The Robinhood Investment Case: Analyzing Recent Stock Trends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Robinhood Investment Case: Analyzing Recent Stock Trends

Robinhood, the once-ubiquitous trading app that democratized investing for millions, has experienced a rollercoaster ride since its IPO. Its stock price has fluctuated wildly, leaving investors wondering: is Robinhood a worthwhile investment now, or is the party over? This article delves into the recent stock trends, analyzing the factors contributing to its volatility and offering insights for potential investors.

The Rise and Fall (and Rise?) of Robinhood:

Robinhood’s initial public offering (IPO) in July 2021 generated significant buzz, fueled by its massive user base and the hype surrounding commission-free trading. However, the post-IPO euphoria quickly faded. The stock price plummeted, impacted by several key factors including:

- Increased Competition: The commission-free trading model, once a unique selling proposition, became the industry standard, eroding Robinhood's competitive advantage. Established players like Fidelity and Schwab quickly adapted, offering similar services.

- Regulatory Scrutiny: Robinhood faced increased regulatory scrutiny following the GameStop saga and other volatile trading events. This uncertainty impacted investor confidence.

- Decreased User Growth: After a period of explosive growth, Robinhood's user acquisition slowed, raising concerns about its long-term sustainability.

- Financial Performance: The company’s financial performance has been inconsistent, with fluctuating revenues and persistent losses. This has made it difficult to justify the stock's valuation for many investors.

Recent Stock Trends and Potential Catalysts:

Despite the challenges, Robinhood's stock has shown some signs of recovery in recent months. This rebound can be attributed to several factors:

- Cost-Cutting Measures: The company has implemented aggressive cost-cutting measures, aiming to improve profitability.

- Focus on Subscription Revenue: Robinhood is increasingly focusing on its subscription-based services, which offer a more predictable revenue stream compared to transaction-based revenue. This diversification strategy is seen as crucial for long-term growth.

- Expansion into New Markets: The company is expanding its product offerings and exploring new markets, seeking to diversify its revenue streams and attract new customer segments. This includes ventures into crypto and other alternative asset classes.

- Improved Financial Guidance: More positive financial guidance from the company has boosted investor confidence.

Is Robinhood a Buy, Sell, or Hold?

Determining whether Robinhood is a good investment currently requires a nuanced assessment. While the recent stock trends show some positive momentum, several risks remain. These include:

- Continued Competition: The competitive landscape remains intense, and maintaining market share will be a significant challenge.

- Regulatory Uncertainty: The regulatory environment remains unpredictable, potentially impacting the company's future operations.

- Dependence on Market Volatility: Robinhood's revenue is still partially tied to market volatility, making its performance susceptible to market downturns.

Ultimately, the decision to invest in Robinhood rests on individual risk tolerance and investment goals. Investors should conduct thorough due diligence, carefully considering the company’s financial performance, competitive landscape, and regulatory risks before making any investment decisions. Consulting a financial advisor is highly recommended.

Looking Ahead:

Robinhood's future trajectory will largely depend on its ability to execute its strategic plan, navigate the competitive landscape, and demonstrate consistent profitability. Continued innovation, diversification of revenue streams, and effective cost management will be crucial for its long-term success. Investors should closely monitor the company’s financial performance and regulatory developments for further insights. For the latest updates, you can refer to Robinhood's investor relations website [link to Robinhood investor relations].

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Robinhood Investment Case: Analyzing Recent Stock Trends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Amanda Seyfrieds Premiere Look A Black Fringe Dress By Paco Rabanne

