Tomorrow's Broadcom (AVGO) Earnings: Impacts And Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tomorrow's Broadcom (AVGO) Earnings: Impacts and Predictions

Broadcom (AVGO) is set to release its Q3 2023 earnings report tomorrow, and investors are holding their breath. The semiconductor giant's performance will offer significant insights into the health of the broader tech sector, particularly within the crucial areas of networking infrastructure and data center equipment. This report will delve into the key factors influencing AVGO's expected results, potential impacts on the market, and expert predictions for the future.

What to Expect from Broadcom's Q3 Report:

Analysts are closely watching several key metrics. Firstly, revenue growth is paramount. While the overall semiconductor market has shown signs of softening, Broadcom's diversified portfolio and strong positions in high-growth areas like 5G infrastructure and AI could buffer it from the worst of the downturn. However, weakening demand for smartphones and PCs could still impact certain segments.

Secondly, profit margins will be scrutinized. Rising inflation and supply chain challenges have impacted profitability across the industry. Broadcom's ability to navigate these headwinds and maintain healthy margins will be a key indicator of its operational efficiency and pricing power.

Finally, guidance for Q4 2023 and beyond is arguably the most crucial aspect of the report. Investors will be keen to understand Broadcom's outlook for the remainder of the year and into 2024, especially concerning the potential for a further slowdown in the tech sector. Any hints of weakening demand or revised projections could significantly impact the stock price.

Potential Impacts on the Market:

Broadcom's results will have a ripple effect across the tech industry. A strong performance could boost investor confidence in the sector, potentially leading to a broader market rally. Conversely, disappointing results could trigger a sell-off, particularly affecting companies in related sectors like networking equipment and semiconductor manufacturing.

The impact on AVGO's stock price itself will be significant. A positive surprise could send the stock soaring, while a negative surprise could lead to a sharp decline. Investors will be closely monitoring the post-earnings trading activity to gauge the market's reaction.

Expert Predictions and Analysis:

Several analysts have offered their predictions for Broadcom's Q3 earnings. While estimates vary, a consensus seems to be forming around a slightly slower-than-expected growth rate, but still within a healthy range. Many believe that Broadcom's diversification and strong relationships with key clients will help mitigate the impact of the current macroeconomic challenges. However, the uncertainty surrounding the global economy remains a major factor. [Link to reputable financial news source analyzing Broadcom's prospects].

Key Considerations for Investors:

- Macroeconomic factors: Global economic conditions, inflation, and geopolitical events will continue to play a crucial role in shaping Broadcom's performance.

- Competition: Intense competition within the semiconductor industry remains a significant challenge.

- Supply chain dynamics: The ongoing complexities in the global supply chain could impact Broadcom's ability to meet demand.

Conclusion:

Tomorrow's Broadcom earnings report will be a pivotal moment for investors. While some uncertainty remains, the company's strong position in key growth markets offers a degree of resilience. However, a careful evaluation of the report, including the provided guidance, is crucial for informed investment decisions. Stay tuned for our post-earnings analysis to break down the results and their implications.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tomorrow's Broadcom (AVGO) Earnings: Impacts And Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Daley A Lifeline For Closeted Queer Athletes Coming Out

