The Guardian Calls For Immediate Action On Mis-sold Car Finance Loans

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Guardian Calls for Immediate Action on Mis-sold Car Finance Loans: A Crisis for Consumers?

The Guardian's recent exposé on widespread mis-selling of car finance loans has sent shockwaves through the UK, prompting calls for immediate government intervention and a major overhaul of the industry's practices. The article highlights a disturbing trend of vulnerable consumers being trapped in unfair and exploitative loan agreements, leaving many facing crippling debt and financial ruin. This isn't just another financial scandal; it's a crisis demanding immediate action.

The Scale of the Problem:

The Guardian's investigation revealed a staggering number of cases where car dealerships and finance companies employed deceptive tactics to secure loan agreements. These tactics included:

- Hidden fees and charges: Consumers were often unaware of significant additional costs, leading to inflated monthly payments and total loan amounts.

- Misrepresentation of interest rates: Dealerships presented misleading information about APRs (Annual Percentage Rates), making loans appear more affordable than they actually were.

- Aggressive sales tactics: High-pressure sales environments pressured vulnerable individuals into accepting loans they couldn't afford.

- Lack of transparency: Complex loan agreements were often presented with minimal explanation, leaving consumers unable to fully understand the terms and conditions.

Who is Affected?

While anyone can fall victim to mis-selling, the Guardian highlights that vulnerable groups, including those with low financial literacy and those facing financial hardship, are disproportionately affected. These individuals often lack the knowledge or resources to challenge unfair loan agreements. This underscores the ethical failings within the car finance industry and the need for stricter consumer protections.

The FCA's Role (Financial Conduct Authority):

The Financial Conduct Authority (FCA) is the UK's independent financial services regulator. The Guardian's report raises serious questions about the FCA's effectiveness in preventing and addressing this widespread mis-selling. Critics argue that current regulations are insufficient to protect consumers and that the FCA needs to implement more robust oversight and enforcement measures. [Link to FCA website]

What Can Consumers Do?

If you suspect you've been a victim of mis-sold car finance, there are steps you can take:

- Review your loan agreement carefully: Look for hidden fees, misleading information, or unfair terms.

- Contact the dealership or finance company: Attempt to negotiate a fairer repayment plan or a resolution.

- Seek independent financial advice: A qualified financial advisor can help assess your situation and explore your options.

- Complain to the Financial Ombudsman Service (FOS): If you are unable to resolve the issue directly, the FOS can investigate your complaint and offer a resolution. [Link to FOS website]

Looking Ahead: The Need for Reform:

The Guardian's call for immediate action is not just a plea; it’s a necessary demand for systemic change. The car finance industry needs stronger regulation, increased transparency, and tougher penalties for those who engage in mis-selling. The government must act swiftly to protect consumers from predatory lending practices and prevent further financial hardship. This is not simply about individual cases; it's about establishing a fairer and more ethical financial landscape for all. The ongoing debate surrounding this issue calls for a broader conversation about financial literacy and the need for greater consumer empowerment. We need to ensure that consumers are equipped with the knowledge and tools to navigate the complexities of car finance and protect themselves from exploitation. The future of responsible lending depends on it.

Keywords: Mis-sold car finance, car finance loans, car loan mis-selling, Financial Conduct Authority (FCA), Financial Ombudsman Service (FOS), consumer rights, debt, financial crisis, UK news, The Guardian, predatory lending, financial literacy, consumer protection.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Guardian Calls For Immediate Action On Mis-sold Car Finance Loans. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Track Nationals 200m Lyles Win Overshadowed By Bednareks Shove

