Trade Deal Fails To Lift Nasdaq 100 To New High; Interest Rate Cut Expectations Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trade Deal Fails to Lift Nasdaq 100 to New High; Interest Rate Cut Expectations Surge

Despite a long-awaited trade deal, the Nasdaq 100 fell short of reaching new highs, sparking a surge in expectations for an imminent interest rate cut by the Federal Reserve. Market analysts are pointing to a combination of factors contributing to this unexpected downturn, leaving investors questioning the future trajectory of the tech-heavy index.

The much-anticipated trade agreement, finalized after months of tense negotiations, had initially been touted as a catalyst for significant market growth. Many predicted a bullish response, with the Nasdaq 100 expected to break previous records. However, the reality proved far more nuanced. While the deal offered some short-term relief, it failed to ignite the sustained rally many had hoped for.

Why Did the Nasdaq 100 Underperform?

Several factors contributed to the Nasdaq 100's underperformance despite the trade deal:

-

Lingering Economic Uncertainty: While the trade deal addressed some immediate concerns, broader economic anxieties remain. Global growth concerns, particularly in Europe and China, continue to weigh on investor sentiment. The ongoing trade war between the US and China, although slightly mitigated by this agreement, still casts a long shadow. [Link to article about global economic slowdown]

-

Profit-Taking: After a significant run-up in the market earlier this year, many investors opted to take profits, leading to a sell-off in tech stocks. This profit-taking contributed significantly to the Nasdaq 100's inability to break through resistance levels.

-

Inflation Concerns: While the trade deal may help alleviate some inflationary pressures in the short term, concerns remain about long-term inflation. This uncertainty is pushing investors towards safer assets, potentially dampening the enthusiasm for riskier tech stocks. [Link to article about inflation concerns]

Interest Rate Cut Speculation Intensifies

The Nasdaq 100's failure to reach new highs, coupled with persistent economic uncertainties, has fueled speculation about an imminent interest rate cut by the Federal Reserve. Many market analysts believe that the Fed will be forced to act to stimulate economic growth and prevent a potential recession.

This expectation is reflected in the bond market, where yields have fallen sharply, signaling a growing belief in a rate cut. The market is now pricing in a significant probability of a rate cut in the coming months, with some predicting multiple cuts before the end of the year.

What does this mean for investors? The current market situation presents a complex picture. While the trade deal is a positive development, its impact has been limited by other economic headwinds. The increased expectation of an interest rate cut suggests that the Federal Reserve is anticipating slower economic growth. Investors should carefully consider their portfolios and adjust their strategies accordingly, perhaps diversifying across different asset classes to mitigate risk.

Looking Ahead: Navigating Market Volatility

The coming weeks and months are likely to be characterized by increased market volatility. Investors should remain vigilant and monitor economic indicators closely. Staying informed through reputable financial news sources is crucial for making informed investment decisions. [Link to your website's financial news section]

This situation highlights the interconnectedness of global markets and the importance of considering a wide range of factors when making investment decisions. The failure of the trade deal to fully boost the Nasdaq 100 serves as a reminder that market movements are rarely driven by a single event, but rather a complex interplay of economic and geopolitical factors. The increased speculation around interest rate cuts underlines the uncertainty many investors are currently facing. Staying informed and adapting to changing market conditions will be key to navigating this period of volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trade Deal Fails To Lift Nasdaq 100 To New High; Interest Rate Cut Expectations Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nahl Inaugural Futures Draft Analyzing The Top Picks And Future Impact