Jun 04, 2025

Tom Daley A Lifeline For Closeted Queer Athletes Coming Out

Jun 04, 2025 -

Sounders Fc Demands Fair Compensation For Club World Cup Participation

Jun 04, 2025

Sounders Fc Demands Fair Compensation For Club World Cup Participation

Jun 04, 2025 -

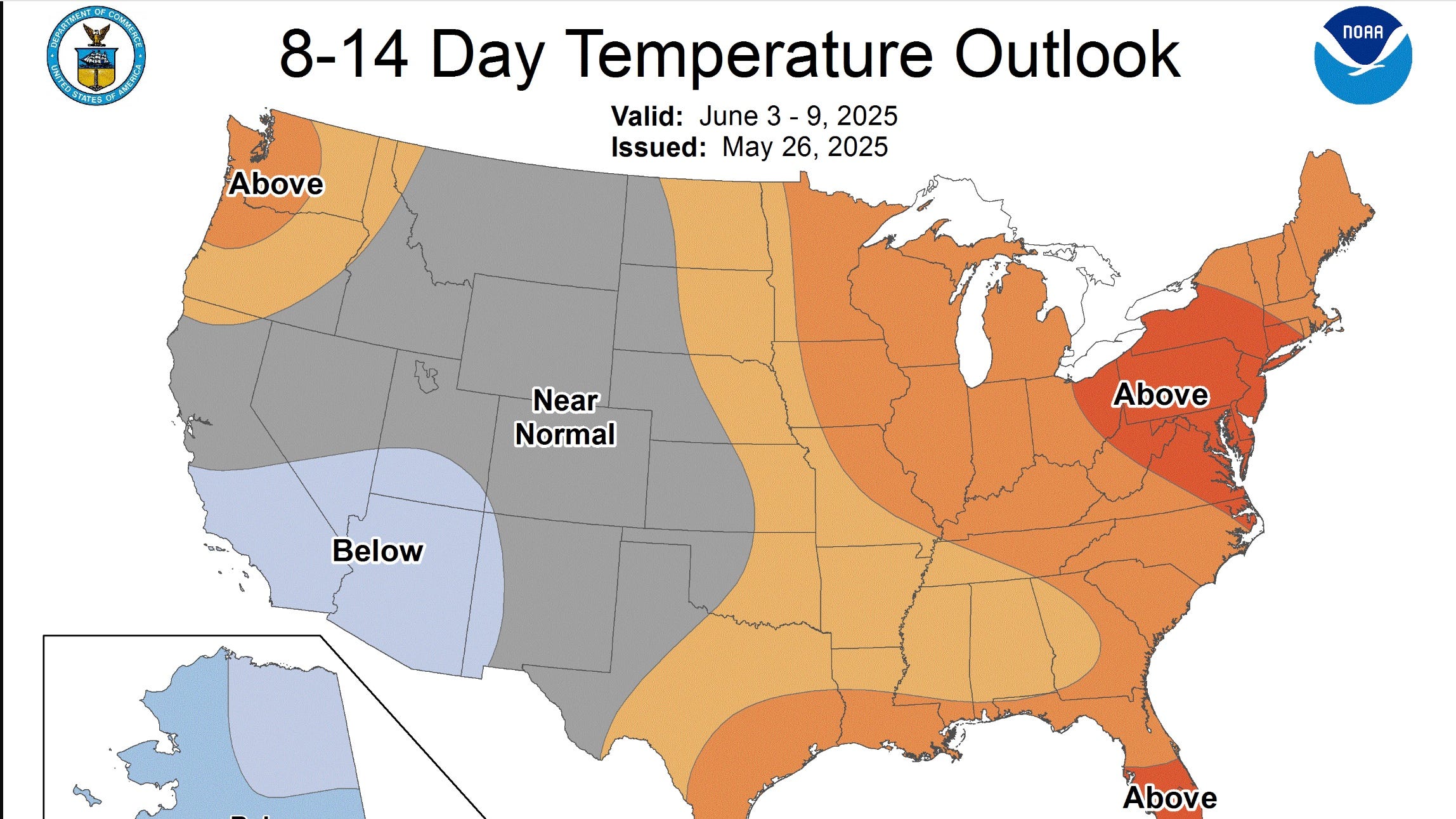

Record Breaking Heat Expected In Oregons Willamette Valley

Jun 04, 2025

Record Breaking Heat Expected In Oregons Willamette Valley

Jun 04, 2025 -

Altmaier Secures Win In A Rollercoaster Match

Jun 04, 2025

Altmaier Secures Win In A Rollercoaster Match

Jun 04, 2025 -

Michigan State Board Of Trustees To Consider J Batt For Athletic Director Role

Jun 04, 2025

Michigan State Board Of Trustees To Consider J Batt For Athletic Director Role

Jun 04, 2025