Tesla Stock Forecast: Could A 1300% Surge Be On The Horizon?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tesla Stock Forecast: Could a 1300% Surge Be on the Horizon?

The electric vehicle (EV) revolution is in full swing, and Tesla, its undisputed leader, finds itself at the heart of the storm. While the stock has experienced volatility, some analysts are predicting a truly astonishing rise: a potential 1300% surge. Is this audacious prediction realistic, or pure speculation? Let's delve into the factors fueling this bold Tesla stock forecast.

The Bull Case for a Tesla Stock Surge:

Several factors contribute to the optimistic outlook for Tesla's stock price. These include:

-

Dominant Market Position: Tesla currently holds a significant lead in the EV market, boasting superior technology, a widespread Supercharger network, and strong brand recognition. This market dominance translates to substantial revenue potential as EV adoption continues to accelerate globally.

-

Innovation and Expansion: Tesla's relentless pursuit of innovation, evident in its advancements in battery technology, autonomous driving capabilities (Autopilot and Full Self-Driving), and energy solutions (Solar Roof, Powerwall), positions it for continued growth. The expansion into new markets and vehicle segments also contributes to its long-term prospects.

-

Energy Business Growth: Tesla's energy business, encompassing solar panels and energy storage solutions, is a rapidly growing segment. This diversification reduces reliance on the automotive sector alone and offers significant long-term revenue streams. The increasing demand for renewable energy further strengthens this sector's potential.

-

Cybertruck and Future Models: The highly anticipated Cybertruck and other upcoming models promise to disrupt existing market segments and attract new customer bases. These vehicles, with their innovative designs and advanced features, could significantly boost Tesla's sales figures.

-

Positive Investor Sentiment: Despite recent market fluctuations, positive investor sentiment surrounding Tesla remains strong. This unwavering confidence in the company's long-term vision and execution capabilities is a key driver of the projected surge.

Challenges and Risks:

While the potential for a 1300% surge is exciting, it's crucial to acknowledge the challenges and risks:

-

Competition: The EV market is becoming increasingly competitive, with established automakers and new entrants vying for market share. Tesla's ability to maintain its technological edge and fend off competition will be critical.

-

Economic Uncertainty: Global economic conditions and potential recessions can significantly impact consumer spending on high-value items like electric vehicles.

-

Regulatory Hurdles: Navigating the complexities of regulations and government policies related to EVs and autonomous driving presents ongoing challenges.

-

Production and Supply Chain Issues: Maintaining efficient production and securing a reliable supply chain are crucial for meeting the growing demand for Tesla vehicles.

The 1300% Surge: Realistic or Overly Optimistic?

A 1300% surge in Tesla's stock price represents a highly ambitious forecast. While the underlying factors supporting Tesla's growth are undeniably strong, such a dramatic increase would require a confluence of positive events and exceed even the most bullish projections. It's important to approach such predictions with a healthy dose of skepticism.

Conclusion:

Tesla's future remains bright, driven by innovation, strong market position, and a growing energy business. While a 1300% stock surge is a highly speculative scenario, the company's potential for substantial growth is undeniable. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions. Remember to consult with a financial advisor before investing in any stock.

Disclaimer: This article provides general information and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tesla Stock Forecast: Could A 1300% Surge Be On The Horizon?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chaos At The Start Comparing The 109th Indy 500 To The Infamous 1992 Race

May 28, 2025

Chaos At The Start Comparing The 109th Indy 500 To The Infamous 1992 Race

May 28, 2025 -

Switzerland Falls Short Team Usa Crowned Ice Hockey World Champions

May 28, 2025

Switzerland Falls Short Team Usa Crowned Ice Hockey World Champions

May 28, 2025 -

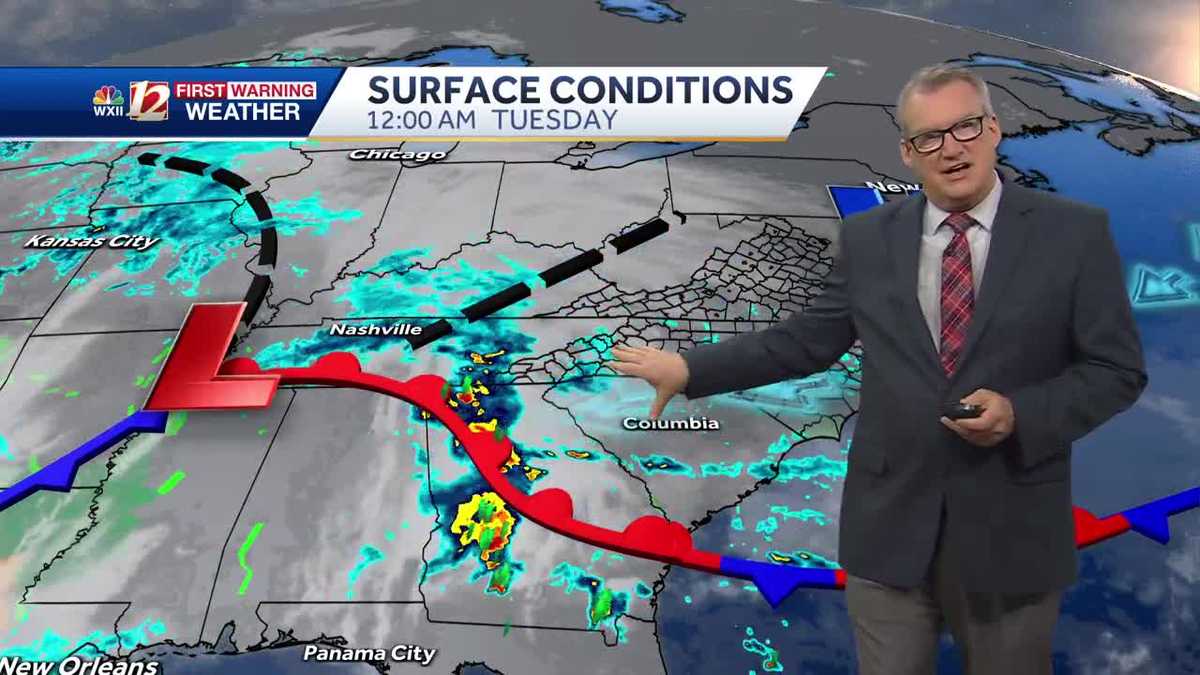

Cool And Wet Tuesday Forecast Impacts On Travel And Outdoor Activities

May 28, 2025

Cool And Wet Tuesday Forecast Impacts On Travel And Outdoor Activities

May 28, 2025 -

Paolini Triumphs Over Yuan Continues Dominant Roland Garros Performance

May 28, 2025

Paolini Triumphs Over Yuan Continues Dominant Roland Garros Performance

May 28, 2025 -

Alex Palous Indiana Double Indy 500 Victory And Knicks Pacers Game

May 28, 2025

Alex Palous Indiana Double Indy 500 Victory And Knicks Pacers Game

May 28, 2025