This Analyst's AMD Stock Prediction: A $100 Price Target?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

This Analyst's AMD Stock Prediction: A $100 Price Target? Could it Happen?

The tech world is buzzing. A recent analyst prediction has sent ripples through the investment community: could AMD stock truly reach a $100 price target? This bold forecast has investors scrambling to understand the rationale and the potential implications. Let's dive deep into this exciting development and explore what it means for AMD and its shareholders.

The Analyst's Rationale: More Than Just Hype

The prediction, originating from [Analyst Name and Firm - replace with actual information if available], isn't based on mere speculation. The analyst points to several key factors driving their bullish outlook for Advanced Micro Devices (AMD):

-

Strong CPU and GPU Market Share Gains: AMD has been steadily gaining market share from its primary competitor, Intel, in the CPU market, particularly in the high-performance computing (HPC) and gaming segments. Their Ryzen processors and Radeon graphics cards have proven increasingly popular, leading to significant revenue growth.

-

Data Center Growth: The data center market is experiencing explosive growth, and AMD's EPYC processors are making significant inroads, competing effectively with Intel's Xeon processors. This sector is a key driver of future revenue projections.

-

Successful Acquisitions and Partnerships: AMD's strategic acquisitions and partnerships have strengthened its position in the market. [Mention specific acquisitions or partnerships if known, linking to relevant news articles]. These moves have diversified their product portfolio and expanded their reach.

-

Technological Innovation: AMD continues to invest heavily in research and development, constantly pushing the boundaries of processor and graphics card technology. This commitment to innovation is crucial for maintaining a competitive edge.

Challenges and Considerations: A Balanced Perspective

While the $100 price target is exciting, it's crucial to acknowledge potential challenges:

-

Competition: The semiconductor industry is fiercely competitive. Intel, Nvidia, and other players are constantly innovating and vying for market share. Maintaining AMD's momentum will require continued innovation and effective execution.

-

Global Economic Uncertainty: Global economic conditions can significantly impact the tech sector. Recessions or supply chain disruptions could negatively affect AMD's performance.

-

Supply Chain Issues: The ongoing global chip shortage, while easing, still presents challenges to production and supply.

What Does This Mean for Investors?

The $100 price target is, of course, not a guarantee. It represents an analyst's projection based on current market conditions and future expectations. Investors should conduct their own thorough due diligence before making any investment decisions. Consider consulting with a financial advisor to assess your personal risk tolerance and investment strategy.

Is $100 Realistic? A Look at the Future

Reaching a $100 price target depends on several factors, including continued market share gains, successful product launches, and overall macroeconomic stability. While ambitious, the analyst's rationale provides a plausible pathway to this significant price increase. However, investors should remember that the stock market is inherently volatile, and significant price fluctuations are possible.

Conclusion: Proceed with Caution, but Stay Informed

The analyst's prediction has undoubtedly generated excitement around AMD stock. While a $100 price target is a considerable leap, the underlying factors supporting this prediction are compelling. However, it's crucial to approach this news with a balanced perspective, considering both the potential upsides and the inherent risks associated with investing in the stock market. Staying informed about AMD's progress and market trends will be critical for making informed investment decisions. Remember to always consult with a financial advisor before making any investment choices.

(Call to Action - subtle): Stay updated on the latest AMD news and analysis by subscribing to our newsletter [link to newsletter signup if applicable].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on This Analyst's AMD Stock Prediction: A $100 Price Target?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chelsea Dominates Psg In Depth Game Analysis From July 13 2025

Jul 16, 2025

Chelsea Dominates Psg In Depth Game Analysis From July 13 2025

Jul 16, 2025 -

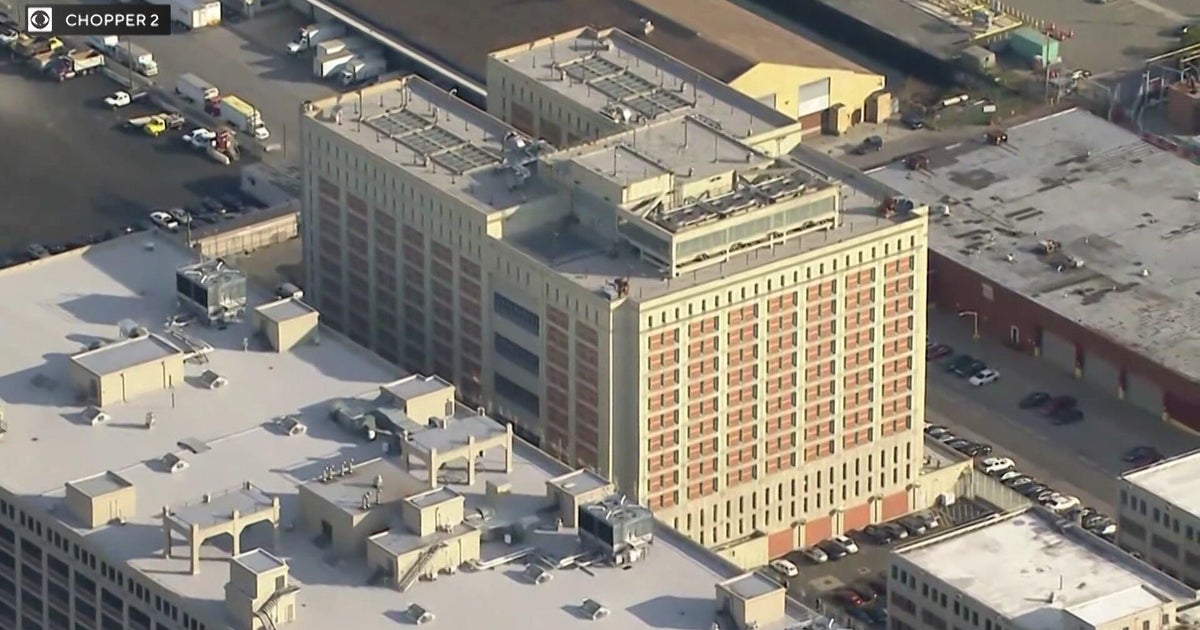

Brooklyn Jail 100 Migrants Join Diddy And Mangione

Jul 16, 2025

Brooklyn Jail 100 Migrants Join Diddy And Mangione

Jul 16, 2025 -

Brooklyns Immigrant Detention Center Activists Push For Immediate Release

Jul 16, 2025

Brooklyns Immigrant Detention Center Activists Push For Immediate Release

Jul 16, 2025 -

Nfl 2023 Postseason Assessing The Chances Of The Bubble Teams

Jul 16, 2025

Nfl 2023 Postseason Assessing The Chances Of The Bubble Teams

Jul 16, 2025 -

Ethan Holliday Son Of Matt Drafted By Colorado Rockies

Jul 16, 2025

Ethan Holliday Son Of Matt Drafted By Colorado Rockies

Jul 16, 2025