Jun 12, 2025

Nahl Inaugural Futures Draft Analyzing The Top Picks And Future Impact

Jun 12, 2025 -

Brewers Top Prospect Misiorowski Joins Major League Roster

Jun 12, 2025

Brewers Top Prospect Misiorowski Joins Major League Roster

Jun 12, 2025 -

The Nascar Controversy A 22 Year Old And The Future Of The Sport

Jun 12, 2025

The Nascar Controversy A 22 Year Old And The Future Of The Sport

Jun 12, 2025 -

Sources Terry Mc Laurins Contract Demands Lead To Commanders Minicamp Absence

Jun 12, 2025

Sources Terry Mc Laurins Contract Demands Lead To Commanders Minicamp Absence

Jun 12, 2025 -

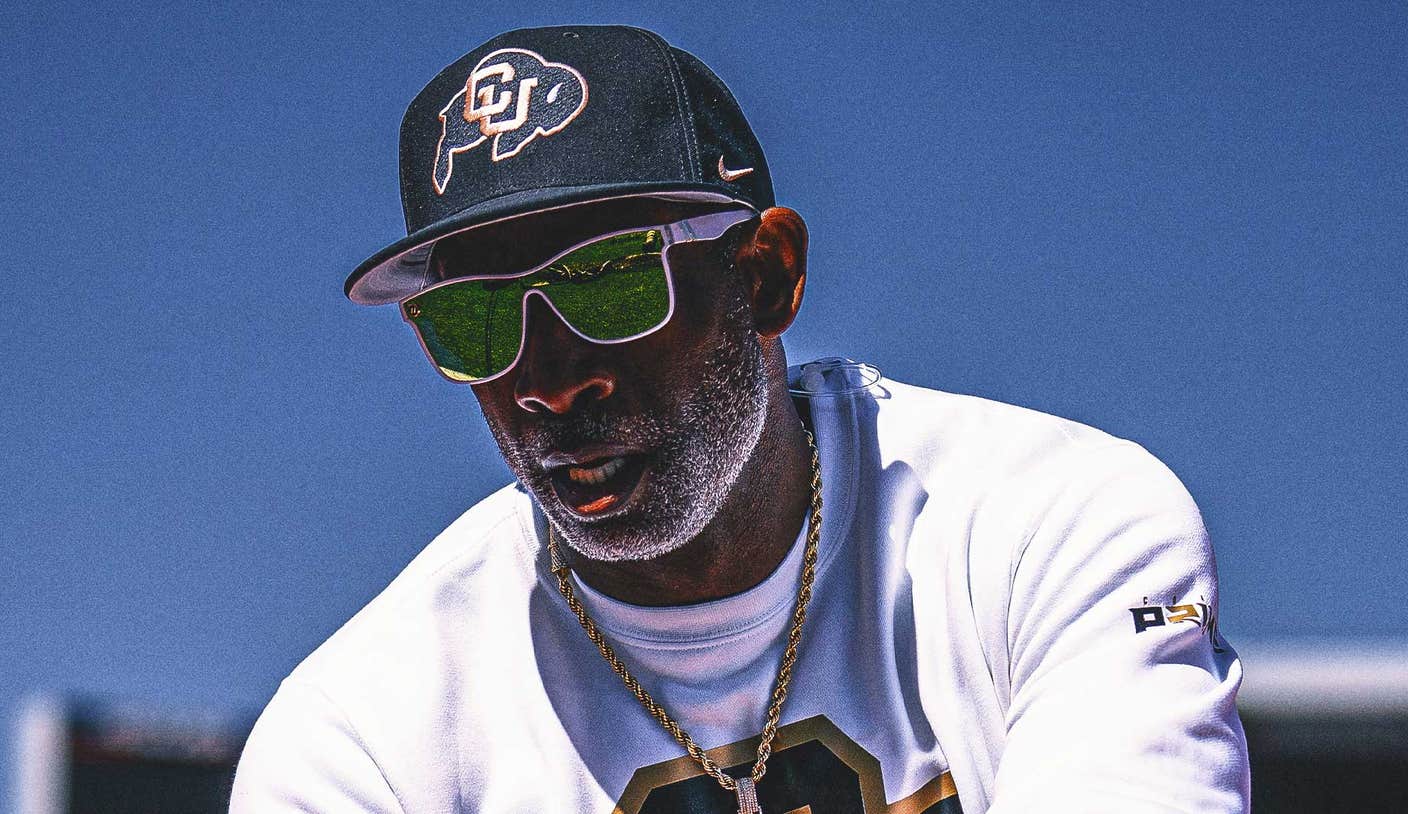

Coach Primes Absence Deion Sanders Leaves Colorado Program Due To Illness

Jun 12, 2025

Coach Primes Absence Deion Sanders Leaves Colorado Program Due To Illness

Jun 12, 2025