Aug 05, 2025

Us Track Nationals 200m Lyles Win Overshadowed By Bednareks Shove

Aug 05, 2025 -

Northeast Georgia Lottery Hot Streak Toccoa Resident Wins Nearly 300 000

Aug 05, 2025

Northeast Georgia Lottery Hot Streak Toccoa Resident Wins Nearly 300 000

Aug 05, 2025 -

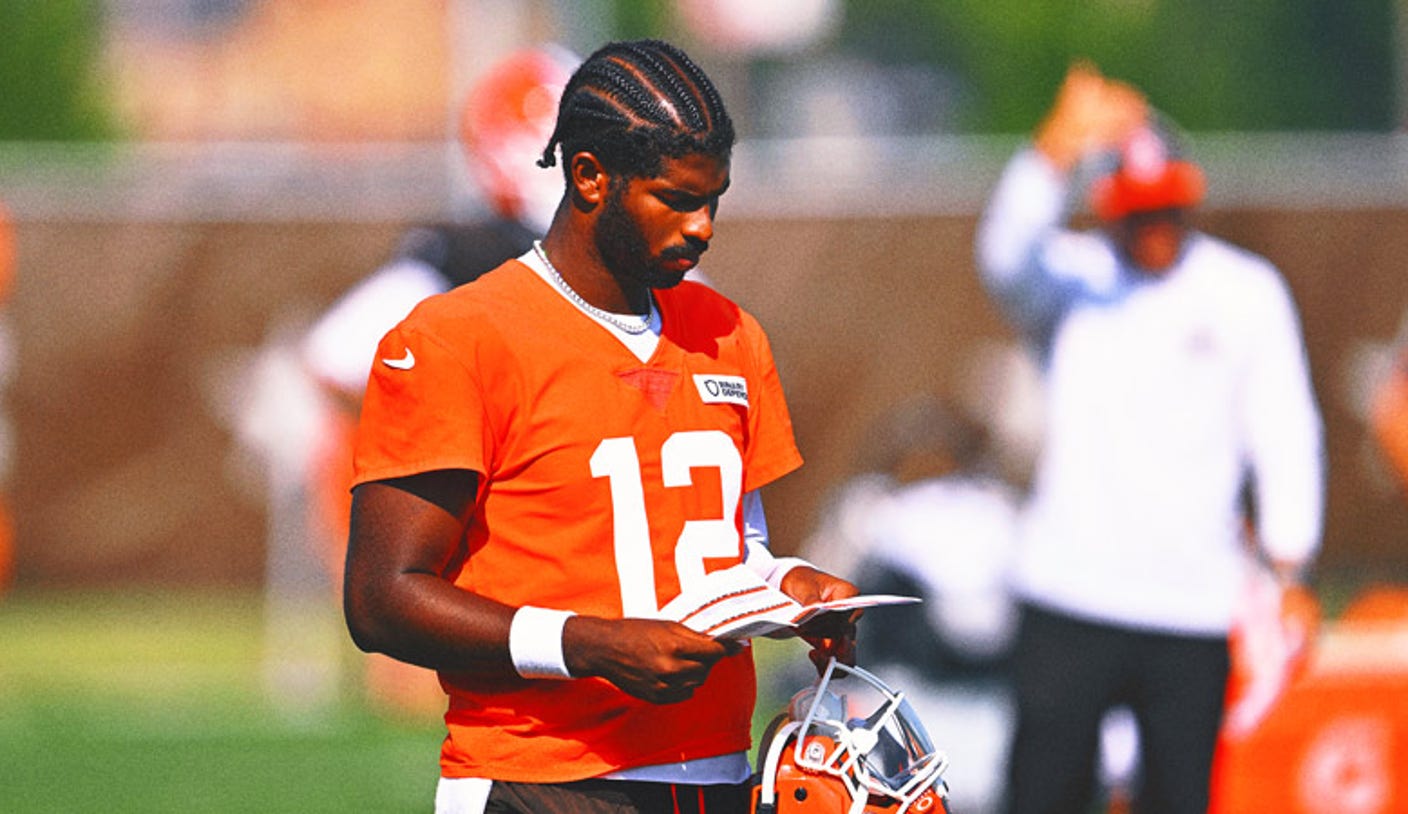

Shedeur Sanders Arm Soreness Cleveland Browns Rookie Misses Practice

Aug 05, 2025

Shedeur Sanders Arm Soreness Cleveland Browns Rookie Misses Practice

Aug 05, 2025 -

Analyzing The 2025 Mlb Trade Deadline Winners And Losers

Aug 05, 2025

Analyzing The 2025 Mlb Trade Deadline Winners And Losers

Aug 05, 2025 -

Mlb Trade Deadline 2024 A Rod Jeter And Ortizs Top Contenders

Aug 05, 2025

Mlb Trade Deadline 2024 A Rod Jeter And Ortizs Top Contenders

Aug 05, 2025

Latest Posts

-

Minor Muscle Injury For Lionel Messi Inter Miami Offers Reassurance Via Espn

Aug 06, 2025

Minor Muscle Injury For Lionel Messi Inter Miami Offers Reassurance Via Espn

Aug 06, 2025 -

Falcons Training Camp Early Roster Projections After Week One

Aug 06, 2025

Falcons Training Camp Early Roster Projections After Week One

Aug 06, 2025 -

Messis Inter Miami Injury Espn Confirms Minor Muscle Problem

Aug 06, 2025

Messis Inter Miami Injury Espn Confirms Minor Muscle Problem

Aug 06, 2025 -

How Wildfire Smoke Impacts Your Health Tips For Safeguarding Yourself

Aug 06, 2025

How Wildfire Smoke Impacts Your Health Tips For Safeguarding Yourself

Aug 06, 2025 -

Jet2 Holidays The Unexpected Rise In Popularity Explained

Aug 06, 2025

Jet2 Holidays The Unexpected Rise In Popularity Explained

Aug 06, 2025