Jun 05, 2025

Amanda Seyfrieds Premiere Look A Black Fringe Dress By Paco Rabanne

Jun 05, 2025 -

Gabby Thomas Heckled Fan Duel Responds With Bettor Ban

Jun 05, 2025

Gabby Thomas Heckled Fan Duel Responds With Bettor Ban

Jun 05, 2025 -

Uswnt Extends Winning Streak Defeats Jamaica 4 0 To Finish Strong

Jun 05, 2025

Uswnt Extends Winning Streak Defeats Jamaica 4 0 To Finish Strong

Jun 05, 2025 -

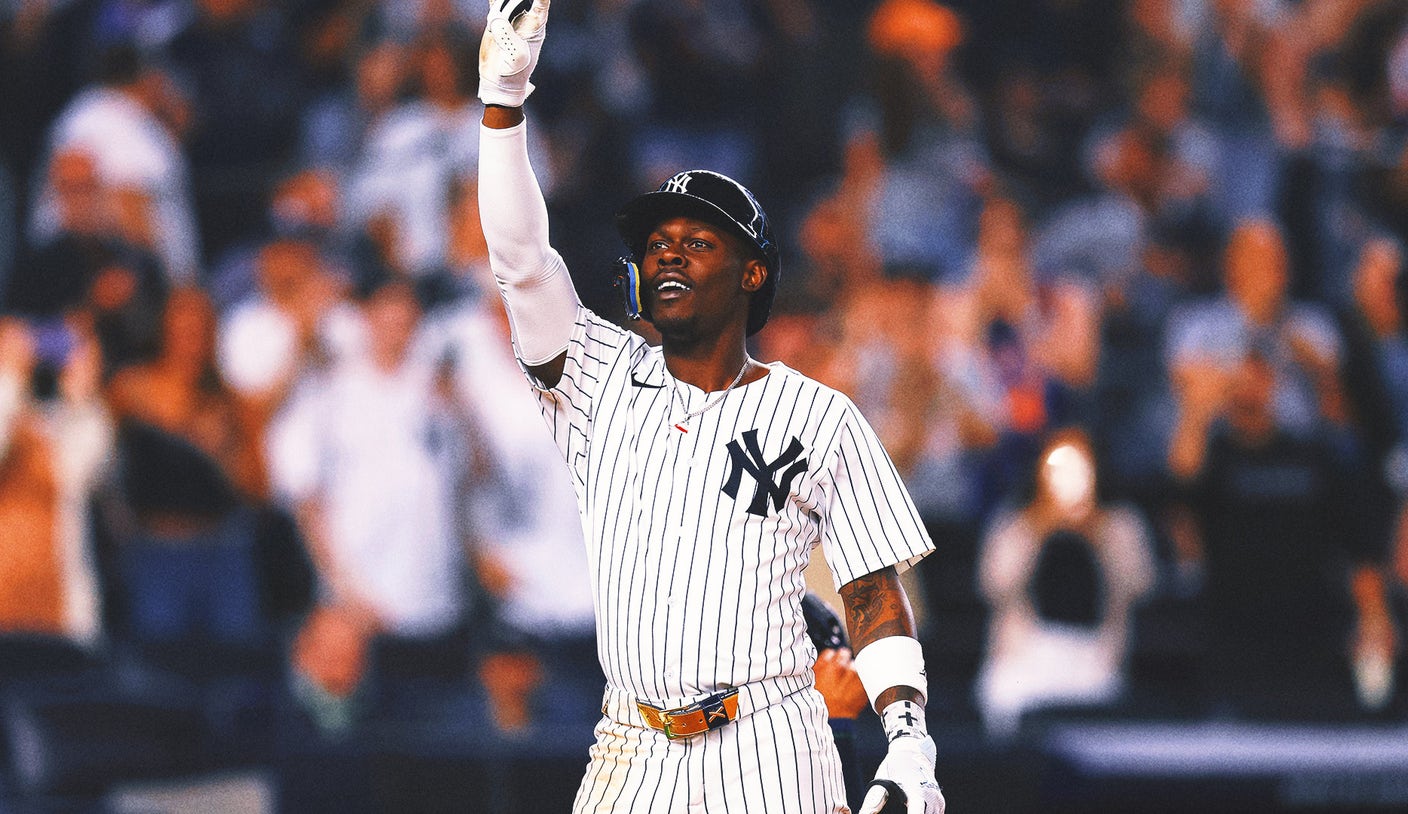

Injury Comeback Chisholm Jr S Home Run Leads Yankees To Win

Jun 05, 2025

Injury Comeback Chisholm Jr S Home Run Leads Yankees To Win

Jun 05, 2025 -

David Andrews A New England Patriots Legacy Forged To The End

Jun 05, 2025

David Andrews A New England Patriots Legacy Forged To The End

Jun 05, 2025