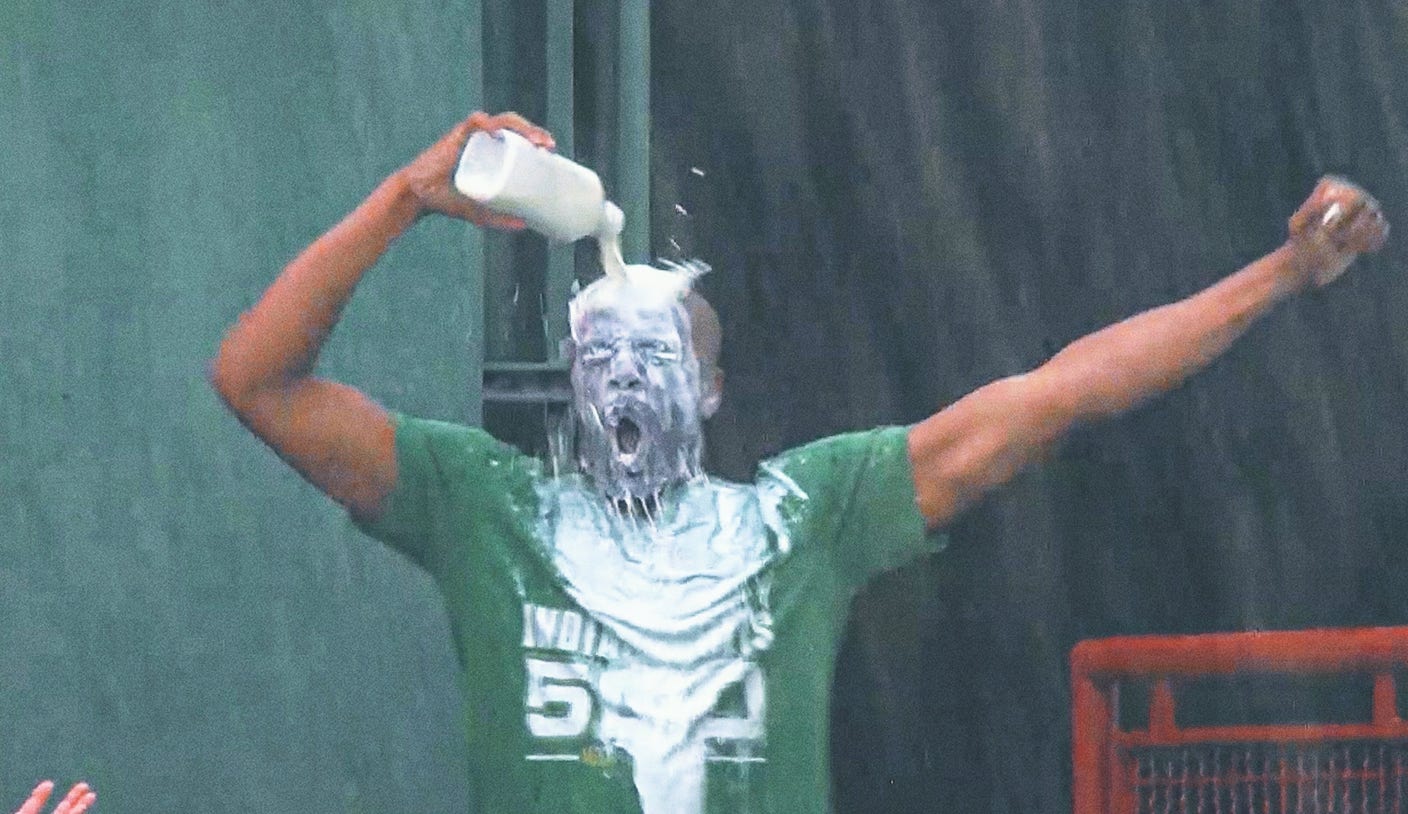

Indy 500 Fever Spreads Baseballs Milk Shower Home Run Celebration

May 27, 2025

Indy 500 Fever Spreads Baseballs Milk Shower Home Run Celebration

May 27, 2025 -

Nfl 2024 Playoff Hopefuls The Backup Quarterbacks Who Could Deliver

May 27, 2025

Nfl 2024 Playoff Hopefuls The Backup Quarterbacks Who Could Deliver

May 27, 2025