The Robinhood Stock Investment Case: A 2024 Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Robinhood Stock Investment Case: A 2024 Perspective

Robinhood, the disruptive brokerage app that democratized investing for millions, has had a rollercoaster ride. Its meteoric rise during the pandemic, followed by a dramatic fall, leaves many investors wondering: is Robinhood stock a buy in 2024? This article delves into the complexities of this investment case, examining the positives and negatives to help you make an informed decision.

Robinhood's Rise and Fall:

The platform's commission-free trading model and user-friendly interface quickly attracted a massive user base, particularly among younger investors. The GameStop saga further propelled Robinhood into the spotlight, though this also highlighted vulnerabilities in its infrastructure and regulatory scrutiny. Since its peak, the stock has experienced significant volatility, leading to considerable losses for early investors. Understanding this history is crucial before considering any investment.

Key Factors Influencing Robinhood's Future:

Several factors will determine Robinhood's success and, consequently, the viability of its stock in 2024 and beyond:

-

Increased Competition: The brokerage industry is highly competitive. Established players and new entrants constantly vie for market share, impacting Robinhood's growth potential. This intense competition necessitates innovation and differentiation to maintain its user base.

-

Regulatory Landscape: Increased regulatory scrutiny and potential changes in financial regulations pose a significant challenge. Compliance costs and potential limitations on services could affect profitability and growth.

-

Revenue Diversification: While commission-free trading initially attracted users, long-term sustainability requires diverse revenue streams. Robinhood is actively pursuing this through options trading, subscriptions, and other financial products. The success of this diversification strategy will be key.

-

User Acquisition and Retention: Maintaining and growing its user base is paramount. Attracting and retaining users in a competitive market requires continuous improvements to the platform's features, user experience, and overall value proposition.

The Bull Case for Robinhood Stock:

Despite the challenges, arguments for investing in Robinhood stock remain:

-

Large User Base: Robinhood still boasts a substantial user base, providing a solid foundation for future growth and revenue generation. This large existing customer pool presents a significant opportunity for cross-selling and upselling various financial products.

-

Technological Innovation: The company continues to invest in technology and innovation, striving to improve its platform and offer new features to enhance user experience and attract new customers. This commitment to innovation could lead to future market share gains.

-

Potential for Growth in Emerging Markets: Expansion into new markets could unlock significant growth opportunities. Successfully tapping into underserved populations globally could significantly boost revenue.

The Bear Case for Robinhood Stock:

However, substantial risks remain:

-

High Debt Levels: Robinhood carries a considerable debt burden, which can strain its financial position and limit its flexibility in responding to market changes.

-

Dependence on Trading Volume: Revenue remains significantly tied to trading volume, making it susceptible to market downturns and volatility. A decrease in trading activity could severely impact its financial performance.

-

Negative Brand Perception: Past controversies and regulatory issues have negatively impacted Robinhood's brand image, potentially affecting customer trust and acquisition efforts.

Conclusion: A Cautious Approach is Warranted

The Robinhood stock investment case in 2024 is complex and multifaceted. While the platform has undeniable potential, significant risks remain. Investors should carefully weigh the potential rewards against the considerable challenges before making any investment decisions. Conduct thorough due diligence, consider your risk tolerance, and consult with a financial advisor before investing in Robinhood or any other stock. The information provided here is for educational purposes only and should not be considered financial advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Robinhood Stock Investment Case: A 2024 Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

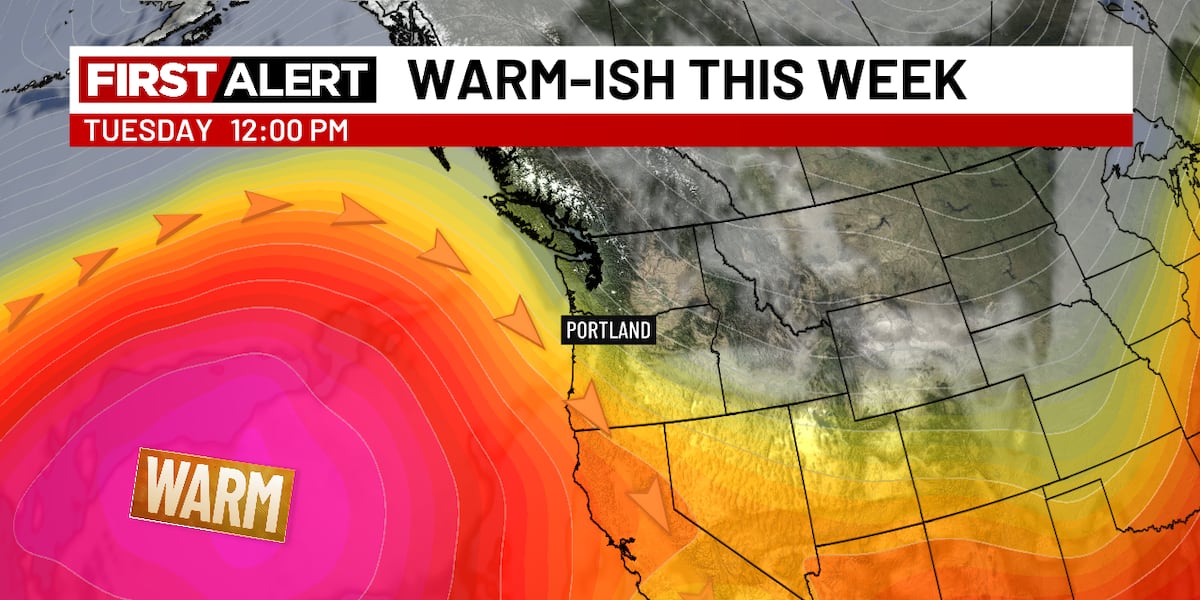

Fair Weather Ahead Junes Sunny And Dry Beginning

Jun 05, 2025

Fair Weather Ahead Junes Sunny And Dry Beginning

Jun 05, 2025 -

Another Portland Energy Firm Threatened With Shutdown What Went Wrong

Jun 05, 2025

Another Portland Energy Firm Threatened With Shutdown What Went Wrong

Jun 05, 2025 -

Luke Weavers Injury Yankees To Add Closer To Il

Jun 05, 2025

Luke Weavers Injury Yankees To Add Closer To Il

Jun 05, 2025 -

Sam Darnold To Start For Seahawks Says Defensive Coordinator Macdonald

Jun 05, 2025

Sam Darnold To Start For Seahawks Says Defensive Coordinator Macdonald

Jun 05, 2025 -

Halle Berrys Go To This Neck Cream Tightens Skin And Its Now On My Wishlist

Jun 05, 2025

Halle Berrys Go To This Neck Cream Tightens Skin And Its Now On My Wishlist

Jun 05, 2025