Tesla Investors React: Evaluating Elon Musk's 1300% Stock Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tesla Investors React: Evaluating Elon Musk's 1300% Stock Projection

Elon Musk's bold prediction of a 1300% increase in Tesla's stock price has sent ripples through the investment world, leaving investors scrambling to evaluate the feasibility of such a dramatic surge. The statement, made during a recent interview, immediately sparked fervent debate, with analysts and individual investors alike weighing the potential factors that could contribute to – or hinder – such ambitious growth.

This article delves into the investor reaction, examining the arguments for and against Musk's projection and exploring the broader implications for Tesla's future.

The Bullish Case: Fueling the 1300% Prediction

Several factors could potentially contribute to a significant increase in Tesla's stock price, although reaching a 1300% increase remains highly speculative. Proponents point to:

-

Dominance in the EV Market: Tesla currently holds a significant market share in the electric vehicle (EV) sector. Continued innovation and expansion into new markets could solidify this position, driving further growth. Their upcoming Cybertruck and planned expansion into more affordable vehicle segments are key factors here.

-

Energy Business Expansion: Tesla's energy business, encompassing solar panels and energy storage solutions like the Powerwall, is a rapidly growing segment. As the demand for renewable energy increases globally, this sector presents a significant avenue for future revenue generation.

-

Technological Advancements: Tesla's commitment to research and development in areas like autonomous driving (Autopilot) and battery technology remains a major draw for investors. Breakthroughs in these areas could significantly enhance the value proposition of their vehicles and further boost the company's valuation.

-

Brand Loyalty and Image: Tesla benefits from a strong brand image and loyal customer base, factors that contribute significantly to its market position and resilience against competition.

The Bearish Case: Challenges to Achieving Exponential Growth

Despite the potential for growth, significant challenges could impede Tesla's ability to reach Musk's projected 1300% increase. These include:

-

Increased Competition: The EV market is becoming increasingly competitive, with established automakers and new entrants vying for market share. This intensified competition could put pressure on Tesla's pricing and profitability.

-

Economic Uncertainty: Global economic conditions, including inflation and potential recessions, could significantly impact consumer demand for luxury vehicles like Tesla's, potentially hindering sales growth.

-

Production Challenges: Maintaining consistent and high-volume production remains a challenge for Tesla. Any disruptions in the supply chain or manufacturing process could negatively impact the company's financial performance.

-

Regulatory Hurdles: Navigating complex regulatory landscapes, particularly concerning autonomous driving technology and safety standards, presents ongoing challenges.

Investor Sentiment and Market Reaction

The immediate market reaction to Musk's statement was mixed. While some investors expressed cautious optimism, others voiced concerns about the projection's unrealistic nature. The stock price experienced some volatility following the announcement, highlighting the uncertainty surrounding the future of the company. Many analysts have released reports urging caution, recommending a more conservative outlook. [Link to a relevant financial news article].

Conclusion: A Long-Term Perspective

While a 1300% increase in Tesla's stock price remains a highly ambitious goal, the company's long-term prospects appear positive. Its position in the growing EV market, coupled with its expansion into the energy sector and technological innovations, offer potential for substantial growth. However, investors should approach this prediction with a healthy dose of skepticism, recognizing the inherent risks and challenges that lie ahead. The future of Tesla's stock price ultimately depends on the company's ability to overcome these challenges and continue to deliver on its ambitious goals. Careful analysis and a long-term perspective are crucial for investors navigating this volatile landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tesla Investors React: Evaluating Elon Musk's 1300% Stock Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

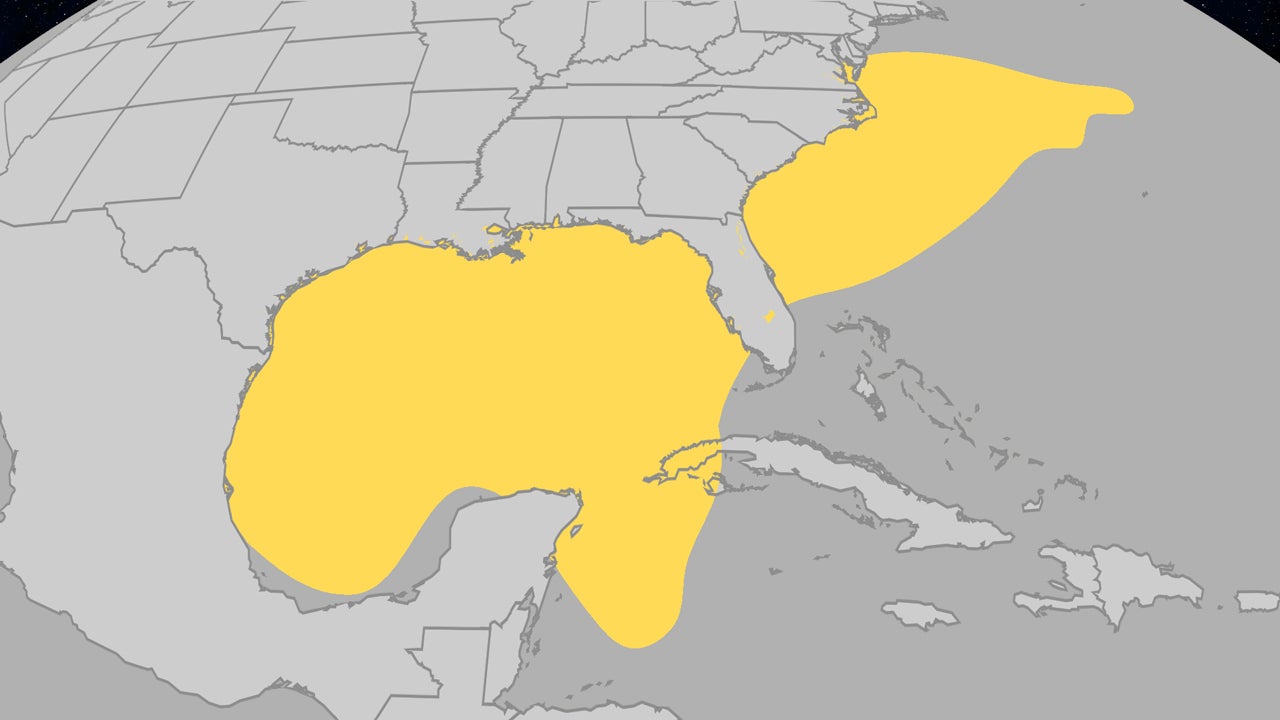

Atlantic Hurricane Season Outlook June Storm Formation And Recent Uptick

May 27, 2025

Atlantic Hurricane Season Outlook June Storm Formation And Recent Uptick

May 27, 2025 -

Elena Rybakina Vs Belinda Bencic A French Open 2025 Showdown

May 27, 2025

Elena Rybakina Vs Belinda Bencic A French Open 2025 Showdown

May 27, 2025 -

Against All Odds Chastains Unbelievable Nascar Coca Cola 600 Win

May 27, 2025

Against All Odds Chastains Unbelievable Nascar Coca Cola 600 Win

May 27, 2025 -

Predicting The French Open Womens Outcomes Day 2 Key Matches

May 27, 2025

Predicting The French Open Womens Outcomes Day 2 Key Matches

May 27, 2025 -

Sailing To Hawaii An Oregon Mans Bold Retirement Plan Involving A 401 K And A Cat

May 27, 2025

Sailing To Hawaii An Oregon Mans Bold Retirement Plan Involving A 401 K And A Cat

May 27, 2025